Smackover Lithium Releases Maiden Inferred Resource For Its Franklin Project Comprising A Portion Of Significant Brine Position In East Texas

| Resource Category | Inferred | Inferred | Total Inferred | |

| Smackover Formation | Upper | Middle | Upper + Middle | |

| Gross Aquifer Volume, km3 | 7.69 | 7.98 | 15.67 | |

| Net Aquifer Volume, km3 | 3.10 | 0.37 | 3.47 | |

| Average Porosity | 18.1% | 12.4% | 17.5% | |

| Brine Volume, km3 | 0.56 | 0.05 | 0.61 | |

| Average Lithium Concentration, mg/L | 671 | 626 | 668 | |

| Lithium Resource, thousand tonnes | 377 | 29 | 406 | |

| LCE, thousand tonnes [5] | 2,005 | 153 | 2,159 | |

| Average Bromide Concentration, mg/L | 4,321 | 4,600 | 4,343 | |

| Bromide Resource, thousand tonnes | 2,426 | 212 | 2,638 | |

| Average Potassium Concentration, mg/L | 13,356 | 12,400 | 13,286 | |

| Potassium Resource, thousand tonnes | 7,500 | 570 | 8,070 | |

| Potash (Potassium Chloride), thousand tonnes [5] | 14,324 | 1,089 | 15,414 | |

| Notes: | ||||

| [1] | Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no guarantee that all or any part of the Mineral Resource will be converted into a Mineral Reserve. | |||

| [2] | Numbers may not add up due to rounding. | |||

| [3] | The resource estimate was completed and reported using a cut-off of 6% porosity (net aquifer) and 100 mg/L lithium and 1,000 mg/L for bromide and potassium. | |||

| [4] | The inferred resource estimate was developed and classified in accordance with guidelines established by the Canadian Institute of Mining and Metallurgy. The associated technical report was completed in accordance with the Canadian Securities Administration's National Instrument 43-101 and all associated documents and amendments. As per these guidelines, the resource was estimated in terms of metallic (or elemental) lithium, bromide and potassium. The effective date for the mineral resource estimate is September 24, 2025. | |||

| [5] | In order to describe the resource in terms of 'industry standard', lithium has been converted to lithium carbonate equivalent (LCE) by a conversion factor of 5.323 and potassium to potash (KCl) by a conversion factor of 1.91. |

Resource Estimation Methodology

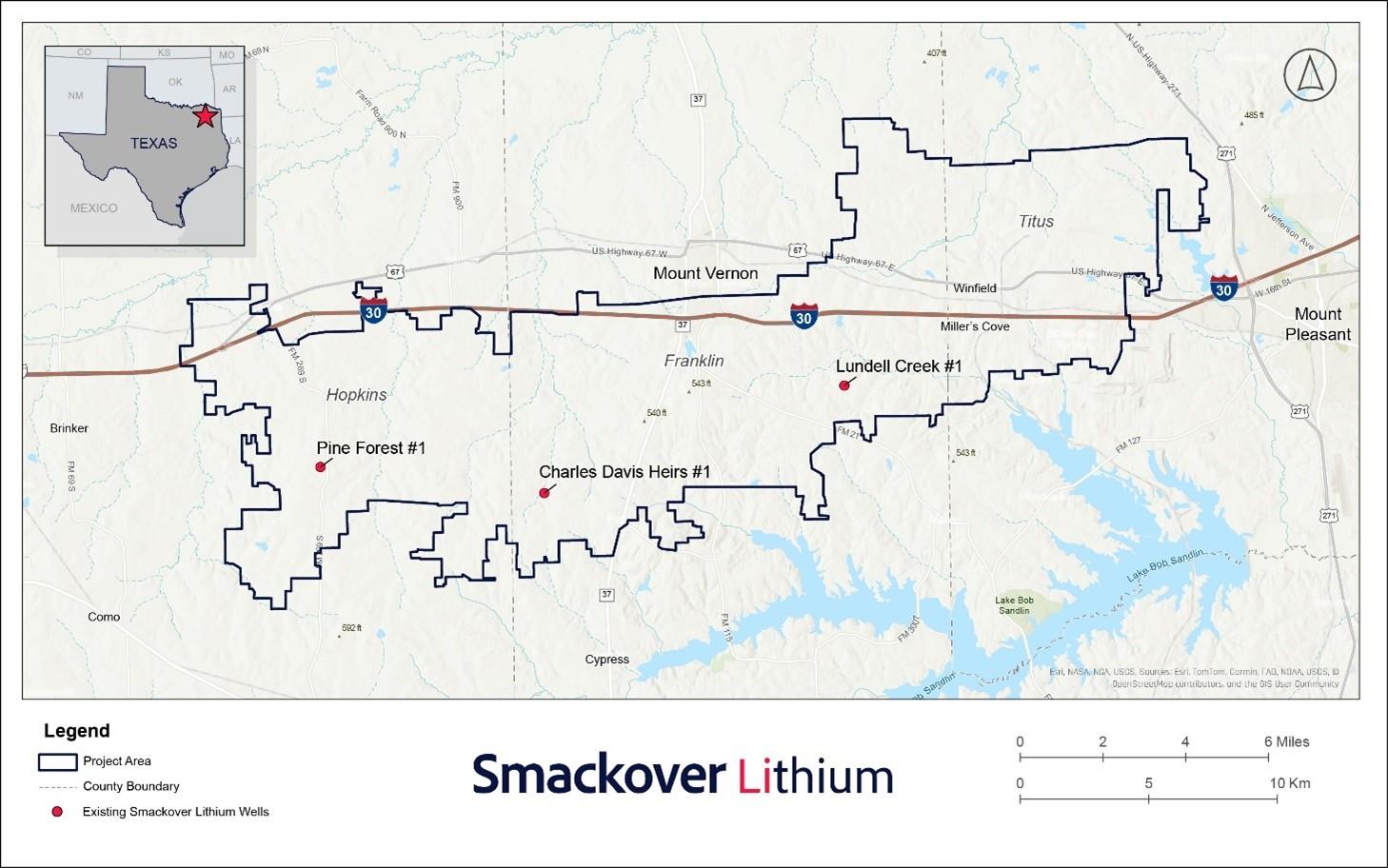

The resource underlies a total of 617 separate brine and brine-sourced mineral leases which are distributed across West Titus, Franklin and East Hopkins Counties in Northeast Texas. The 32,455-hectare (80,199 acres) project area consists of 18,732 gross brine mineral hectares (46,287 gross brine mineral acres) leased by Smackover Lithium.

The Project inferred resource is based upon a confined brine aquifer deposit contained within the porosity of the Smackover Formation. The Smackover Formation in Northeastern Texas is commonly subdivided into three intervals, the Reynolds Member Oolite (predominantly oolitic grainstone with common dolomite replacement) referred to in this report as the Upper Smackover, the Middle Smackover (a burrowed pellet packstone), and the Brown Dense (dark, dense micritic limestone) referred to in this report as the Lower Smackover. The brine resource, as reported, is contained within the Upper and Middle Smackover, which underlie the entire Franklin Project area. The Lower Smackover does not contribute to the current resource estimate as further information is needed to assess the resources contained therein. The brine resource is in an area where oil and gas exploration previously occurred. The data used to estimate and model the resource were gathered from 2D seismic, abandoned oil and gas exploration and production wells on or adjacent to the Project and three exploration wells completed by Smackover Lithium on the Project.

The Upper and Middle Smackover formations are similar in thickness across the Project. The depth, shape and thickness of the Smackover Formation were mapped out in a static geologic model (Petra) using the following data:

- 400 km (250 miles) of 2D seismic lines; 191 wells drilled into the subsurface in the general Project area; and Eight wells with electric logs on the Project and 45 wells with electrical logs surrounding the Project.

Porosity data used to further characterize the Smackover Formation geologic model included:

- Six porosity logs available on the Project; 204 core samples from two wells (Lundell Creek #1 and Pine Forest #1) collected and analyzed in 2023 for porosity from Upper and Middle Smackover Formation in 2023; and Upper and Middle Smackover Formation porosity values based upon LAS (Log ASCII Standard) density/porosity logs from 31 wells within or adjacent to the Project.

Based upon the above data, the average porosity values of 18.1% and 12.4% were calculated for the Upper and Middle Smackover Formation, respectively (see Table 1).

Representative brine chemistry was assessed using 14 brine samples taken from three wells drilled by the JV. This data yielded an average lithium concentration of 671 mg/L and 626 mg/L for the Upper and Middle Smackover, respectively. Sample quality assurance and quality control was maintained throughout by use of sample blanks and duplicates and by using an accredited, independent laboratory, Western Environmental Testing Laboratory in Sparks, Nevada.

To complete the in-place inferred resource analysis, core samples and well logging data were used to create net porosity-thickness (net aquifer >6% porosity) maps for the Upper and Middle Smackover. Net porosity-thickness is a direct indicator of the amount of brine below any location on the Project. Each net porosity-thickness map is multiplied by the constituent (lithium, bromide or potassium) concentration value, then integrated over the gross mineral acreage leased by the JV within the project area to obtain the in-place inferred resource estimates for each Smackover Formation zone (see Table 1).

Next Steps and Recommendations

The principal recommendations from the inferred resource assessment are to further refine the characteristics of the Upper and Middle Smackover Formation aquifers, brine chemistry and to assess reserve forecasts. Further characterization of the resource will be accomplished by drilling additional appraisal wells and re-entering three shut-in wells to gather dynamic data. This will facilitate the maturation and definition of a Preliminary Feasibility Study.

The JV will also conduct direct lithium extraction testing of the project brine, leveraging insights gained from Standard Lithium's Demonstration Plant located in El Dorado, Arkansas, as well as the JV's South West Arkansas project.

Qualified Persons

Disclosure of a scientific or technical nature in this news release, other than with respect to the inferred resource, was prepared under the supervision of Mr. Stephen Ross, P.Geo., British Columbia, Vice President of Resource Development for Standard Lithium and a Qualified Person for purposes of, and as that term is defined in, National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Mr. Ross is not independent of the Company.

Mr. Abinash Moharana, Registered Member of the Society for Mining, Metallurgy & Exploration (SME), is senior mining engineer with WSP USA Inc. Mr. Marek Dworzanowski, EUR ING and CEng, is a consulting metallurgical engineer. Mr. Robert E. Williams, PG, CPG, is a Principal Geologist at Haas & Cobb Petroleum Consultants. Mr. Randal M. Brush, P.E., is a Senior Engineering Advisor at Haas & Cobb Petroleum Consultants.

Each of Mr. Moharana, Mr. Dworzanowski, Mr. Williams and Mr. Brush have reviewed and approved the technical information contained in this news release related to the inferred resource, in their area of expertise, and are considered to be“independent” of Standard Lithium and the Franklin Project for purposes of NI 43-101.

About Smackover Lithium

Smackover Lithium is a joint venture between Standard Lithium and Equinor. Formed in May 2024, Smackover Lithium is developing two DLE projects in southwest Arkansas and East Texas (the“Projects”). Standard Lithium owns a 55% interest and Equinor holds the remaining 45% interest in the two Projects, with Standard Lithium maintaining operatorship.

About Standard Lithium

Standard Lithium is a leading near-commercial lithium development company focused on the sustainable development of a portfolio of large, high-grade lithium-brine properties in the United States. The Company prioritizes projects characterized by high-grade resources, robust infrastructure, skilled labor, and streamlined permitting. Standard Lithium aims to achieve sustainable, commercial-scale lithium production via the application of a scalable and fully integrated DLE and purification process. The Company's flagship projects are in the Smackover Formation, a world-class lithium brine asset, focused in Arkansas and Texas. In partnership with global energy leader Equinor, Standard Lithium is advancing the South West Arkansas Project, a greenfield project located in southern Arkansas, and actively exploring promising lithium brine prospects in East Texas.

Standard Lithium trades on both the TSX Venture Exchange (the“TSXV”) and the NYSE American under the symbol“SLI”. Visit the Company's website at for more information.

About Equinor

Equinor is an international energy company committed to long-term value creation in a low-carbon future. Equinor's portfolio of projects encompasses oil and gas, renewables, and low-carbon solutions, with an ambition of becoming a net-zero energy company by 2050. Headquartered in Norway, Equinor is the leading operator on the Norwegian continental shelf and has offices in more than 20 countries worldwide. Equinor's partnership with Standard Lithium to mature DLE projects builds on its broad US energy portfolio of oil and gas, offshore wind, low carbon solutions, and battery storage projects.

For more information on Equinor in the US, please visit: Equinor in the US - Equinor .

Investor Inquiries

Daniel Rosen

+1 604 409 8154

...

Media Inquiries

...

Use of Non-GAAP Measures

Certain financial measures referred to in this news release are not measures recognized under International Financial Reporting Standards (“ IFRS ”) and are referred to as non-GAAP financial measures or ratios. These measures have no standardized meaning under IFRS and may not be comparable to similar measures presented by other companies. The definitions established and calculations performed by Smackover Lithium are based on management's reasonable judgement and are consistently applied. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

The non-GAAP financial measures used in this news release are common to the mining industry. All-in operating cost per tonne is a non-GAAP financial measure or ratio and has no standardized meaning under IFRS Accounting Standards and may not be comparable to similar measures used by other issuers. As the Franklin Project is not in production, the Company does not have historical non-GAAP financial measures nor historical comparable measures under IFRS, and therefore the foregoing prospective non-GAAP financial measures may not be reconciled to the nearest comparable measures under IFRS.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain“Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words“anticipate”,“believe”,“estimate”,“expect”,“target,“plan”,“forecast”,“may”,“could”,“should”,“schedule”,“predict”,“budget”,“project”,“potential” and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to intended development timelines, the potential completion of a Pre-Feasibility Study for the Project, the cost and timing of any development of the Project, the reliability of third-party information, continued access to mineral properties or infrastructure, fluctuations in the market for lithium and its derivatives and other factors or information. Such statements represent the Company's current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.

The figure accompanying this announcement is available at .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- New Cryptocurrency Mutuum Finance (MUTM) Raises $15.8M As Phase 6 Reaches 40%

- Bydfi Joins Korea Blockchain Week 2025 (KBW2025): Deepening Web3 Engagement

- Yield Basis Nears Mainnet Launch As Curve DAO Votes On Crvusd Proposal

- 0G Labs Launches Aristotle Mainnet With Largest Day-One Ecosystem For Decentralized AI

- Ethereum-Based Defi Crypto Mutuum Finance (MUTM) Raises Over $16 Million With More Than 720M Tokens Sold

- Fintech's Gender Gap In Focus: Drofa Comms' Women Leading The Way Joins Evolvh3r's She Connects At TOKEN2049

Comments

No comment