India Wastewater Treatment Market Size, Share, Trends, Demand, Industry Analysis And Forecast 2025-2033

Key Highlights

-

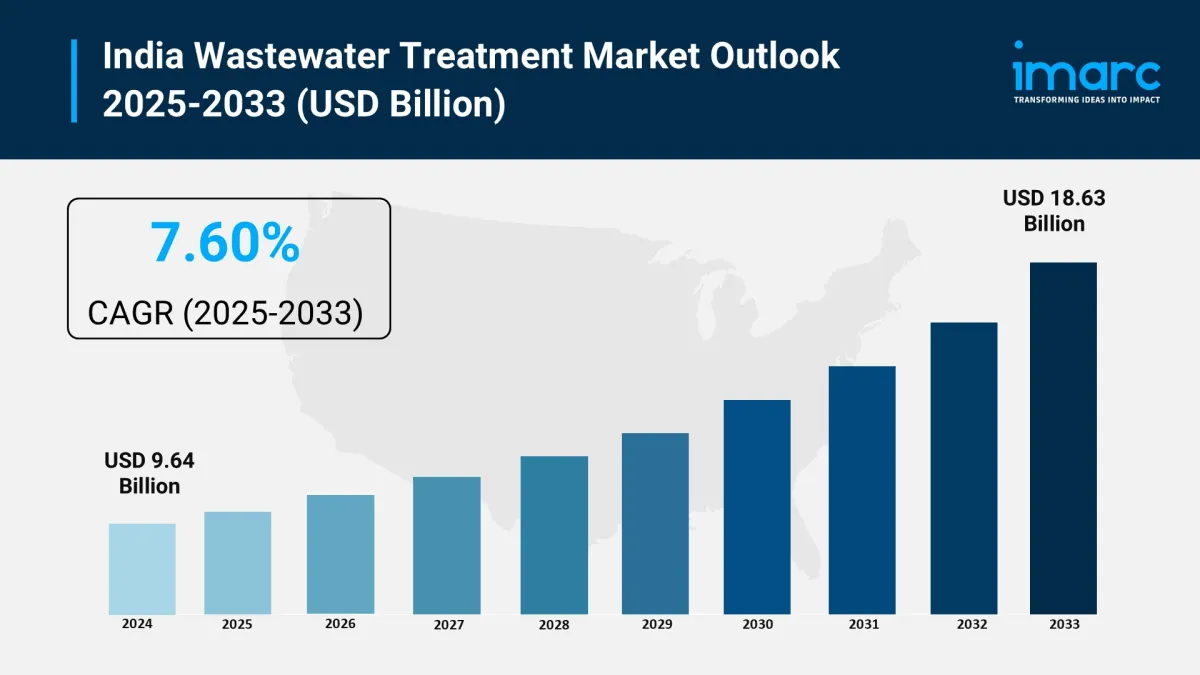

Market Size (2024): USD 9.64 Billion

Forecast (2033): USD 18.63 Billion

CAGR (2025–2033): 7.60%

Urban wastewater generation rising due to expanding population and infrastructure

Growing demand for zero liquid discharge (ZLD) solutions and industrial reuse

Increasing government investments and public-private partnerships (PPP) in wastewater infrastructure

Request Free Sample Report: https://www.imarcgroup.com/india-wastewater-treatment-market/requestsample

How is AI Transforming the Wastewater Treatment Market in India?

Technology adoption is accelerating, enabling more efficient and sustainable water recovery:

-

Membrane Bioreactors (MBRs): Widely used for compact, high-quality treatment systems

IoT and SCADA Systems: Enable remote monitoring, predictive maintenance, and real-time quality analysis

Decentralized Treatment Plants (DTPs): Promoting local reuse of water for non-potable applications in residential and commercial zones

Advanced Oxidation Processes (AOPs): Effective for treating high-strength industrial effluents

Key Market Trends and Drivers

-

Urbanization & Industrial Growth: Expanding municipal wastewater and rising effluent loads from manufacturing, food processing, and pharmaceuticals

Environmental Regulations: Central Pollution Control Board (CPCB) and State Pollution Control Boards (SPCBs) enforcing stricter discharge norms

Jal Shakti Abhiyan & Namami Gange: Government initiatives driving investments in STPs, CETPs, and rejuvenation of water bodies

Water Reuse Mandates: Increasing focus on recycling treated water for irrigation, industrial cooling, and urban non-potable usage

Smart City Development: Boosting adoption of decentralized and modular treatment technologies

Market Segmentation

Segmentation by Product Type:

-

Chemicals

Disinfection Equipment

Filtration Equipment

Membrane Systems

Others

Segmentation by Technology:

-

Primary Treatment

Secondary Treatment

Tertiary Treatment

Segmentation by Application:

-

Municipal Wastewater

Industrial Wastewater

Segmentation by Region:

-

North India

South India

East India

West India

Latest Developments in Industry

-

In March 2025, the Indian government announced new funding under the Atal Mission for Rejuvenation and Urban Transformation (AMRUT 2.0) to support the expansion of STPs across tier 2 and tier 3 cities.

In April 2025, VA Tech Wabag secured a major contract to construct a 150 MLD sewage treatment plant in Uttar Pradesh under the Namami Gange initiative.

Ion Exchange launched a new series of compact biological treatment solutions tailored for decentralized rural wastewater treatment in July 2025.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- PU Prime Launches Halloween Giveaway: Iphones, Watches & Cash Await

- Ozzy Tyres Grows Their Monsta Terrain Gripper Tyres Performing In Australian Summers

- Edgen Launches Multi‐Agent Intelligence Upgrade To Unify Crypto And Equity Analysis

- Zeni.Ai Launches First AI-Powered Rewards Business Debit Card

- M2 Capital Announces $21 Million Investment In AVAX Digital Asset Treasury, AVAX One

- Tria Raises $12M To Be The Leading Self-Custodial Neobank And Payments Infrastructure For Humans And AI.

Comments

No comment