Global Network Encryption Market Surges Amid Rising Cybersecurity Demands And Data Privacy Regulations

Market Overview

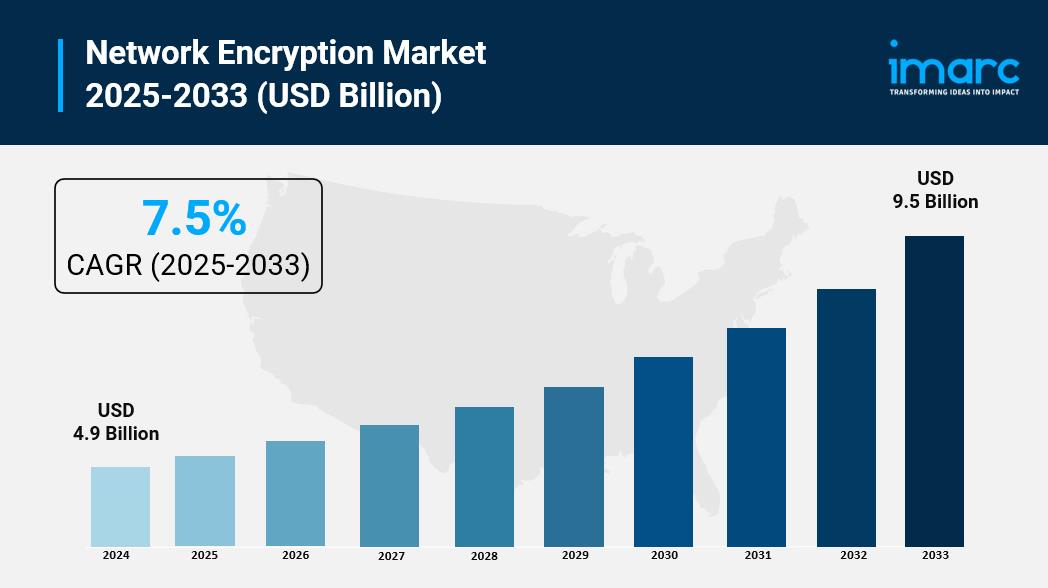

The global network encryption market reached a value of USD 4.9 billion in 2024 and is projected to nearly double to USD 9.5 billion by 2033 , exhibiting a compound annual growth rate (CAGR) of 7.5% during 2025–2033. The market is being driven by the rapid deployment of 5G networks , increased cloud adoption , and growing concerns about cybersecurity and data privacy . With digital transformation accelerating across industries, the need for secure data-in-transit has never been greater.

Key Stats-

Market Value (2024): USD 4.9 Billion

Projected Value (2033): USD 9.5 Billion

CAGR (2025–2033): 7.5%

Leading Segment (2025): BFSI sector

Top Region: North America

Major Players: Cisco Systems Inc., IBM Corporation, Thales Group, Juniper Networks Inc., Nokia Corporation, and more.

Emerging to meet changing cyber threats are next-generation encryption technologies including multi-layer security architectures and quantum-resistant algorithms. A major enabler is the worldwide deployment of 5G infrastructure, which allows for high-speed, low-latency data transfers needing secure transmission across bigger network surfaces.

2. Cybersecurity & Regulatory ComplianceEncryption is becoming a cornerstone of corporate cybersecurity plans as data breaches and ransomware attacks are on the increase. Strict data protection standards are being imposed across industries by regulatory systems including GDPR, HIPAA, and PCI-DSS, which is fueling the spread of sophisticated network encryption products.

3. Cloud Migration & Digital WorkflowsThe need to protect data across hybrid and multi-cloud systems is growing as businesses move toward cloud-first approaches. Network encryption provides end-to-end data protection, therefore facilitating safe remote access, mobile device usage, and international data interchange without infringing on either privacy or performance.

AI or Technology ImpactArtificial intelligence (AI) and machine learning (ML) are playing an increasing role in the network encryption landscape. These technologies enable adaptive encryption algorithms that dynamically assess risks and automate threat responses. Moreover, AI-driven key management systems enhance encryption efficiency, reduce human error, and ensure secure scalability across enterprise networks.

Segmental Analysis By Component:-

Hardware

Solutions and Services (dominant in 2025 due to cloud integration and ease of deployment)

-

Cloud-based (fastest-growing segment due to remote accessibility and scalability)

On-premises

-

Small and Medium-Sized Enterprises (SMEs)

Large Enterprises (leading share in 2025 due to larger attack surfaces and compliance requirements)

-

Telecom and IT

BFSI (dominates due to data sensitivity and regulatory demand)

Government

Media and Entertainment

Others

North America leads the global network encryption market, supported by advanced IT infrastructure, high investments in cybersecurity, and strict regulatory frameworks. The region is home to leading tech firms and a mature BFSI sector, both of which prioritize robust network protection.

Asia PacificAsia Pacific is the fastest-growing region, driven by the rapid digital transformation in countries like China, India, Japan, and South Korea. Increasing adoption of mobile banking, cloud computing, and government digitalization initiatives are enhancing demand.

EuropeEurope is experiencing stable growth, backed by GDPR compliance and rising investments in IT security across industries like manufacturing, healthcare, and public services.

Latin America & Middle East and AfricaThese regions are emerging as growth markets due to digital infrastructure upgrades and rising awareness of cybersecurity risks. Governments and enterprises are investing in encryption as part of broader digital security strategies.

Market Dynamics Drivers:-

Surge in cyber threats and data breaches

Expansion of 5G and IoT applications

Mandatory compliance with international cybersecurity standards

Cloud adoption across all enterprise sizes

-

High costs of deployment in SMEs

Complex integration with legacy systems

-

Rising demand for quantum-safe encryption

Growth in software-defined perimeter (SDP) solutions

Increasing mergers and acquisitions to strengthen encryption portfolios

Integration of zero-trust network architectures

-

Cisco Systems Inc.

International Business Machines Corporation (IBM)

Thales Group

Juniper Networks Inc.

Nokia Corporation

Atos SE

F5 Networks Inc.

Ciena Corporation

Raytheon Technologies Corporation

Rohde & Schwarz GmbH & Co KG

PacketLight Networks Ltd.

Colt Technology Services Group Limited

Securosys SA

Senetas Corporation Limited

Viasat Inc.

These players are engaging in strategic partnerships , acquisitions , and product innovations to expand their global footprint and meet rising enterprise demands.

Recent Developments-

Cisco acquired Isovalent (April 2024) to enhance its multicloud network security capabilities.

Thales Group launched a new quantum-safe VPN solution for government and defense sectors in 2023.

IBM and Juniper Networks partnered to deliver AI-powered, encrypted hybrid cloud infrastructure.

Ciena introduced WaveLogic 6 , an encryption-integrated optical transport solution.

Governments in North America and Europe are increasing encryption mandates in defense and financial services.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=4969&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment