South Korean Activity Improved, Suggesting A Strong Third Quarter

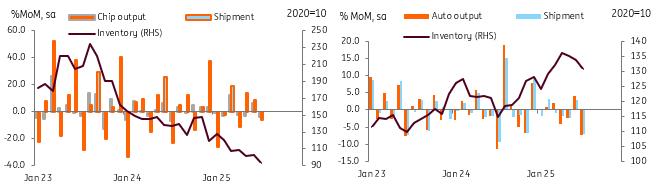

Overall, South Korean manufacturing output increased in July. But US tariffs appeared to have different impacts by industry. They led to an output increase in electronic goods, boosted to front-loading to avoid potential sectoral tariffs, and declines in auto output.

The launch of the new mobile phone models increased the output quite sharply by 13.3%. Computers and other electronic devices gained ground strongly. Semiconductor output actually slid 3.6%, though this was probably related to inventory adjustments as stockpile dropped 9%.

The biggest impact of the US tariffs is on the motor sector. Output dropped 7.3%, falling three months out of four, while shipments also dropped 7.1%. A 25% auto tariff is expected to weigh on the industry going forward.

Auto vs Chips

Source: CEIC More encouraging signs from service and retail sales

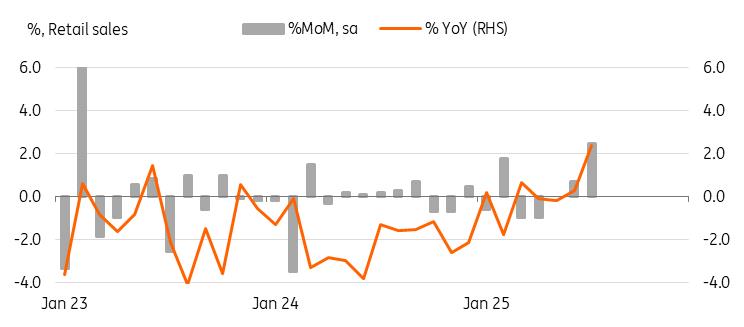

Retail sales advanced 2.5% in July, partly boosted by a jump in mobile phone sales. But other sales were solid as well, with auto sales up 1.8% and household appliances up 6.6%. Semi-durable goods and non-durable goods sales all gained for a second month.

The government's cash aid program began at the end of July. We anticipate a more significant impact in August and beyond. Also, with a second round of cash payouts – this time income-based -- from September, combined with more Chinese tourists expected due to the visa waiver program, retail sales and service output are expected to strengthen throughout the second half.

Retail sales rose for a second month in July

Source: CEIC Investment also shows a recovery in July

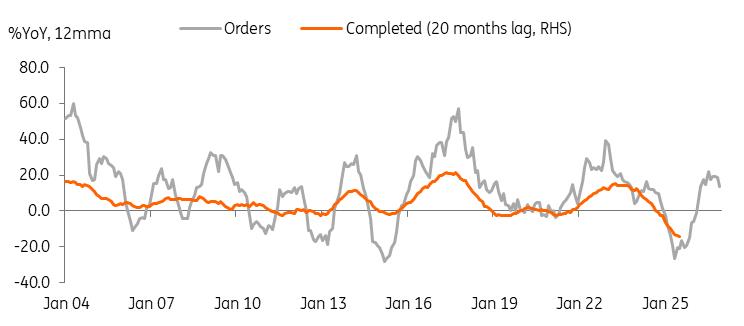

Equipment investment rebounded strongly by 7.9% in July, after declining for four months. IT sector investment grew steadily, while other volatile transportation equipment (mostly aircraft) rose firmly by 38.3%, thus pushing up the headline figure. We have seen capital goods imports rise in recent months, and we expect equipment investment to grow in the third quarter. For construction, the most concerning area of the domestic economy, overall output fell 1.0% in July after a 6.4% gain in June. But it seems construction is slowly bottoming out as orders received rise for a second month. Civil engineering is recovering partly thanks to government support. The three-month sequential trend showed that the contraction has actually shallowed from -6.7% on a three-month-on-three-month basis in March to -0.8% in July. We remain cautious about the construction recovery, but for now, this is a positive sign.

Construction may have been bottoming out

Source: CEIC, ING estimates GDP outlook

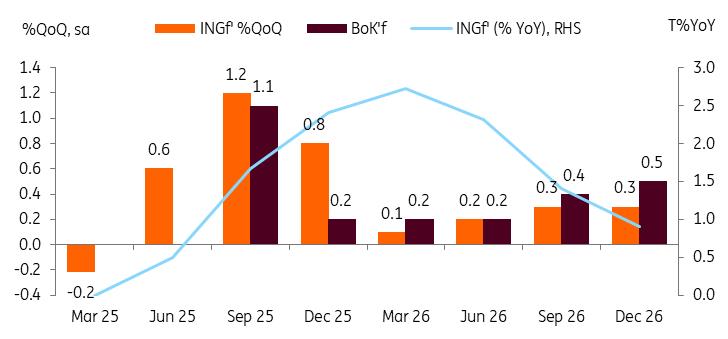

Next week, we will get the latest August exports data. We expect exports to decelerate, but mostly due to unfavourable calendar day effects. Daily average exports continue to rise solidly by around 5%. We believe exports will remain positive in the near term amid strong global AI demand and reduced tariff uncertainty. This should be favourable for exports for the near term. The local business survey showed meaningful improvement to support our view.

Thus, we expect 3Q25 GDP to grow 1.2% quarter-over-quarter and 0.8% in 4Q25. Compared to the Bank of Korea's growth outlook, we see a higher growth in 4Q25. That's because we expect construction activity to slowly stabilise and for private consumption and services to recover strongly in the fourth quarter, even if the fiscal boost dissipates.

GDP outlook ING vs BoK

Source: BoK, ING estimates

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment