Australia Automotive Market Size, Share, Trends, Growth And Opportunity Analysis 2025-2033

Report Attributes and Key Statistics:

-

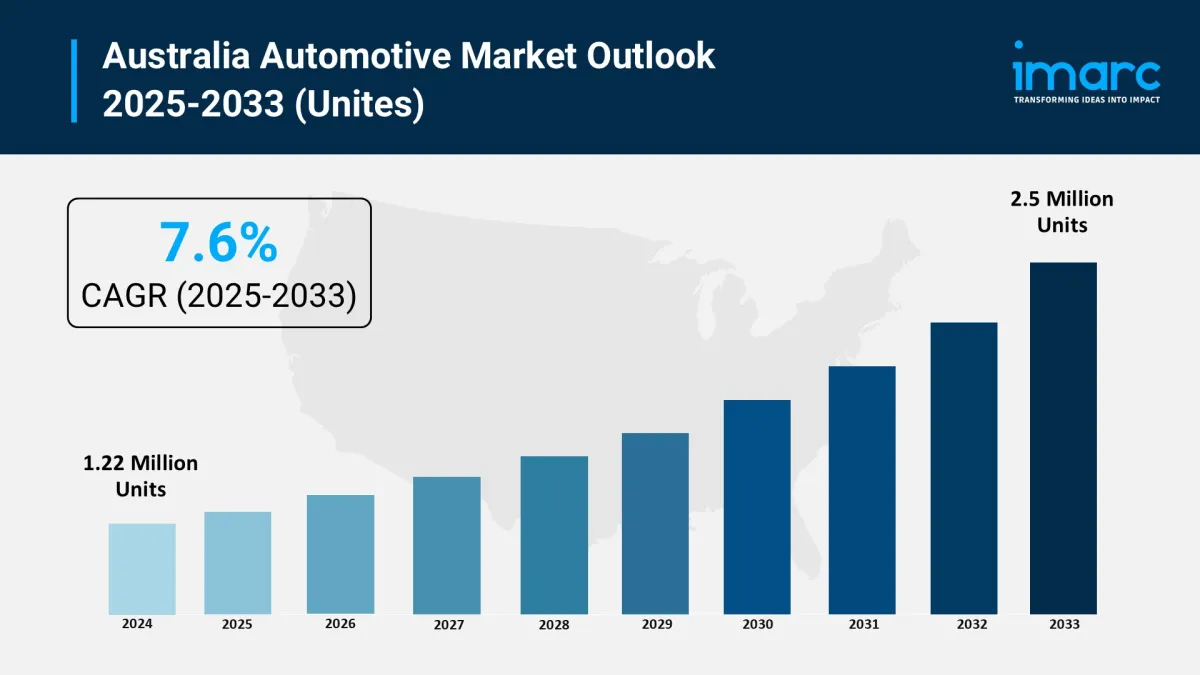

Base Year: 2024

Forecast Period: 2025-2033

Market Size in 2024: 1.22 Million Units

Market Forecast in 2033: 2.5 Million Units

Growth Rate (CAGR 2025-2033): 7.6%

Australia Automotive Market Overview:

The Australian automotive market is growing quickly due to urbanization, rising demand for fuel-efficient and eco-friendly vehicles, and changing consumer preferences. Government incentives that promote sustainability, such as tax rebates and stricter emission standards, are speeding up the adoption of electric vehicles (EVs). The expansion of charging stations also supports this shift. The rise of ride-sharing services and subscription-based vehicle ownership is changing traditional sales strategies. At the same time, ongoing advancements in autonomous driving, connectivity, and safety features are making the market more attractive. The commercial vehicle sector is growing thanks to increasing e-commerce, construction, and mining activities.

Request For Sample Report: https://www.imarcgroup.com/australia-automotive-market/requestsample

Australia Automotive Market Trends and Drivers:

Key trends include a rise in electric vehicle adoption, backed by more charging infrastructure and government subsidies. Connected and autonomous vehicle technologies that use AI, IoT, and 5G are changing how vehicles work and how consumers experience them. The growth of shared mobility platforms, such as car-sharing and ride-hailing, is affecting traditional ownership models, especially in cities. There is strong consumer interest in SUVs and utility vehicles (utes) that offer versatility and off-road capabilities, along with more electrification options. Aftermarket services are evolving by using telematics and predictive maintenance, taking advantage of longer vehicle ownership trends.

Market growth stems from a rising consumer preference for low-emission vehicles, supported by policies and environmental awareness. More government incentives, including significant subsidies for electric utility vehicles and investments in infrastructure, are boosting sales. Advances in autonomous features and connectivity improve vehicle safety and comfort, attracting buyers. Expanding urban populations and ongoing infrastructure development promote vehicle sales. There is also growing demand for commercial vehicles in logistics, mining, and construction, helping to support business usage. Furthermore, financial solutions like flexible loans and subscription models are making vehicles more affordable.

Market Challenges and Opportunities:

The Australian automotive market faces challenges, such as supply chain disruptions that affect vehicle availability and production costs. Semiconductor shortages have occasionally limited manufacturing capacity. Market penetration in rural and remote areas is still low due to insufficient charging infrastructure and connectivity. High development costs for advanced technologies, such as augmented reality and autonomous driving, slow the adoption of some innovations. Regulatory scrutiny around emissions, data privacy, and automotive safety requires compliance investments. Competitive pressure from imports and fluctuating raw material prices also impact profitability and pricing strategies.

Emerging opportunities include expanding electric vehicle infrastructure, particularly in regional and remote areas, which can enhance market reach. Innovations in autonomous and connected vehicle technology create possibilities for new products and improved consumer services. The growth of urban ridesharing and subscription-based mobility models offers alternative revenue opportunities. The commercial vehicle segment benefits from increased electrification of fleets and telematics integration that boosts operational efficiency. Additionally, Australia's abundant critical mineral reserves can support local battery supply chains, strengthening EV manufacturing. Aftermarket services are also innovating through digital platforms and predictive maintenance, further energizing the sector.

Australia Automotive Market Key Growth Drivers:

-

Rising adoption of electric and hybrid vehicles supported by government incentives

Expanding charging infrastructure and urbanization

Technological advances in autonomous driving and connected car technologies

Growth in commercial vehicle demand from mining, construction, and logistics sectors

Increasing popularity of shared mobility and subscription vehicle ownership models

Robust aftermarket services strengthened by digitalization and telematics

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/australia-automotive-market

Australia Automotive Market Segmentation:

By Type:

-

Passenger Vehicles

Commercial Vehicles

By Application:

-

Personal Use

Municipal Use

Business Use

By Region:

-

Australia Capital Territory & New South Wales

Victoria & Tasmania

Queensland

Northern Territory & Southern Australia

Western Australia

Competitive Landscape:

-

Toyota Motor Corporation Australia Limited

Ford Motor Company of Australia Pty Limited

Volkswagen Group Australia Pty Ltd

Hyundai Motor Company Australia Pty Limited

Volvo Car Australia Pty Ltd

Other regional and international automotive manufacturers and distributors

Australia Automotive Market News:

-

August 2025 – The Australian government is moving ahead with a national road user charge , beginning with electric vehicles (EVs). Estimated at $300–$400 per year , this mileage-based fee is designed to replace declining fuel excise revenues and may later extend to all vehicles. Trials in heavy vehicles are also under consideration, with further planning set for September.

August 2025 – Industry experts caution that the EV road user charge could slow down clean vehicle adoption, particularly if applied before EVs reach a 30% share of new sales. Critics warn that affordability challenges could undermine the country's clean transport transition.

Key Highlights of the Report:

-

Comprehensive market size forecast to 2033 with historical trend analysis

Insightful review of EV adoption and technological trends including ADAS and autonomous vehicles

Detailed segmentation by vehicle type, application, and region

Analysis of government incentives and infrastructure projects supporting growth

Assessment of challenges like supply chain constraints and regulatory requirements

Competitive landscape profiling key players and strategic initiatives

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=22065&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Vietnam Vegan Food Market Size, Share, Trends And Report 2025-2033

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- Accounting And Bookkeeping Service Business Plan 2025: How To Start, Operate, And Grow

- Japan Shrimp Market Predicted To Hit USD 7.8 Billion By 2033 CAGR: 2.62%

- Microgrid Market Growth, Key Trends & Future Forecast 2033

- Australia Automotive Market Size, Share, Trends, Growth And Opportunity Analysis 2025-2033

Comments

No comment