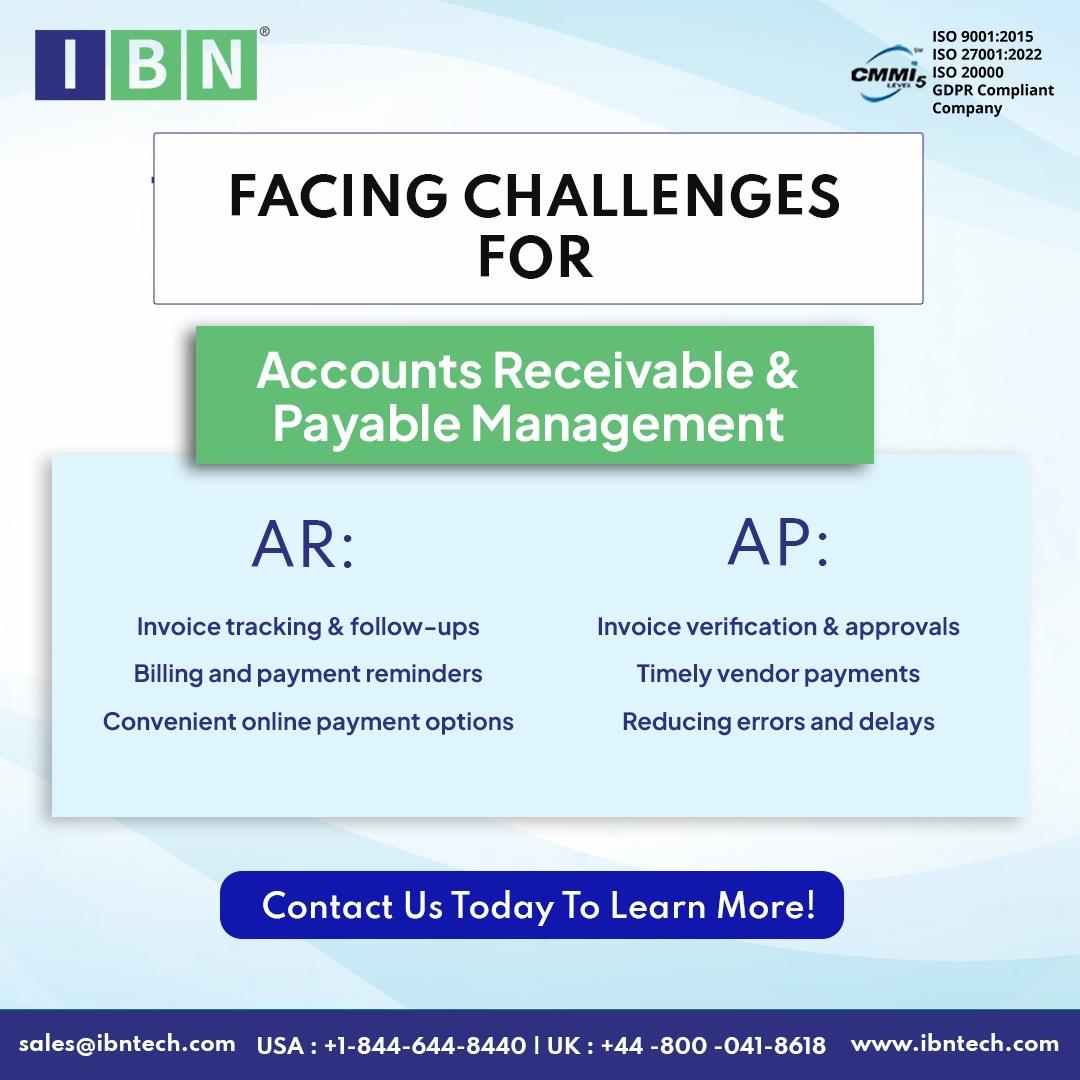

Account Payable Services By IBN Technologies Transform Business Financial Operations

"AP/AR [USA]"Businesses are increasingly turning to accounts payable services to enhance financial accuracy and efficiency. These services streamline invoice processing, ensure compliance with regulations, and strengthen vendor relationships. Companies leveraging accounts payable services gain better operational control, reduce risks, and improve overall financial management across departments and industries.

Miami, Florida - 12 Sep, 2025 - Financial operations are even at the core of business success, and organizations seek greater accuracy, compliance, and operational efficiency. Companies across industries are embracing outsourced accounts payable services to automate invoice processing, maintain audit-ready records, and reduce risk. Outsourced accounts payable services provide standard accounts payable management and robust financial controls, allowing internal personnel to focus on critical initiatives without compromise on accuracy. By instituting formalized procedures and professional management, companies can enhance cash management, develop vendor relationships, and minimize costly errors. With more advanced vendor interaction and regulatory requirements, outsourced accounts payable solutions are now an essential tool for long-term financial health and operations accuracy.

Challenges Confronting Accounts Payable Operations

Organizations managing accounts payable internally often encounter persistent inefficiencies:

Invoice processing slows payment cycles and increases errors

Compliance pressures from complex tax and regulatory requirements

Non-standardized accounts payable procedures lead to frequent mistakes

Gaps in internal controls create potential for fraud and financial loss

Difficulty scaling staff or resources during peak periods

These challenges highlight the importance of structured, outsourced accounts payable services that enhance transparency, efficiency, and financial accuracy.

Innovative Solutions Through Outsourced Accounts Payable Services

Outsourced accounts payable services provide organizations with expert oversight, structured workflows, and scalable solutions designed to address operational hurdles. Core service features include:

✅ Accurate invoice verification aligned with purchase order standards

✅ Clear oversight of daily payables across all departments

✅ Issues identified and resolved before vendor outreach is needed

✅ Supplier agreements automatically integrated into payment schedules

✅ Financial records structured for audits and reporting purposes

✅ Support for high-volume retail transactions during peak inventory periods

✅ Continuous adherence to vendor tax and regulatory requirements

✅ Detailed store-level invoice tracking for precise monthly reporting

✅ Real-time dashboards ensuring internal transparency and reconciliation

✅ Dedicated retail AP teams handling complete documentation workflows

By leveraging these services, companies can reduce administrative burden, enhance payment accuracy, and maintain control over accounts payable procedures. Scalable solutions allow organizations to adjust to workload fluctuations and evolving regulatory demands without compromising operational efficiency.

Retail AP Achievements in California

California retail companies are experiencing higher accuracy and stronger vendor relationships by modernizing their financial processes. Strategic collaborations and outsourced accounts payable services have played a pivotal role in these improvements.

● Invoice processing efficiency increased by 40%

● Manual checks replaced with multi-level verification workflows

● Vendor confidence strengthened through consistent, precise payments

Professional service providers continue to guide California retailers with expert accounts payable oversight. Retail teams leveraging outsourced accounts payable services now enjoy streamlined accounts payables management and a well-structured approach to long-term financial control.

Advantages of Outsourcing Accounts Payable Services

Outsourcing accounts payable services offers measurable benefits for businesses:

Cost Efficiency: Reduces expenses associated with staffing, training, and systems

Process Acceleration: Streamlined workflows speed up approvals and payments

Regulatory Assurance: Standardized procedures minimize accounts payable risks and support audit readiness

Scalable Flexibility: Services adapt to seasonal or project-based volume fluctuations

Strategic Focus: Internal teams can prioritize high-value planning and decision-making

These advantages strengthen vendor relationships, improve operational resilience, and create a sustainable financial management framework.

Looking Ahead: The Future of Accounts Payable Services

With the finance functions becoming increasingly complex, outsourced accounts payable functions are now a strategic resource for organizations looking to uphold operational excellence. Firms that adopt these functions enjoy structured accounts payable processes, enhanced compliance, and full audit preparedness. Organized workflows and experienced management enable organizations to streamline payment cycles, minimize operational risk, and increase internal visibility across departments.

Companies embracing outsourced accounts payable solutions are now free to redirect internal resources towards strategic endeavors, fueling long-term development while keeping finance sharp. Leveraging the expertise of professional accounts payable enables companies to protect cash flow, reduce accounts payable risks , and create operational agility.

Organizations aiming to maximize their financial processes and reduce operation mistakes are invited to investigate expert accounts payable solutions. Working with experienced providers of outsourced accounts payable services keeps firms nimble, compliant, and effective at managing financial transactions.

Related Service:

Bookkeeping Services:

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 26 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment