India Air Purifier Market Size, Share, Growth, Trends Analysis And Forecast Report 2025-2033

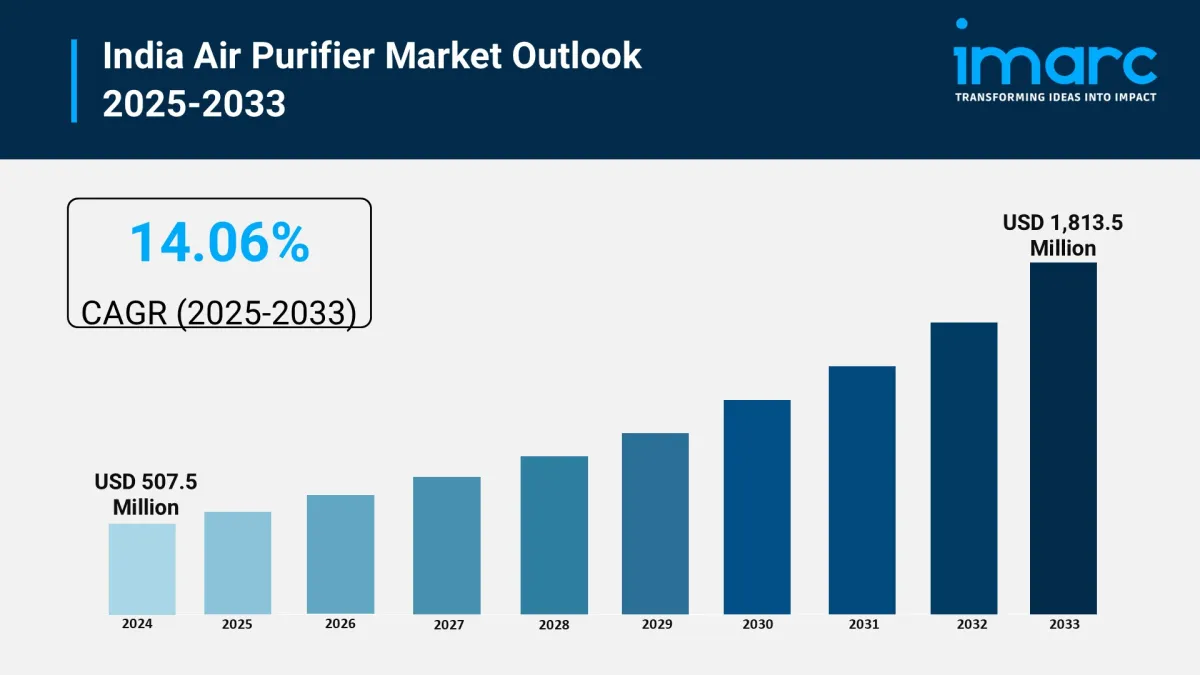

The India air purifier market reached USD 507.5 million in 2024 and is expected to reach USD 1,813.5 million by 2033 , growing at a CAGR of 14.06% from 2025 to 2033. The market is expanding rapidly, driven by rising concerns over air pollution, increasing health awareness, growing urbanization, and higher disposable incomes. Seasonal smog events, industrial emissions, and indoor air quality concerns are prompting greater adoption across residential, commercial, and industrial segments. Technological advancements and the availability of compact, energy-efficient models are further boosting demand.

Key Highlights

-

Market size (2024): USD 507.5 million

Forecast (2033): USD 1,813.5 million

CAGR (2025–2033): 14.06%

Rising health consciousness amid worsening air quality in urban centers

Technological innovation driving demand for smart, connected air purifiers

Growing penetration in both residential and commercial spaces

Seasonal demand peaks during winter pollution spikes in North India

Key companies operating in the India air purifier market include Blueair India (Unilever plc), Crusaders Technologies India Private Limited, Daikin Airconditioning India Pvt. Ltd. (Daikin Industries Ltd.), Dyson Technology India Pvt Ltd, Eureka Forbes Limited, Kent RO Systems Ltd, LG Electronics India Limited (LG Electronics Inc.), Panasonic Life Solutions India Pvt. Ltd. (Panasonic Corporation), Philips India Limited (Koninklijke Philips N.V.), Sharp Business System (India) Pvt. Ltd., and Xiaomi Technology India Private Limited (Xiaomi Inc.).

Request for a free sample copy of this report: https://www.imarcgroup.com/india-air-purifier-market/requestsample

How Is AI Transforming the Air Purifier Market in India?

AI and IoT integration are reshaping product capabilities and user engagement through:

-

Real-time air quality monitoring with adaptive filtration adjustments

Predictive maintenance alerts to ensure optimal filter performance and longevity

Smart home integration for remote control via voice assistants and mobile apps

Data analytics for personalized air quality insights based on usage patterns

AI-based energy optimization to reduce electricity consumption without compromising performance

Key Market Trends and Drivers

-

Air Pollution Awareness: Increasing respiratory illnesses and awareness of PM2.5 and PM10 hazards

Smart Technology Adoption: Rise in AI-enabled, Wi-Fi-connected air purifiers

Product Diversification: Availability of models catering to varying budgets and spaces

Government Regulations: Policies encouraging clean air technologies in public and private buildings

Seasonal Pollution Spikes: Heightened sales during smog-heavy months, especially in North India

Corporate & Institutional Demand: Offices, hospitals, and schools adopting large-scale purification systems

Market Segmentation

The report has segmented the market into the following categories:

Filter Technology Insights:

-

High Efficiency Particulate Air (HEPA) – Leading segment for fine particle filtration.

Activated Carbon – Effective in removing odors and harmful gases.

Ionic Filters – Attract and neutralize airborne particles through ionization.

Others – Includes UV filters and hybrid technologies.

Mounting Type Insights:

-

Fixed – Integrated into building HVAC systems.

Portable – Flexible, movable units for single-room or personal use.

Application Insights:

-

Commercial – Offices, retail spaces, hospitality.

Industrial – Manufacturing, healthcare, and heavy industries.

Residential – Urban households prioritizing indoor air quality.

Sales Channel Insights:

-

Direct Sales – Manufacturer-to-customer or corporate sales.

Indirect Sales:

-

Supermarkets and Hypermarkets – Easy availability for mass-market customers.

Specialty Stores – Electronics and appliance retailers.

Online – E-commerce platforms with wide product variety.

Others – Small-scale and regional distributors.

Regional Insights:

-

North India

West and Central India

South India

East India

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask an analyst: https://www.imarcgroup.com/request?type=report&id=20276&flag=C

Latest Developments in the Industry

-

Launch of smart, AI-enabled purifiers with mobile app integration and real-time air quality feedback.

Corporate wellness programs incorporating air purifiers in workspaces to improve productivity.

Rising popularity of compact and portable purifiers for small apartments and personal use.

Partnerships between global brands and Indian distributors to expand product reach in tier-2 and tier-3 cities.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Edgen And Sahara AI Announce Strategic Collaboration To Pioneer Decentralized Validation In Market Intelligence

- Virtual Pay Group Secures Visa Principal Acquirer License

- Japan Buy Now Pay Later Market Size To Surpass USD 145.5 Billion By 2033 CAGR Of 22.23%

- GCL Subsidiary, 2Game Digital, Partners With Kucoin Pay To Accept Secure Crypto Payments In Real Time

- United States Acetic Acid Market Size, Growth & Forecast 2033

- Bitget Launches PTBUSDT For Futures Trading And Bot Integration

Comments

No comment