Metaplanet Ranks Among Top 5 Bitcoin Treasuries With $633M Purchase

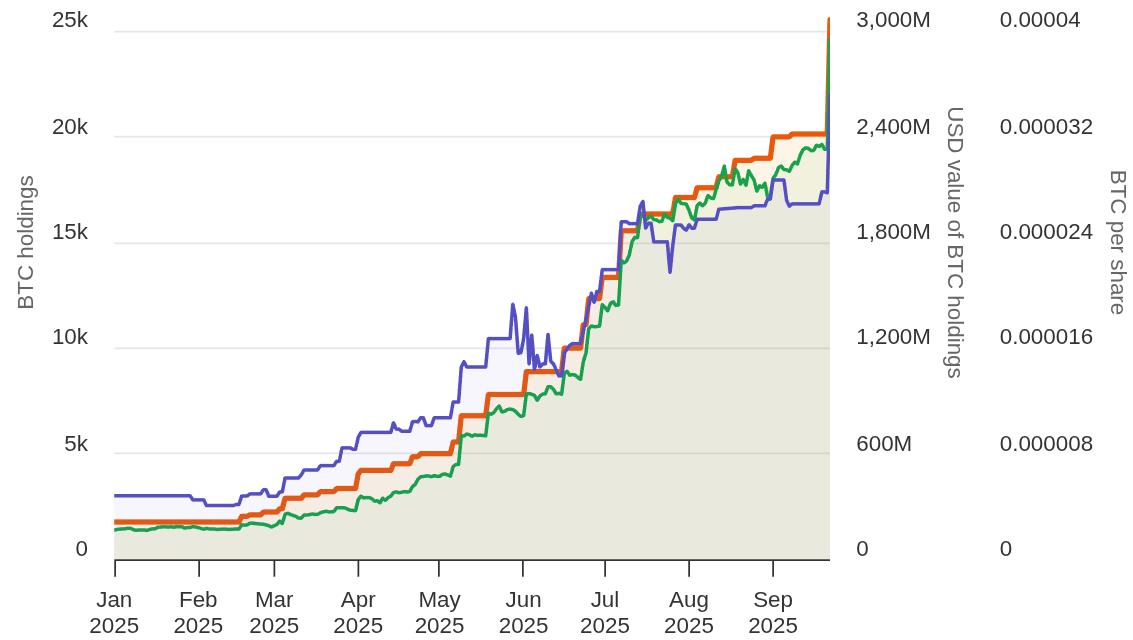

The company announced on Monday that it purchased the 5,419 BTC at an average cost of approximately 17.28 million yen (around $117,000) per Bitcoin , totaling roughly $633 million. As a result, Metaplanet now holds a total of 25,555 BTC , valued at nearly $3 billion at current market prices. Despite the increase in Bitcoin holdings, the company's stock price has not kept pace with its expanding crypto treasury.

Metaplanet's Bitcoin holdings in 2025 chart. Source: BitcoinTreasuries

The latest purchase was made at just under $117,000 per Bitcoin , which is currently slightly above the current market price of about $112,500. This entry place the company's Bitcoin yield - the change in BTC per fully diluted share - at 10.3% from July 1 to September 22, reflecting gains relative to its overall investment.

While Metaplanet's Bitcoin holdings have surged in value over the past month, increasing from approximately $2.1 billion to nearly $3 billion, its stock performance has lagged behind, falling more than 30% over that period. Shares traded at $4.09 on Monday, rising 3.8% after recent declines. Despite the downward trend, the stock has still gained nearly 78% this year, though it remains well below its peak of $15.35 observed in mid-May.

Metaplanet's Growth Strategy and ChallengesDespite mounting pressures on its stock price, Metaplanet continues to pursue aggressive expansion plans. Earlier this month, the company established Metaplanet Income Corp., a US-based subsidiary in Miami with an initial capital of $15 million, aimed at expanding its Bitcoin income streams. Simultaneously, it launched Bitcoin Japan Inc., reinforcing its focus on domestic blockchain-based assets and services.

Furthermore, Metaplanet announced a planned issuance of 385 million new shares at a discount, aiming to raise an estimated $1.44 billion to fund further Bitcoin acquisitions and growth initiatives. This financing strategy indicates the company's belief in continued expansion within the cryptocurrency and DeFi sectors, despite the recent downturn in its stock market valuation.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment