Why Kashmir's Property Market Is Heading For The Hills

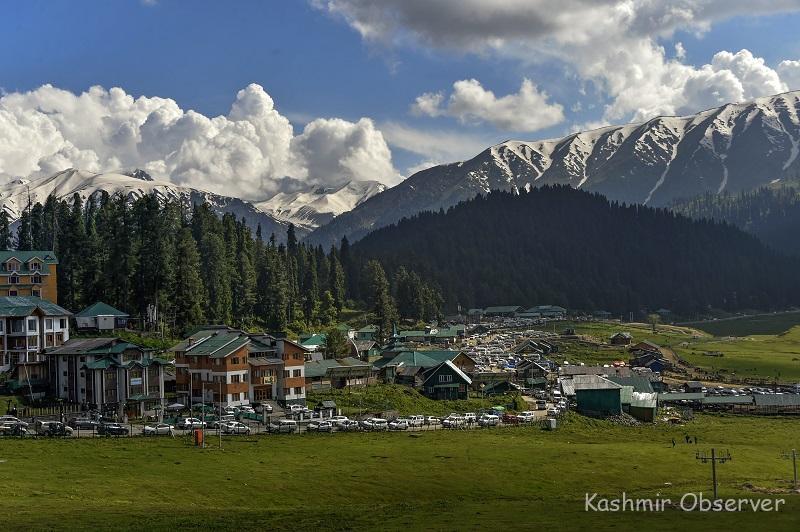

KO file photo by Abid Bhat

A few years ago, if you asked where to buy land in Kashmir, most people would mention city colonies like Hyderpora or Lal Bazar. These were seen as safe bets. Steady. Predictable. Families bought homes there, confident their value would grow with time. But lately, the story has taken a turn.

Residential property in these areas isn't growing the way it used to. Over the last two or three years, prices have barely moved. Meanwhile, if you step into the mountain air of places like Gulmarg, Pahalgam or Sonmarg, it's a different picture. In these tourist hotspots, land prices have shot up-twice, even three times what they were before COVID hit.

It's not just a coincidence. After the pandemic, Kashmir's tourism sector saw a sharp revival. Visitors returned in big numbers, and investors followed. They're buying land for resorts, cottages, guesthouses and boutique hotels. The demand for tourist-facing infrastructure is rising fast, and the market is responding. Real estate, once a slow and steady game, is now leaning toward the scenic.

You can see this shift if you compare Kashmir with other popular tourist regions in India. Take Lonavala, for instance, near Mumbai. It has long attracted real estate interest. But right now, Kashmir's growth in tourism-linked property is outpacing expectations, even compared to old favorites like Lonavala. The landscape, both physical and financial, is changing.

Of course, this isn't without bumps. A recent incident in Pahalgam, a tragic attack, sent a ripple through investor sentiment. Events like these remind everyone that Kashmir's beauty also comes with unpredictability. Markets pause, buyers hold back, and prices dip. But if history is any guide, recovery follows.

Read Also The Easiest Way to Invest in Real Estate Without Buying Property Ultimate Guide to Indiana 90-Hour Real Estate Pre-License CourseFor decades, Kashmir's real estate doubled every 15 to 20 years, giving annual returns as high as 15 to 20 percent. That kind of growth built trust. But now, some investors are beginning to ask if that streak can continue. Prices have risen so much in certain areas that future returns may not look the same. What goes up quickly doesn't always keep climbing.

That's why many are starting to think differently. Instead of putting all their savings into land, they're branching out. Gold and silver are making a comeback. Global stocks and ETFs-terms that felt distant not long ago-are now part of local financial conversations. Families in Kashmir are talking about diversification, a word that once belonged to big-city advisors.

This shift isn't just about strategy. It's about survival. With markets moving unpredictably, people want to spread their risks. And with better access to financial tools and advice, they finally can. Banks and advisors are seeing more footfall. People are asking sharper questions, looking for long-term safety, not just short-term gains.

Land still matters here. It always will. But the way people think about investment is changing. There's a growing understanding that real estate, while valuable, is just one part of the puzzle. A balanced portfolio might include a small cottage in Gulmarg and a few smart investments in global funds.

Kashmir's real estate story is no longer just about where to build. It's about how to think. And right now, the smartest investors are looking beyond the valley floor.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment