Facility Management Market Size, Growth, Key Players, Opportunity And Forecast 2025-2033

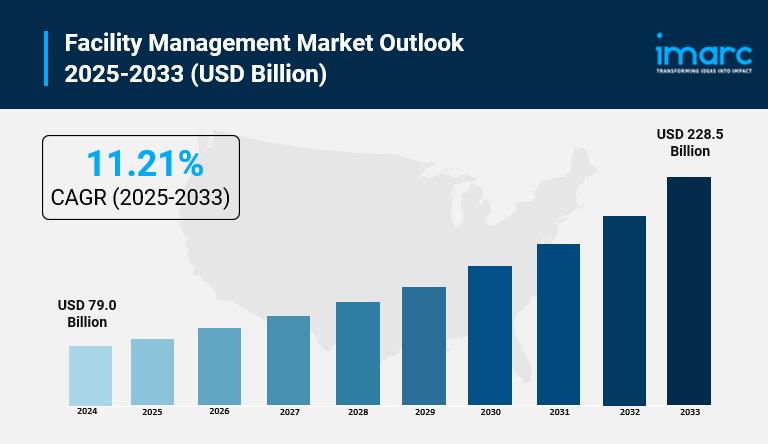

The global facility management market size was valued at USD 79.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 228.5 Billion by 2033, exhibiting a CAGR of 11.21% during 2025-2033. North America currently dominates the market, holding a significant market share of over 32.2% in 2024. The market is growing swiftly, led by smart building uptake, value-added services demand growth, and regulatory compliance. IoT, AI, and automation are redefining operational efficiency and predictive maintenance. Further, ESG compliance and digitalization trends are speeding up the market developments.

Key Stats for Facility Management Market:

-

Facility Management Market Size (2024): The global facility management market was valued at approximately USD 79.0 billion.

Facility Management Market Forecast (2033): The market is projected to reach USD 228.5 billion , with a robust CAGR of 11.21% from 2025 to 2033 .

North America leads the market with a share exceeding 32.2% .

Additional high-growth regions include Europe , Asia-Pacific , Latin America , and Middle East & Africa .

Top companies in IT Training Market: AHI Facility Services, ATALIAN, CBRE, Compass Group India, Emeric Facility Services, G4S Limited, Guardian Service Industries, Inc., ISS World, Jones Lang LaSalle IP, Inc, Mitie Group plc, OCS Group Holdings Ltd, Sodexo, Tenon Group

Request for a sample copy of the report: https://www.imarcgroup.com/facility-management-market/requestsample

Why is the Facility Management Market Growing?

The facility management market is expanding rapidly due to several key factors. First, the rising demand for integrated services that enhance operational efficiency, reduce costs, and improve occupant experiences is driving market growth. Organizations across sectors-such as commercial real estate, healthcare, manufacturing, and education-are increasingly outsourcing facility management to focus on core business activities. Growing emphasis on sustainability and energy efficiency is further boosting demand for smart building solutions, green cleaning practices, and efficient resource management. Second, rapid urbanization, infrastructure development, and an increasing number of commercial complexes in emerging markets such as Southeast Asia, the Middle East, and Latin America are fueling service adoption. In 2025, the integration of IoT, predictive maintenance, and data analytics, along with strategic partnerships between facility service providers and technology firms, will continue to strengthen the market's position globally.

AI Impact on the Facility Management Market

AI is significantly transforming the facility management market in 2025 by optimizing operations, maintenance, and service delivery. In building operations, AI-powered systems enable predictive maintenance, monitor energy consumption, and automate climate control, resulting in cost savings and sustainability benefits. For security, AI-driven surveillance and access control systems enhance safety through real-time threat detection and analytics. On the service management front, AI analyzes occupant behavior and preferences to tailor workspace layouts, cleaning schedules, and resource allocation for improved user satisfaction. Additionally, AI-driven data insights help facility managers identify inefficiencies, forecast equipment lifecycles, and prioritize investments. In client engagement, AI-enabled chatbots and service portals streamline request handling, while smart IoT integrations create responsive, adaptive building environments. Collectively, these advancements are redefining how facility management services are delivered, monitored, and experienced worldwide.

Segmental Analysis

The facility management market is segmented based on solution, service, deployment type, organization size, and vertical. Each segment plays a vital role in shaping the market's growth dynamics.

Analysis by Solution:

-

Facility Property Management

Building Information Modeling

Integrated Workplace Management System

Facility Operations and Security Management

Others

Facility property management represents the largest segment of the market, driven by its substantial role in overall growth. It involves the management and supervision of various real estate assets, including retail stores, residential complexes, commercial buildings, and industrial facilities.

Analysis by Service:

-

Deployment and Integration

Consulting and Training

Support and Maintenance

Auditing and Quality Assessment

Others

The deployment and integration segment is witnessing strong growth in the facility management market, focusing on the implementation and seamless integration of facility management solutions, including hardware, software, and technology infrastructure.

Analysis by Deployment Type:

-

On-Premises

Cloud

On-premises holds the largest share of the market in 2024, accounting for approximately 56.9%. This segment is experiencing significant growth as it involves deploying facility management solutions directly within an organization's physical infrastructure, rather than relying on cloud-based or off-site hosting.

Analysis by Organization Size:

-

Large Enterprises

Small and Medium Size Enterprises

Large enterprises encompass organizations with significant scale and complex facility management needs across multiple locations or extensive portfolios. They usually have a wide range of complex facility management needs, such as overseeing several properties, making the best use of available space, making sure regulations are followed, and putting energy-saving measures into action.

Analysis by Vertical:

-

Banking, Financial Services, and Insurance

IT and Telecom

Real Estate

Government and Public Sector

Healthcare

Education

Retail

Others

The banking, financial services, and insurance (BFSI) segment dominates the market in 2024, holding approximately 23.8% share. This segment includes banks, financial institutions, insurance providers, and related organizations, all operating in highly regulated environments with strict compliance standards, especially concerning security and data privacy.

Analysis of Facility Management Market by Regions

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

In 2024, North America held the largest market share, exceeding 32.2%. The region is witnessing strong growth in the facility management market due to its well-established commercial infrastructure and the presence of numerous large enterprises, institutions, and organizations. With extensive facility management requirements, many of these entities outsource services to specialized providers, fueling market expansion.

What are the Drivers, Restraints, and Key Trends of the Facility Management Market?

Market Drivers:

The facility management market is primarily driven by the growing demand for integrated services that enhance operational efficiency, reduce costs, and improve occupant experiences. Businesses across sectors-including commercial real estate, healthcare, manufacturing, and education-are increasingly outsourcing facility management to focus on core operations. The adoption of advanced technologies, such as IoT, AI, and predictive analytics, is further fueling efficiency gains and service innovation. In 2025, sustainability initiatives, including energy-efficient building systems and green facility practices, are expected to accelerate adoption. Rising urbanization, infrastructure development, and the growing need for compliance with health, safety, and environmental regulations are also boosting market growth.

Market Restraints:

Despite promising growth, the facility management market faces notable challenges. High implementation and operational costs, particularly for advanced technology solutions, can limit adoption among small and medium-sized enterprises. Data privacy and cybersecurity concerns, especially in cloud-based facility management systems, remain significant hurdles. Additionally, labor shortages and the need for specialized skills in operating modern building systems can strain service quality. Regulatory complexities-such as differing safety standards and environmental requirements across regions-add operational challenges for global service providers. Economic fluctuations impacting real estate investments may also influence demand for facility management services.

Key Market Trends:

Key trends shaping the facility management market include the increasing integration of smart technologies, enabling predictive maintenance, automated energy management, and enhanced security systems. The focus on sustainability is driving the adoption of eco-friendly cleaning methods, renewable energy solutions, and waste reduction initiatives. In 2025, demand for hybrid workplace management solutions is rising as organizations adapt to flexible work models. Evolving service models, such as outcome-based contracts, are gaining traction, shifting the focus from task completion to measurable performance outcomes. Furthermore, digital platforms and mobile applications are enhancing transparency, client engagement, and real-time reporting, transforming how facility management services are delivered and monitored globally.

Leading Players of Facility Management Market:

According to IMARC Group's latest analysis, prominent companies shaping the global facility management landscape include:

-

AHI Facility Services

ATALIAN

CBRE

Compass Group India

Emeric Facility Services

G4S Limited

Guardian Service Industries, Inc.

ISS World

Jones Lang LaSalle IP, Inc

Mitie Group plc

OCS Group Holdings Ltd

Sodexo

Tenon Group

Key Developments in the Facility Management Market

-

April 2024: SmartCheck, a SaaS-based facility management solutions provider, secured undisclosed debt financing from Incred Capital, with Lakhani Financial Services facilitating the transaction. The funding will support SmartCheck's accelerated growth and innovation in the rapidly evolving facility management sector.

February 2024: CBRE Group Inc. announced an agreement to acquire J&J Worldwide Services, a provider of engineering services, base support operations, and facilities maintenance for the U.S. federal government. The acquisition, made from private equity firm Arlington Capital Partners, will strengthen CBRE's capabilities in specialized government facility services.

October 2023: OCS, a global facilities services provider, acquired UK-based Accuro, a company offering critical facilities management solutions with strong expertise in the education and healthcare sectors.

July 2023: Johnson Controls revealed plans to enhance its OpenBlue digital buildings platform through the acquisition of FM:Systems, a leader in workplace management software. This move expands OpenBlue's SaaS suite with advanced, cloud-based workplace management functionalities.

March 2023: HIG Capital, an alternative asset investment firm with multiple facility management-related subsidiaries, acquired Synecore and Meesons Future. These were integrated with its earlier acquisitions of CPS and Classic Lifts to form the Andwis Group, a new enterprise of technical service providers.

March 2023: Planon Group announced the acquisition of control.IT Unternehmensberatung GmbH, a real estate asset and portfolio management software specialist in the DACH region. The deal includes SaaS products such as bison.box and CollaborationApp, along with control.IT's subsidiaries easol GmbH and Synapplix GmbH.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment