Epay.Me Reinvents Itself As A Global Forex Technology Powerhouse, Expands Beyond Payment Services

The company now offers an integrated platform combining deep liquidity, advanced CRM, and payment solutions tailored for forex brokers and financial institutions. This all-in-one ecosystem aims to simplify operations, enhance security, improve compliance, and help brokers scale efficiently in a competitive market. Headquartered in Dubai, Epay emphasizes its strong infrastructure, 24/7 support, and commitment to regulatory standards, positioning itself as a leading fintech innovator in the Middle East and globally.

A Strategic Evolution Beyond Payments

Epay began its journey by offering secure, innovative payment aggregation and gateway services across the UAE and global markets. Today, the company has repositioned itself as a one-stop technology ecosystem for forex brokers , combining liquidity, CRM, and payments under a unified, secure platform.

With this bold move, Epay is setting a new benchmark for financial technology in the Middle East and beyond. By integrating multiple solutions under one roof, the company is not only simplifying operations for brokers but also redefining how financial institutions interact with technology in a competitive industry.

Expanded Offerings Designed for Brokers' Growth

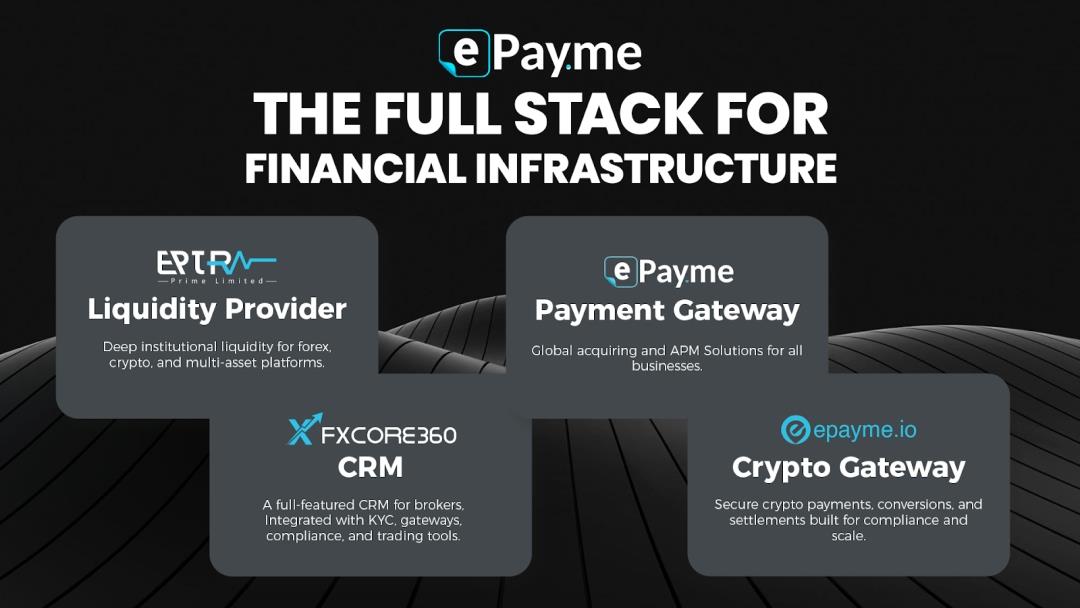

Epay's new verticals are tailored to the evolving demands of modern brokerage firms:

-

Deep Liquidity for Brokers Institutional-grade liquidity with tighter spreads, faster execution, and complete transparency, ensuring brokers can deliver world-class trading experiences to their clients. This level of liquidity access allows brokers to confidently expand into new regions and serve a diverse client base with reliability.

Advanced CRM with Integrated Payment Gateways & APMs A next-generation client management solution that not only streamlines onboarding and compliance but also connects seamlessly to global payment rails and alternative payment methods (APMs). It also empowers firms to personalize customer engagement, automate workflows, and stay ahead of regulatory requirements with minimal friction.

Complete One-Stop Tech Solutions An all-in-one secure ecosystem that integrates liquidity, CRM, and payment infrastructure, enabling brokers to scale without juggling multiple providers.

Technology, Trust, and Transformation

“Our mission has always been to combine innovation with security ,” said the Epay leadership team.“This expansion is not just about adding new services-it's about creating a unified, dependable technology powerhouse that helps brokers navigate the complexities of today's forex industry with speed, compliance, and transparency.”

The company highlighted that brokers today face increasing challenges around trust, operational efficiency, and regulatory compliance. By centralizing liquidity, CRM, and payment solutions, Epay is directly addressing these challenges and enabling brokers to focus on what matters most-growth and client satisfaction.

A Global Vision Backed by Local Strength

Headquartered in Dubai, a global fintech hub, Epay has invested heavily in its infrastructure to ensure scalability and reliability. The company's solutions come with:

-

24/7 global operational support

Military-grade security infrastructure

Multi-currency, cross-border payment capabilities

Full compliance with international regulatory standards. With its proven track record, the company is uniquely positioned to help brokers future-proof their businesses and thrive in a fast-evolving financial landscape.

About Epay

Founded in 2018 and headquartered in Dubai, UAE, Epay is a fintech innovator redefining how brokers and financial institutions access technology. Originally launched as a payment aggregator and PSP, Epay has since evolved into a global forex technology powerhouse, offering deep liquidity, advanced CRM, connected payments, and infrastructure solutions that empower brokers to scale efficiently and securely.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment