Poland's Solid Economic Growth Still Reliant On Services

In August, industrial production increased by 0.7% year-on-year and seasonally-adjusted data points to a 0.1% month-on-month decline, extending the period of near-stagnation seen since early 2022. Output was particularly weak in export-oriented industries like automotive (-4.2% YoY) and the manufacture of electrical equipment (-3.1% YoY). Some other manufacturing sectors continue to grow at a double-digit pace, including the maintenance and installation of machinery and equipment, the manufacture of other transport equipment, and the manufacture of machinery and equipment, possibly reflecting military defence activity. But overall, the August report did not bring any significant rebound in total production and the Polish industry remains in stagnation, as it has for over three years, similarly to other countries in Central and Eastern Europe. We also think some manufacturing sectors are suffering from competitiveness issues driven by a sharp rise in wages in recent years, stagnant investment and intensifying competition from Asia.

No signs of significant rebound in industryIndustrial output, 2021=100, SA

Source: GUS.Headwinds are particularly visible in manufacturing as external demand remains weak, held back by Germany's economic stagnation and subdued appetite for European exports. Polish manufacturing inputs usually constitute a substantial part of the goods exported by the euro area. While the trade deal between the European Union and the United States has somewhat reduced the uncertainty for businesses, the new conditions are less favourable for Europe (despite the“it-could-be-worse” narrative, American import tariffs are still higher) and do not give grounds for optimism regarding the outlook for European exports in the coming months. Some support may come from German fiscal stimulus over the medium term, but its impact may be limited given the fact that Poland does not specialise in providing investment goods which may constitute the bulk of the German package (infrastructure, defence).

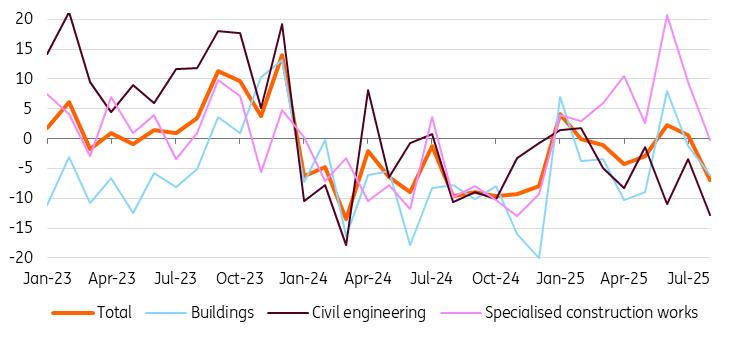

Construction in contractionAugust construction data disappointed as output nosedived by 6.9% YoY showing weakness across all sub-sectors. Civil engineering was especially weak (-12.8% YoY), reflecting delays in disbursing the EU structural and Resilience and Recovery (RRF) funds. In the case of the latter, we currently expect the majority of nearly PLN100bn of remaining RRF grants (€23bn, 2.6% of GDP) to be transferred to final beneficiaries in 2026, whereas until a few months ago we projected an investment boom in 2025. Currently, we expect a more balanced distribution of RRF outlays between 2025 and 2026. That means that investment in 2025 is likely to be less robust than we had expected at the beginning of this year, but should be stronger in 2026. The gap is filled by stronger-than-expected private consumption as households seem to be tapping into savings generated last year, when they experienced a surge in real disposable income and were relatively reluctant to spend.

Broad-based declines in construction in AugustConstruction output, %YoY

Source: GUS. Labour market softening gradually

Labour market data points to gradual easing of still tight conditions. Wage growth in businesses moderated to 7.1% YoY, posting the lowest annual rate since February 2021. The period of double-digit growth in wages is clearly behind the Polish labour market. Employment continued to decline (-0.8% YoY), reflecting both shrinking labour supply (unfavourable demographics, slower inflow of migrants) and somewhat weaker demand for workers. The slowdown in wages is alleviating worries among some MPC members who regularly cite elevated wage growth as one of the main upside risks to inflation.

Wage growth is slowing downAverage wage and sallary in enterprises, %YoY

Source: GUS, ING. Economic conditions allow for further rate cuts, but timing is uncertainAugust figures from the real economy point to stagnant industry and a recession in construction, but economic growth remains robust and is most likely accelerating on the back of a buoyant expansion in the services sectors. Demand remains weak externally but strong at home. The rebound in fixed investment is still slow to materialise amid delays in the utilisation of EU funds, but consumer confidence is improving and 2Q25 data suggests that households are eager to spend thanks to savings generated last year, even though real income growth has slowed. We still expect 3.5% economic growth this year, and 3Q25 GDP growth should be stronger than the 3.4% YoY growth posted in the previous quarter.

The August data on wage growth, employment and PPI call for disinflation to continue in both headline and core inflation. With a relatively high real interest rate, the central bank still has room for monetary easing, even though policymakers are cautious and are mainly focusing on upside risks to inflation. Still, we expect one more 25bp rate cut by the end of this year - most likely in November, as the new National Bank of Poland staff projection should show inflation close to the target over the medium term. However, we do not rule out that rate setters may decide to cut in October, instead of waiting till November. Either way, we expect only one more move from the MPC this year., two in 2026 and possibly one more in 2027.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Motif AI Enters Phase Two Of Its Growth Cycle

- 1Inch Unlocks Access To Tokenized Rwas Via Swap API

- Kucoin Presents Kumining: Embodying Simple Mining, Smart Gains For Effortless Crypto Accumulation

- With Seal, Walrus Becomes The First Decentralized Data Platform With Access Controls

- Jpmorgan Product Head Joins GSR Trading MD To Build Institutional Staking Markets

- Innovation-Driven The5ers Selects Ctrader As Premier Platform For Advanced Traders

Comments

No comment