India Veterinary Service Market Size, Share, Growth, Top Companies And Report 20252033

Key Highlights:

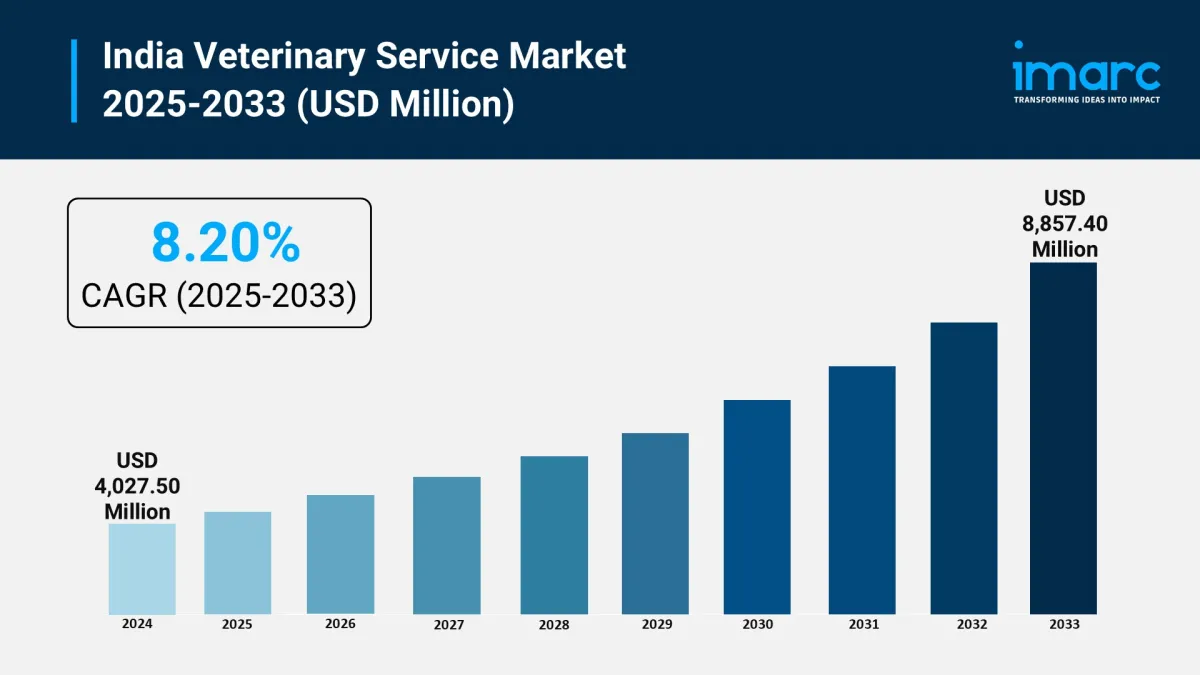

. 2024 Market Size: USD 4,027.50 Million

. 2033 Forecast Size: USD 8,857.40 Million

. CAGR (2025–2033): 8.20%

. Increasing demand for preventive care and advanced veterinary treatments

. Growth in companion animal ownership and pet healthcare spending

. Expansion of rural veterinary outreach programs and mobile clinics

. Rising focus on specialized diagnostics and minimally invasive surgeries

Get Free Sample Report: https://www.imarcgroup.com/india-veterinary-service-market/requestsample

How Is AI Transforming the Market?

AI is revolutionizing veterinary services through predictive diagnostics, AI-assisted imaging interpretation, and telemedicine platforms for remote consultations. Machine learning tools enable early detection of diseases, personalized treatment planning, and real-time monitoring of animal health via wearable devices. AI-powered scheduling and resource allocation systems are also improving clinic efficiency and client experience.

Key Market Trends and Drivers:

. Rising pet humanization and demand for premium veterinary care

. Increasing farm animal productivity initiatives through health monitoring

. Growing adoption of veterinary telehealth platforms in urban and rural areas

. Expansion of government-led animal welfare and vaccination programs

. Integration of advanced imaging and surgical technologies in veterinary facilities

Market Segmentation:

By Service:

. Surgery

. Diagnostic Tests and Imaging

. Physical Health Monitoring

. Others

By Animal Type:

. Companion Animal

. Farm Animal

By End Use:

. Veterinary Clinic

. Veterinary Hospital

By Region:

. North India

. South India

. East India

. West India

Competitive Landscape:

The market features both established veterinary service providers and emerging tech-driven startups. Competitive analysis covers market structure, key player positioning, top winning strategies, competitive dashboards, and company profiles.

Latest Developments:

. In February 2025, Supertails, a tech-driven pet care brand, launched its first offline clinic in Bengaluru with Fear Free Certified veterinarians, aimed at reducing pet anxiety during visits.

. In March 2024, Himachal Pradesh launched the 1962 mobile veterinary service for 44 blocks at a cost of ₹7.04 crore, deploying mobile ambulances across districts to improve rural veterinary access.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment