Weak Japanese Industrial Production Complicates Boj's Rate Decision

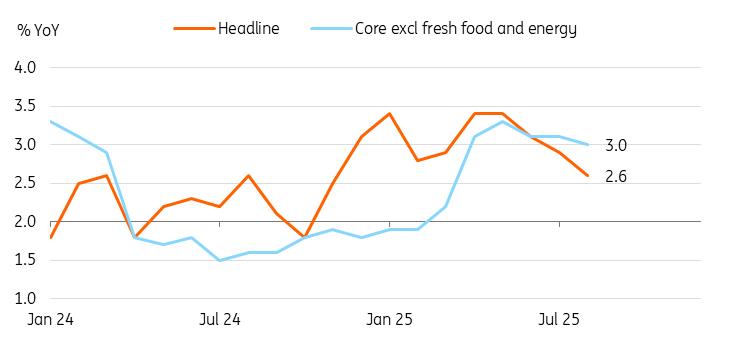

| 2.6% YoY |

Tokyo CPI inflation

Core inflation excluding fresh food and energy 3.0% |

| As expected |

A big drop in utility prices (-8.8% YoY) was the main reason for the cooling of headline Tokyo inflation, while fresh food (4.1%) and transport & communication (3.3%) prices rose. Inflation rose 0.1% month on month, mostly thanks to services prices rising by 0.2%. Despite a sharp cooling of headline inflation, core inflation excluding fresh food and energy rose 3.0%, signalling underlying price pressures remain firm.

Meanwhile, a tight labour market is expected to support a sustained trend of wage growth. The unemployment rate unexpectedly fell to 2.3% in July (vs 2.5% in June, market consensus), and the job-to-application ratio stayed at 1.22. We believe a structural shortage of labour supply will increase wage growth pressures going forward, resulting in inflation staying around 2%.

Core inflation remains above 3% YoY for five months in a row

Source: CEIC

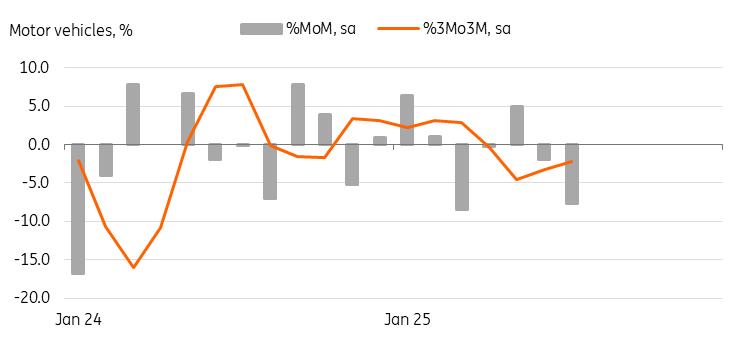

| -1.6% |

Industrial Production

-0.9% YoY |

| Lower than expected |

Markets largely expected weak industrial production in July thanks to tariff-related volatility after a solid gain in June. But actual IP was weaker than expected by dropping 1.6% MoM (vs -1.1% market consensus). The large drop came from car output (-7.6%). We believe it is mostly due to the US tariffs. Semiconductor-making equipment also fell by -16.4%. But given the strong global AI demand, this may be temporary. The drop in retail sales (-1.6%) was also bigger than expected (-0.2%) and the decline was broad based, thus adding downside risks to the current quarter's growth.

Motor output declined for a second month, probably due to the US tariffs

Source: CEIC BoJ watch

We continue to believe that the Bank of Japan will deliver a 25 hike in October thanks to reduced uncertainty over US tariffs and firm inflation. But the BoJ's concern about weak growth may have increased after today's weak activity data. We need to monitor exports and other activity data in the coming months to see whether they normalise as we expected.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Invromining Expands Multi-Asset Mining Platform, Launches New AI-Driven Infrastructure

- Superconducting Materials Market Size, Trends, Global Industry Overview, Growth And Forecast 2025-2033

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- Building Automation System Market Size, Industry Overview, Latest Insights And Forecast 2025-2033

- Brazil Edtech Market Size, Share, Trends, And Forecast 2025-2033

- Australia Automotive Market Size, Share, Trends, Growth And Opportunity Analysis 2025-2033

Comments

No comment