Accounts Payable Services By IBN Technologies Boost Transparency And Accuracy In Corporate Finance

"AP AR [ USA ]"Retail companies in Georgia enhance financial management by adopting accounts payable services. The update streamlines invoice processing, reduces errors, and improves vendor coordination. Businesses gain stronger oversight on procurement and payments, allowing scalable financial control and consistent supplier performance. This move reflects growing adoption of specialized accounts payable services in the retail sector.

As companies navigate increasingly complex financial landscapes, the demand for reliable and efficient accounts payable services is rising. Modern enterprises must handle vast volumes of invoices, payments, and regulatory obligations, which often stretch internal finance teams beyond capacity. Businesses are now seeking specialized accounts payable services to streamline processes, improve accuracy, and strengthen oversight. By leveraging expert teams, structured workflows, and advanced technology, organizations can reduce errors, accelerate approvals, and maintain compliance with accounting standards. The adoption of accounts payable services has emerged as a strategic approach to optimizing cash flow, enhancing vendor relationships, and improving overall operational resilience, signaling a shift from routine processing to proactive financial management.

Streamline financial workflows and improve payment accuracy Get a Free Consultation:

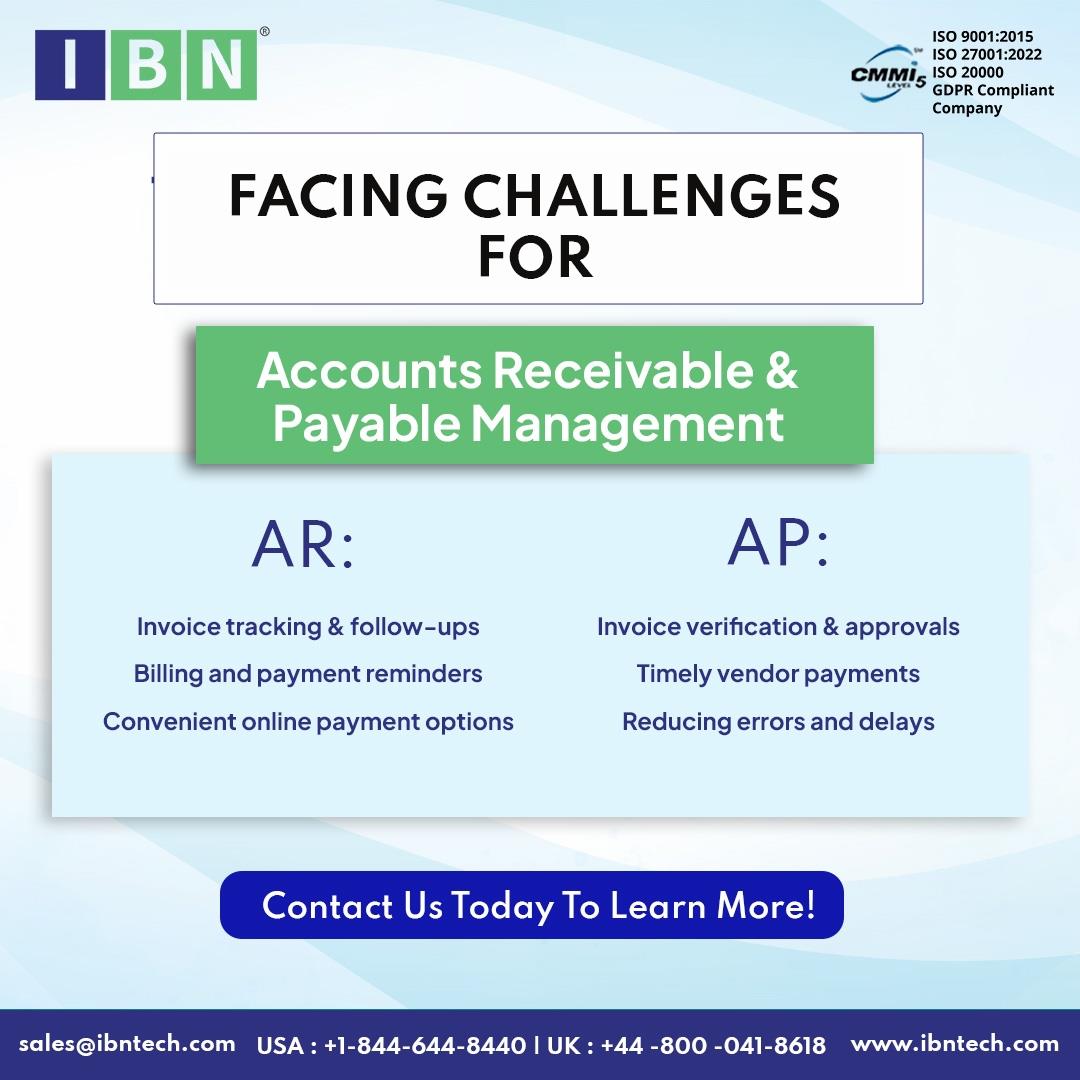

Industry Challenges

Many organizations continue to face persistent issues with traditional accounts payable management , including:

Invoice processing delays causing slower approvals and payments

Limited visibility into accounts payable procedures and workflow bottlenecks

Increased operational costs from in-house staffing requirements

Exposure to accounts payable risks, including errors and compliance breaches

Difficulty scaling processes across multi-location operations

These challenges can result in extended invoice cycles, strained supplier relationships, and decreased financial visibility, underscoring the need for efficient outsourced solutions.

IBN Technologies' Solutions

IBN Technologies delivers comprehensive accounts payable services designed to tackle these industry challenges. By integrating experienced finance professionals with advanced systems, the company ensures accuracy, speed, and compliance in all accounts payable procedures. Key features of their services include:

✅ Pre-planned vendor payments designed for high-volume hospitality operations

✅ Streamlined invoice monitoring for project-based and short-term agreements

✅ Enterprise-wide transparency for all accounts payable processes

✅ Instant notifications for upcoming obligations and payment deadlines

✅ Precise vendor alignment using rules-based accounts payable workflows

✅ Audit-ready reporting solutions compliant with local tax regulations

✅ Adaptive support tailored to demanding hospitality accounting schedules

✅ Advisory assistance for teams handling temporary and seasonal vendors

✅ Structured support for supplier reconciliation during closing cycles

✅ Professional strategies embedded into routine payables managementBy outsourcing accounts payable management to IBN Technologies, businesses reduce administrative burden, ensure accuracy, and achieve consistent compliance, allowing finance teams to focus on higher-value strategic initiatives.

Retail Payment Improvements in Georgia

Retailers in Georgia are experiencing significant gains by updating their accounts payable operations. By utilizing outsourced accounts payable services, finance teams streamline invoice processing and gain enhanced transparency with partners such as IBN Technologies.

● Invoice processing time cut by 40%

● Manual tracking replaced with standardized verification procedures

● Vendor scheduling optimized through consistent payment cycles

Collaborating with IBN Technologies has provided Georgia retailers with greater control over purchasing and financial oversight. The adoption of outsourced accounts payable services is enabling retailers to maintain reliable supplier performance and scalable governance across their financial systems.

Benefits of Outsourcing

Engaging with professional accounts payable services provides measurable advantages, including:

Faster invoice processing and reduced operational costs

Streamlined workflows with fewer errors and higher compliance

Increased visibility into cash flow and supplier obligations

Strengthened vendor relationships through timely, accurate payments

Scalable solutions to support business growth and multi-location operations

Outsourcing these critical functions ensures reliability while minimizing accounts payable risks, empowering organizations to enhance financial control without expanding internal resources.

Conclusion

As companies face mounting pressures from growing invoice volumes and regulatory requirements, accounts payable services have become an essential tool for modern financial management. By adopting structured, technology-enabled outsourcing solutions, organizations can transform their accounts payable functions from routine administrative tasks into strategic assets that support cash flow optimization, risk mitigation, and improved vendor collaboration.

IBN Technologies has established itself as a trusted partner in delivering tailored accounts payable services, combining expert professionals, streamlined workflows, and advanced reporting tools. Businesses leveraging these services gain end-to-end visibility into financial operations, strengthen compliance readiness, and reduce operational inefficiencies, creating a more resilient accounting framework.

The integration of accounts payable services also enables organizations to concentrate on core growth initiatives while leaving the complex tasks of invoice management, reconciliation, and regulatory compliance to specialized providers. Companies that embrace this approach achieve measurable improvements in operational efficiency, faster payment cycles, and stronger vendor partnerships.

Organizations seeking to elevate their accounts payable processes, improve compliance, and enhance financial oversight are encouraged to explore IBN Technologies' solutions. Schedule a consultation or request a quote today to see how accounts payable services can optimize workflows, minimize errors, and drive long-term business success.

Related Service:

Bookkeeping Services:

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 26 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment