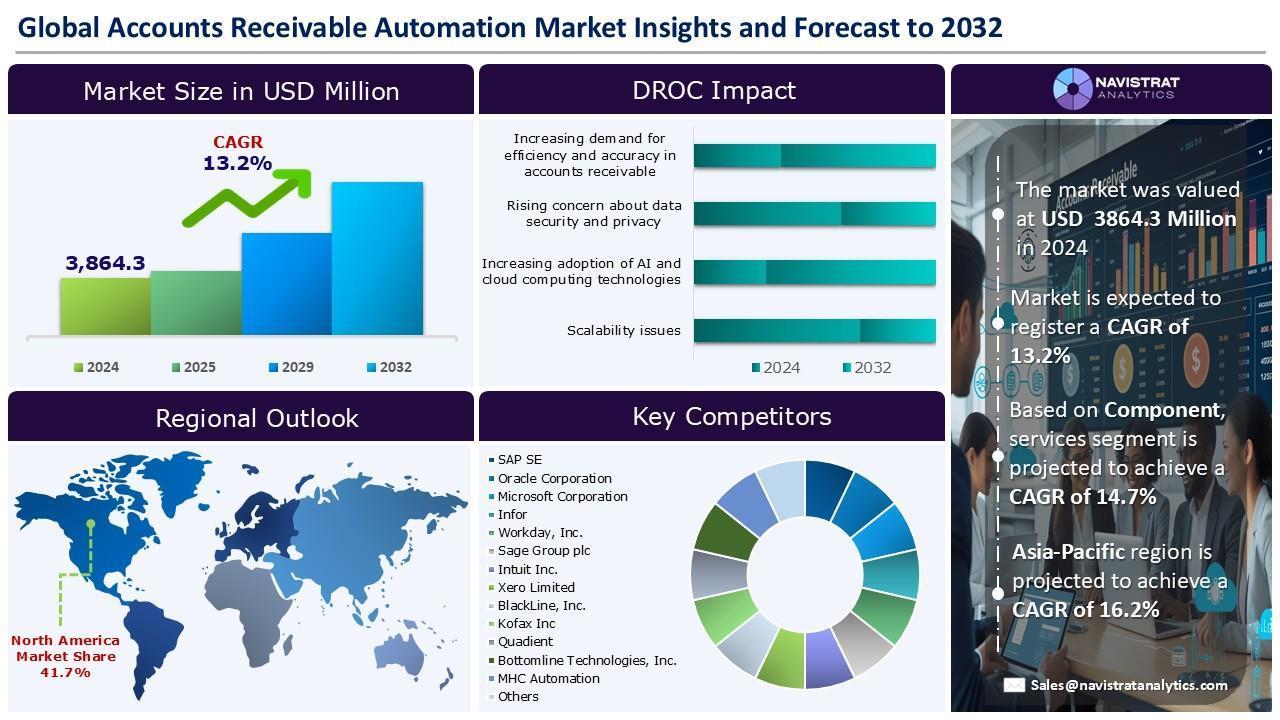

Accounts Receivable Automation Market Size to Reach USD 10,153.4 Million in 2032

(MENAFN- Navistrat Analytics) August 13, 2025 - The global accounts receivable automation market is witnessing robust revenue growth. Increasing focus on improved cash flow management is the major factor driving revenue growth of the market. Organizations are now seeking to accelerate payment cycles, reduce days sales outstanding (DSO), and minimize bad debt risks. Automated AR solutions enable real-time tracking of outstanding invoices, streamline billing processes, and provide predictive analytics for payment behavior. It allows businesses to address potential delays proactively.

For example, Sysmex, a global leader in hematology diagnostics, achieved significant advancements in AR operations. The company recovers $3.4M in overdue service contracts within 30 days, boosting cash flow by $10M, and reducing the late payment rate from 61% to 44%. Adoption of AR automation solutions is expanding as companies prioritize liquidity optimization in a competitive business environment. It is fueling revenue growth of the market.

In March 2024, Celonis, a global leader in process mining, introduced the new Sailfin Accounts Receivable (AR) app suite, created in partnership with Sailfin Technologies. The suite is designed to help AR teams maximize efficiency, streamline daily AR operations, boost productivity, and generate substantial cash savings worth millions.

However, rising concerns over data security and privacy are restraining the revenue growth of the accounts receivable automation market. Organizations are now remaining cautious about adopting cloud-based or third-party solutions that handle sensitive financial and customer information. Automated AR platforms process large volumes of confidential data, including payment details, credit histories, and customer records, making them potential targets for cyberattacks and data breaches. This apprehension slows market adoption and limits revenue growth of the market.

Segments Market Overview and Growth Insights:

Based on end-use, the accounts receivable automation market is segmented into Banking, Financial Services, and Insurance (BFSI), healthcare, retail & e-commerce, manufacturing, IT & telecom, energy & utilities, transportation & logistics and others.

Banking, Financial Services, and Insurance (BFSI) segment contributed the largest revenue share in 2024 due to high volume of complex financial transactions and the pressing need for accuracy, compliance, and operational efficiency. In July 2024, U.S. Bank introduced an integrated Accounts Receivable (AR) platform designed to help suppliers improve cash flow, cut costs through automation, and enhance payment experiences. Developed in partnership with Billtrust, the U.S. Bank Advanced Receivables solution merges the bank’s strengths in payments and risk management with Billtrust’s advanced AR technology to simplify the complex B2B receivables process.

Regional Market Overview and Growth Insights:

North America held the largest revenue share in 2024, driven by extensive digital transformation and early adoption of advanced financial technologies, particularly in the U.S. and Canada. Businesses in the region are increasingly adopting AR automation to enhance cash flow management, improve accuracy, and lower operational expenses. In March 2025, U.S.-based financial operations platform provider Tesorio launched an AI agent for supplier portals within its Accounts Receivable (AR) automation, collections, and cash flow management platform, enabling fully automated portal-based invoicing—from submission to payment tracking.

Competitive Landscape and Key Competitors:

The accounts receivable automation market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the market report are:

oSAP SE

oOracle Corporation

oMicrosoft Corporation

oInfor

oWorkday, Inc.

oSage Group plc

oIntuit Inc.

oXero Limited

oBlackLine, Inc.

oKofax Inc

oQuadient

oBottomline Technologies, Inc.

oMHC Automation

oHighRadius Corporation

oVersaPay Corporation

oEmagia Corporation

Buy Your Exclusive Copy Now:

Major Strategic Developments by Leading Competitors:

FIS: On February 06, 2025, FIS, a global leader in financial technology spanning the entire money lifecycle, has launched FIS Revenue Insight, a predictive analytics solution aimed at helping businesses enhance collections. Leveraging proprietary, patented AI-powered technology, FIS Revenue Insight provides actionable insights into cash at risk, enabling organizations to proactively detect potential issues, speed up revenue generation, and support business growth.

Fazeshift: On January 07, 2025, Fazeshift, an AI agent for Accounts Receivable, secured USD 4M in seed funding led by Gradient, Google’s early-stage AI fund, with participation from Y Combinator, Wayfinder, Pioneer Fund, Ritual Capital, Phoenix Fund, and notable angel investors such as Terrence Rohan, Kulveer Taggar, and Rich Aberman. Utilizing an LLM-powered framework, Fazeshift efficiently manages complex workflows, leveraging highly specialized prompts tailored to each task to deliver the precision and adaptability essential for enterprise-grade operations.

Navistrat Analytics has segmented global Accounts Receivable Automation market on the basis of component, pricing model, deployment, organization size, end-use and region:

•Component Outlook (Revenue, USD Million; 2022-2032)

oSolutions

oServices

•Pricing Model Outlook (Revenue, USD Million; 2022-2032)

oSubscription-Based

oOne-Time License

oPay-As-You-Go

•Deployment Outlook (Revenue, USD Million; 2022-2032)

oOn-Premises

oCloud

•Organization Size Outlook (Revenue, USD Million; 2022-2032)

oSmall and Medium-Sized Enterprises (SMEs)

oLarge Enterprises

•End-Use Outlook (Revenue, USD Million; 2022-2032)

oBanking, Financial Services, and Insurance (BFSI)

oHealthcare

oRetail & E-commerce

oManufacturing

oIT & Telecom

oEnergy & Utilities

oTransportation & Logistics

oOthers

•Regional Outlook (Revenue, USD Million; 2022-2032)

oNorth America

a.U.S.

b.Canada

c.Mexico

oEurope

a.Germany

b.France

c.U.K.

d.Italy

e.Spain

f.Benelux

g.Nordic Countries

h.Rest of Europe

oAsia Pacific

a.China

b.India

c.Japan

d.South Korea

e.Oceania

f.ASEAN Countries

g.Rest of APAC

oLatin America

a.Brazil

b.Rest of LATAM

oMiddle East & Africa

a.GCC Countries

b.South Africa

c.Israel

d.Turkey

e.Rest of MEA

Get a preview of the complete research study on our website:

©Navistrat Analytics (navistratanalytics.com)

For example, Sysmex, a global leader in hematology diagnostics, achieved significant advancements in AR operations. The company recovers $3.4M in overdue service contracts within 30 days, boosting cash flow by $10M, and reducing the late payment rate from 61% to 44%. Adoption of AR automation solutions is expanding as companies prioritize liquidity optimization in a competitive business environment. It is fueling revenue growth of the market.

In March 2024, Celonis, a global leader in process mining, introduced the new Sailfin Accounts Receivable (AR) app suite, created in partnership with Sailfin Technologies. The suite is designed to help AR teams maximize efficiency, streamline daily AR operations, boost productivity, and generate substantial cash savings worth millions.

However, rising concerns over data security and privacy are restraining the revenue growth of the accounts receivable automation market. Organizations are now remaining cautious about adopting cloud-based or third-party solutions that handle sensitive financial and customer information. Automated AR platforms process large volumes of confidential data, including payment details, credit histories, and customer records, making them potential targets for cyberattacks and data breaches. This apprehension slows market adoption and limits revenue growth of the market.

Segments Market Overview and Growth Insights:

Based on end-use, the accounts receivable automation market is segmented into Banking, Financial Services, and Insurance (BFSI), healthcare, retail & e-commerce, manufacturing, IT & telecom, energy & utilities, transportation & logistics and others.

Banking, Financial Services, and Insurance (BFSI) segment contributed the largest revenue share in 2024 due to high volume of complex financial transactions and the pressing need for accuracy, compliance, and operational efficiency. In July 2024, U.S. Bank introduced an integrated Accounts Receivable (AR) platform designed to help suppliers improve cash flow, cut costs through automation, and enhance payment experiences. Developed in partnership with Billtrust, the U.S. Bank Advanced Receivables solution merges the bank’s strengths in payments and risk management with Billtrust’s advanced AR technology to simplify the complex B2B receivables process.

Regional Market Overview and Growth Insights:

North America held the largest revenue share in 2024, driven by extensive digital transformation and early adoption of advanced financial technologies, particularly in the U.S. and Canada. Businesses in the region are increasingly adopting AR automation to enhance cash flow management, improve accuracy, and lower operational expenses. In March 2025, U.S.-based financial operations platform provider Tesorio launched an AI agent for supplier portals within its Accounts Receivable (AR) automation, collections, and cash flow management platform, enabling fully automated portal-based invoicing—from submission to payment tracking.

Competitive Landscape and Key Competitors:

The accounts receivable automation market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the market report are:

oSAP SE

oOracle Corporation

oMicrosoft Corporation

oInfor

oWorkday, Inc.

oSage Group plc

oIntuit Inc.

oXero Limited

oBlackLine, Inc.

oKofax Inc

oQuadient

oBottomline Technologies, Inc.

oMHC Automation

oHighRadius Corporation

oVersaPay Corporation

oEmagia Corporation

Buy Your Exclusive Copy Now:

Major Strategic Developments by Leading Competitors:

FIS: On February 06, 2025, FIS, a global leader in financial technology spanning the entire money lifecycle, has launched FIS Revenue Insight, a predictive analytics solution aimed at helping businesses enhance collections. Leveraging proprietary, patented AI-powered technology, FIS Revenue Insight provides actionable insights into cash at risk, enabling organizations to proactively detect potential issues, speed up revenue generation, and support business growth.

Fazeshift: On January 07, 2025, Fazeshift, an AI agent for Accounts Receivable, secured USD 4M in seed funding led by Gradient, Google’s early-stage AI fund, with participation from Y Combinator, Wayfinder, Pioneer Fund, Ritual Capital, Phoenix Fund, and notable angel investors such as Terrence Rohan, Kulveer Taggar, and Rich Aberman. Utilizing an LLM-powered framework, Fazeshift efficiently manages complex workflows, leveraging highly specialized prompts tailored to each task to deliver the precision and adaptability essential for enterprise-grade operations.

Navistrat Analytics has segmented global Accounts Receivable Automation market on the basis of component, pricing model, deployment, organization size, end-use and region:

•Component Outlook (Revenue, USD Million; 2022-2032)

oSolutions

oServices

•Pricing Model Outlook (Revenue, USD Million; 2022-2032)

oSubscription-Based

oOne-Time License

oPay-As-You-Go

•Deployment Outlook (Revenue, USD Million; 2022-2032)

oOn-Premises

oCloud

•Organization Size Outlook (Revenue, USD Million; 2022-2032)

oSmall and Medium-Sized Enterprises (SMEs)

oLarge Enterprises

•End-Use Outlook (Revenue, USD Million; 2022-2032)

oBanking, Financial Services, and Insurance (BFSI)

oHealthcare

oRetail & E-commerce

oManufacturing

oIT & Telecom

oEnergy & Utilities

oTransportation & Logistics

oOthers

•Regional Outlook (Revenue, USD Million; 2022-2032)

oNorth America

a.U.S.

b.Canada

c.Mexico

oEurope

a.Germany

b.France

c.U.K.

d.Italy

e.Spain

f.Benelux

g.Nordic Countries

h.Rest of Europe

oAsia Pacific

a.China

b.India

c.Japan

d.South Korea

e.Oceania

f.ASEAN Countries

g.Rest of APAC

oLatin America

a.Brazil

b.Rest of LATAM

oMiddle East & Africa

a.GCC Countries

b.South Africa

c.Israel

d.Turkey

e.Rest of MEA

Get a preview of the complete research study on our website:

©Navistrat Analytics (navistratanalytics.com)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Ethereum-Based Meme Project Pepeto ($PEPETO) Surges Past $6.5M In Presale

- 1Inch Unlocks Access To Tokenized Rwas Via Swap API

- Meme Coin Little Pepe Raises Above $24M In Presale With Over 39,000 Holders

- Chipper Cash Powers 50% Of Bitcoin Transactions With Bitcoin Lightning Network Via Voltage

- Kucoin Partners With Golf Icon Adam Scott As Global Brand Ambassador

- ROVR Releases Open Dataset To Power The Future Of Spatial AI, Robotics, And Autonomous Systems

Comments

No comment