How Smart Traders Use AI To Detect Whale Wallet Moves And Boost Profits

- AI enables instant processing of onchain data to identify high-value cryptocurrency transactions in real time.

Connecting blockchain APIs allows traders to monitor whale activity continuously and create personalized alert feeds. Advanced clustering algorithms reveal behavioral patterns and relationships among whale wallets, indicating strategic moves.

A phased AI approach-from transactional filtering to automated response-can give traders a systematic advantage in volatile markets.

Traders in the crypto markets constantly seek ways to anticipate major moves by large wallet holders. In August 2025, one Bitcoin whale sold 24,000 BTC -almost $2.7 billion-causing a rapid market dip and liquidating over $500 million in leveraged bets within minutes. If traders had foreseen such activity, they could have hedged their positions or even capitalized on the downturn, transforming chaos into opportunity.

Today, artificial intelligence offers robust tools for analyzing blockchain transaction data, flagging unusual wallet activity, and identifying whale strategies. These AI-driven insights go beyond traditional technical analysis, providing a deeper, real-time understanding of onchain movements.

Onchain data analysis of crypto whales with AIThe most straightforward application of AI in whale detection involves filtering. AI models can be trained to recognize transactions exceeding certain thresholds-for example, transfers of over $1 million in ETH -by connecting directly to blockchain APIs. These APIs deliver continuous streams of transaction data, allowing AI scripts to flag large or suspicious transfers automatically.

Steps to implement this method include:

Step 1: Sign up with blockchain API providers like Alchemy, Infura, or QuickNode.

Step 2: Generate API keys and craft scripts to fetch real-time transaction data.

Step 3: Apply query filters to target specific transactions, such as high-value transfers or particular wallet addresses.

Step 4: Continuously monitor new blocks for transactions that meet your criteria, triggering alerts when detected.

Step 5: Store and review flagged transactions via dashboards or databases for further analysis.

This analytical layer transforms raw transaction data into actionable insights, shifting traders from reactive to proactive strategies-moving beyond mere market sentiment or chart patterns to observe the actual onchain activity shaping prices.

Behavioral analysis of crypto whales with AILarge wallets are often operated with sophisticated strategies-splitting transactions, multiple wallets, or moving assets gradually to obscure intentions. AI's machine learning techniques, such as clustering and graph analysis, can identify interconnected wallets, revealing the full network behind a whale's activity.

Graph analysis for connection mappingBy treating wallets as nodes and transactions as links, AI can map out complex networks, revealing groups of wallets operated by a single entity-even if they don't directly transact with each other.

Clustering for behavioral patternsOnce connected, the AI can group wallets with similar behaviors-long-term accumulation, market distribution, or exchange inflow-helping traders recognize strategic moves in real time.

AI then labels these clusters, transforming raw data into clear signals, indicating whether whales are accumulating, distributing, or exiting DeFi positions, providing traders with the intelligence to anticipate market shifts.

Advanced metrics and the onchain signal stackTo deepen market insights, traders incorporate broader onchain metrics, such as SOPR (spent output profit ratio) and NUPL (net unrealized profit/loss). Fluctuations in these indicators often signal trend reversals, especially when combined with flow metrics like inflows, outflows, and exchange ratios.

By integrating these signals into an onchain analytics stack, AI can generate predictive models that assess overall whale activity, rather than just isolated large transactions. This multi-layered analysis enables traders to identify early signs of market movement, with greater confidence and precision.

Did you know? AI is also vital for blockchain security. It can detect smart contract vulnerabilities and potential exploits before they are exploited, safeguarding assets in addition to analyzing market activity.

Guide to deploying AI whale tracking tools Step 1: Data collection

Connect to blockchain APIs like Dune, Nansen, Glassnode, or CryptoQuant for real-time and historical data filtered by transaction size.

Step 2: Model training

Train machine learning models on clean datasets, using classification or clustering to identify whale wallets and behavior patterns.

Step 3: Sentiment analysis

Incorporate social media and news sentiment analysis to contextualize whale movements and market mood shifts.

Step 4: Alerts and automation

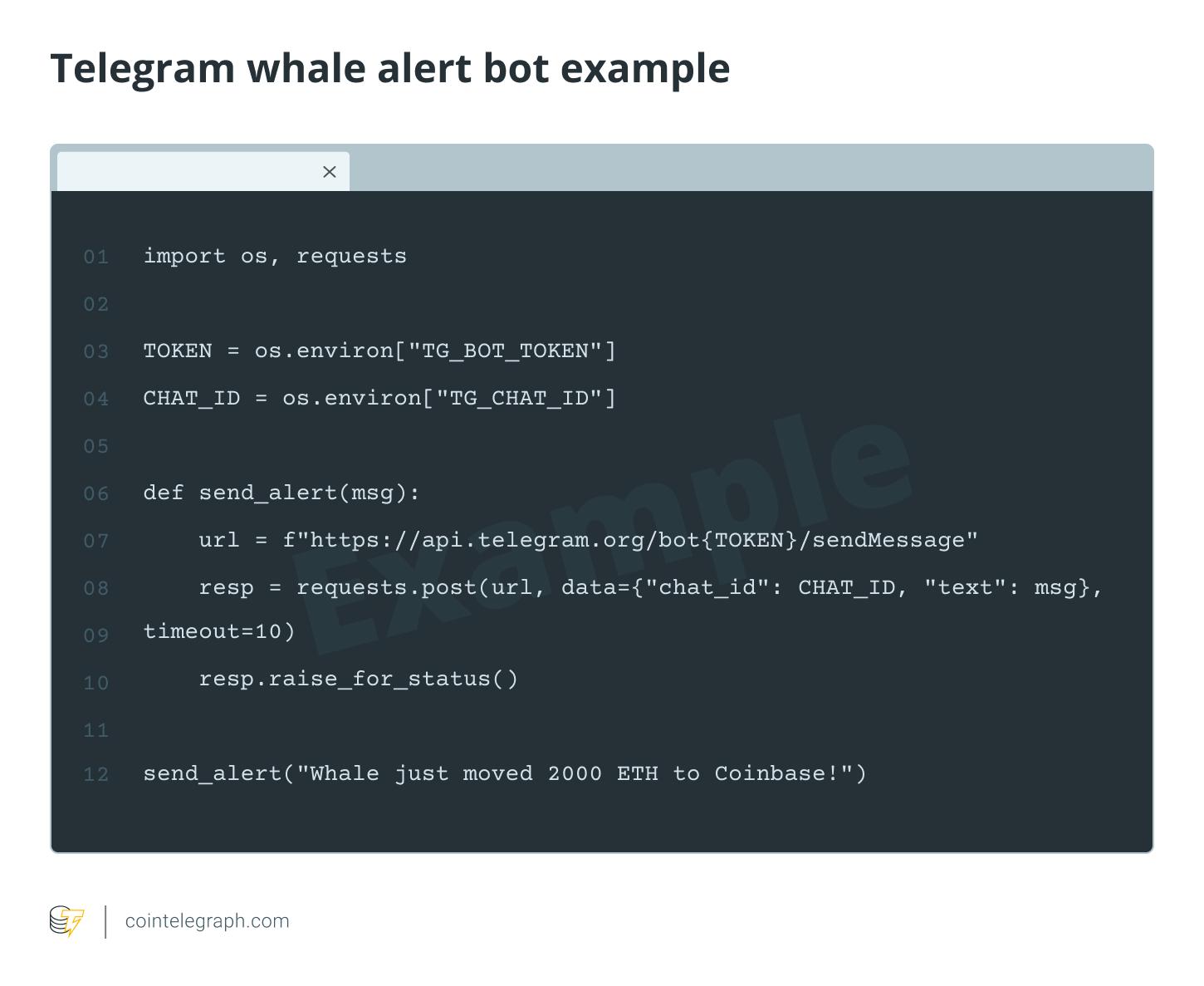

Set up real-time notifications via messaging platforms like Discord or Telegram , and integrate automated trading bots that respond to whale signals.

This phased approach-from basic monitoring to full automation-gives crypto traders a structured method to anticipate market shifts driven by whale activity and act proactively rather than reactively in the volatile crypto environment.

This article does not constitute investment advice. Cryptocurrency trading involves risk; always conduct your own research before making financial decisions.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment