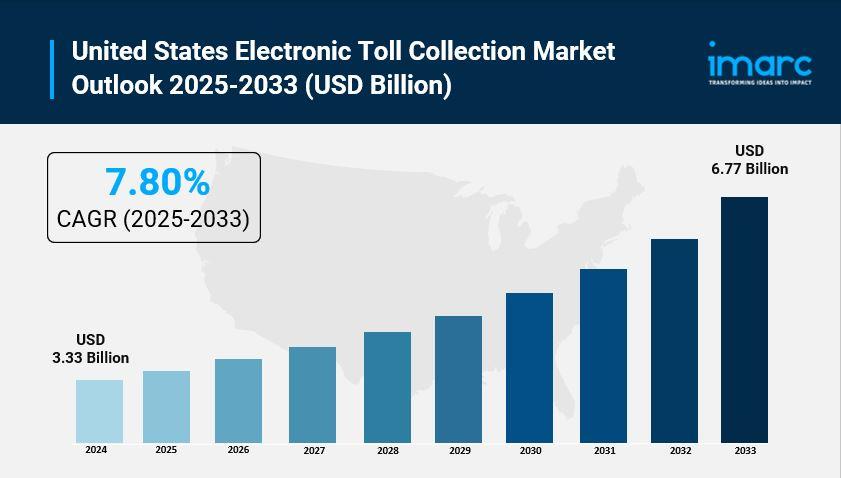

United States Electronic Toll Collection Market Share Outlook With Demand Projections 20252033

Key Highlights

-

Rising Demand: The increasing need for efficient transportation solutions and the growing congestion in urban areas are driving significant demand in the U.S. Electronic Toll Collection (ETC) market. Motorists are actively seeking ways to minimize delays and streamline their travel experience, leading to a surge in the adoption of electronic tolling systems across various states and municipalities.

Industry Applications: ETC systems are being utilized in multiple sectors, including highway management, public transportation, and urban planning. Their capability to facilitate seamless payment processes enhances user convenience and satisfaction, making them a preferred choice for commuters and travelers looking to avoid traditional toll booth stops.

Technological Innovations: Advancements in tolling technology, such as enhanced transponder systems, mobile payment options, and real-time traffic monitoring, are improving both user experience and operational efficiency. Furthermore, the integration of data analytics and smart infrastructure is enabling transportation authorities to optimize toll collection and reduce congestion effectively.

User Awareness: There is a growing recognition among consumers regarding the benefits of electronic tolling, such as reduced travel times and lower environmental impact. This increased awareness is driving investments in public education campaigns aimed at informing motorists about the advantages of using ETC systems compared to traditional cash tolling methods.

Regulatory Standards: The evolving regulatory framework surrounding electronic tolling is shaping market dynamics. New policies focused on interoperability, data privacy, and consumer protection are prompting operators to adapt their systems and practices, ensuring compliance while fostering public trust and promoting the responsible use of tolling technologies.

Market Leaders: Key players in the U.S. ETC market, such as E-ZPass, FasTrak, and SunPass, are at the forefront of innovation and system development. These companies are establishing industry benchmarks for efficiency, reliability, and customer engagement, significantly influencing the future of electronic tolling and its role in enhancing transportation infrastructure.

. Request Free Sample Report: https://www.imarcgroup.com/united-states-electronic-toll-collection-market/requestsample

AI is significantly transforming the United States Electronic Toll Collection (ETC) Market by enhancing operational efficiencies, customer experience, and traffic management. Through advanced data analytics and machine learning, AI streamlines tolling processes, predicts traffic patterns, and personalizes user interactions. This evolution not only improves system effectiveness but also positions leading companies at the forefront of innovation in the tolling industry.

-

AI Integration:

AI is revolutionizing the U.S. ETC Market by refining toll collection methods and customer engagement. This integration enables smarter market analysis and traffic forecasting, resulting in more effective and targeted communication strategies for agencies aiming to connect with motorists.

-

System Optimization:

AI-driven software analyzes traffic data and user feedback, allowing transportation authorities to optimize tolling systems that meet real-time demands. This optimization ensures that tolling operations are not only efficient but also aligned with user expectations and traffic conditions.

-

Predictive Analytics:

AI algorithms monitor traffic trends and user behaviors, predicting peak usage times and potential bottlenecks based on historical data. This proactive approach enables agencies to adjust toll rates and operational strategies in real-time, enhancing traffic flow and reducing congestion.

-

Customer Experience Enhancement:

Through AI, agencies gather insights into motorist preferences and payment behaviors, allowing for tailored communication strategies and loyalty programs. This data-driven approach enhances user satisfaction by providing personalized experiences that cater to individual travel needs and preferences.

-

Enhanced Sustainability:

AI technologies improve sustainability in the ETC sector by optimizing traffic management and reducing vehicle emissions. Advanced analytics help agencies identify efficient practices and minimize environmental impact, promoting responsible operations within the transportation infrastructure.

-

Market Leadership:

Leading players in the ETC market leverage AI to set new standards for operational efficiency and user engagement. By adopting AI-driven solutions, these organizations enhance their competitive edge and contribute to the evolution of tolling systems and market dynamics.

United States Electronic Toll Collection Market SegmentationAnalysis by Technology:

-

RFID

DSRC

Others

In 2024, the RFID segment dominated the electronic toll collection market, capturing 55.4% of the share due to its cost-effectiveness, reliability, and seamless integration into existing toll networks. This widespread adoption was bolstered by state initiatives promoting cashless tolling, enhancing vehicle flow and reducing delays on major routes.

Analysis by System:

-

Transponder – or Tag-Based Toll Collection Systems

Other Toll Collection Systems

In 2024, transponder-based toll collection systems dominated the electronic toll collection market with a 69.8% share, driven by their reliability, legacy adoption, and cross-state compatibility. These systems enhanced traffic flow by enabling toll collection without stops, while states offered discounts to tag users, solidifying their role in both urban and interstate travel.

Analysis by Subsystem:

-

Automated Vehicle Identification

Automated Vehicle Classification

Violation Enforcement System

Transaction Processing

In 2024, the automated vehicle classification (AVC) segment led the electronic toll collection market with a 45.0% share, driven by the need for accurate tolling based on vehicle size and weight. AVC systems, deployed on highways and express lanes, enabled variable toll rates without slowing traffic, enhancing compliance, reducing errors, and supporting the demand for multi-lane free-flow operations.

Analysis by Offering:

-

Hardware

Back Office and Other Services

In 2024, the hardware segment dominated the electronic toll collection market with a 60.4% share, driven by extensive investments in tolling infrastructure such as gantries, RFID readers, and license plate recognition systems. The shift to cashless tolling on major highways and the growth in commercial vehicle traffic necessitated robust, all-weather systems, supported by federal funding for large-scale hardware deployments.

Analysis by Toll Charging:

-

Distance Based

Point Based

Time Based

Perimeter Based

In 2024, distance-based tolling led the electronic toll collection market as policymakers sought fairer alternatives to declining fuel tax revenues, particularly with the rise of electric vehicles. Pilot programs in states like Oregon and Virginia utilized GPS and RFID systems to track vehicle distance, enabling personalized billing and congestion management while enhancing equity and resource allocation.

Analysis by Application:

-

Highways

Urban Areas

In 2024, highways dominated the electronic toll collection market with a 63.2% share, driven by increased interstate travel and heavy freight movement. States focused on expanding ETC along major corridors like I-95 and I-10, deploying RFID gantries and AVC systems to enhance efficiency, reduce congestion, and generate revenue for infrastructure improvements.

Regional Analysis:

-

Northeast

Midwest

South

West

In 2024, the South led the electronic toll collection market due to rapid infrastructure growth and heavy investments in express lanes and all-electronic tolling systems by states like Texas and Florida. The region's warm climate, growing metro areas, and strong policy support facilitated year-round system deployment and increased toll volumes from both regional travel and freight traffic.

Latest Development in the Industry

-

January 2025: New York City implemented congestion pricing, becoming the first US city to do so. Utilizing electronic tolling, the USD 9 peak-hour fee aimed to reduce traffic, improve air quality, and fund transit upgrades. Similar systems in London, Singapore, and Milan showed reduced emissions and enhanced transportation efficiency.

January 2025: TransCore launched its Infinity tolling system on the West Virginia Turnpike, introducing toll-by-plate payment and upgraded E-ZPass infrastructure. The deployment enhanced processing speeds and convenience, following the 2024 launch of TransCore's Integrity back-office system, which improved account management and streamlined toll payment for Turnpike drivers.

January 2025: Bay City began tolling both the Independence and Liberty Bridges using an electronic toll system with scanners and no on-site collectors. Residents with transponders accessed the bridges for free, while non-residents faced tolls up to USD 11.50. The move aimed to fund essential bridge repairs through user-based fees.

January 2025: The Transportation Corridor Agencies issued an RFI to repurpose 10 former toll plazas on SR 73, 133, 241, and 261 after shifting to All Electronic Tolling. This initiative supported ETC growth by reallocating underused assets to enhance mobility and community value.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment