403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

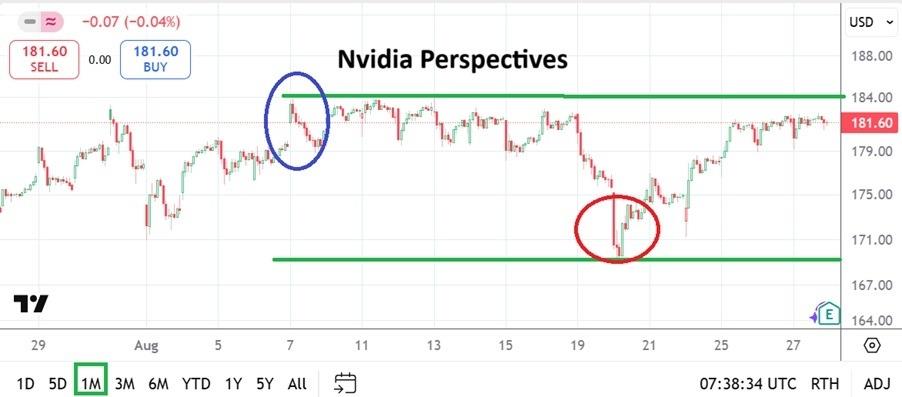

Nvidia Analysis 28/08: Wagering Decisions (Chart)

(MENAFN- Daily Forex) In early trading this morning via futures markets and CFD platforms, Nvidia has seen some selling after its quarterly earnings report was published on Wednesday evening. Nvidia is apparently facing a wave of sudden selling in the aftermath of its quarterly earning report which was released last night. However, before day traders believe that Nvidia is now going to see a one way path lower, some perspective is needed because long term investment institutions are unlikely to let go of the Nvidia equity anytime soon.Yes, there are enough day traders in Nvidia nowadays that can move the company's value in extreme ways. And day traders have to also recognize there is a significant difference in the real cash market compared to CFD speculation. If a retail trader is selling Nvidia via their CFD account, this has no real effect on the cash market that Nvidia actually is affected by. Cash is king in trading and moves the markets on Perceived Bad NewsAlso the perceived bad news as interpreted by some analysts last night may prove to be very short lived. Nvidia was touching all time highs in early August when it flirted with the 185.00 vicinity. The Nasdaq listed price of Nvidia upon its close yesterday was 181.60. For traders looking at CFD accounts where futures prices are boiling – prices may be quite different.Top Forex Brokers1 Get Started 74% of retail CFD accounts lose money Before Nvidia opens today via the Nasdaq market, speculators who want to participate need to understand that they are trading within a volatile market that may see sudden spikes in the coming hours. Nvidia's quarterly earnings report last night actually produced solid profit revenues. However, they warned that some of their business faces unknown conditions because of changing environments. And concerns regarding China and implications regarding tariffs remain a difficult formula to produce a viable outlook Need to Understand Long-Term OptimismNvidia may face some selling today. However day traders need to look at technical support levels and ask themselves where buying will suddenly emerge. Optimistic outlooks long-term for Nvidia remain a steady part of the investment world's diet.

- Nvidia's quarterly report was solid enough last night to keep it likely quite supported in the face of any short-term speculative selling. And let's remember selling in Nvidia that may be happening this morning could be folks who are cashing out profits too. Perhaps Nvidia is not going to break its record highs today or tomorrow, but selling Nvidia with a negative outlook is likely wrong thinking for any extended period. Traders should also note U.S GDP numbers will be released later today. The growth statistics may play a role in Nvidia's trading near-term as it mixes with shifting winds in the marketplace.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Versus Trade Launches Master IB Program: Multi-Tier Commission Structure

- Mutuum Finance (MUTM) New Crypto Coin Eyes Next Price Increase As Phase 6 Reaches 50% Sold

- Flexm Recognized As“Highly Commended” In The Regtech Category At The Asia Fintech Awards Singapore 2025

- Tappalpha's Flagship ETF, TSPY, Surpasses $100 Million In AUM

- Stocktwits Launches Stocktoberfest With Graniteshares As Title Partner

- Pendle Grows An Additional $318 Million TVL Just 4 Days After Plasma Launch

Comments

No comment