403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Recent U.S. Tariffs Impact European Industries

(MENAFN) On Monday, Fitch Ratings predicted that recent US tariffs on European imports—20 percent for the EU and 10 percent for the UK—will likely hinder revenue and profit growth in various European industries.

The primary consequences for affected sectors will be influenced by trade exposure and intensified competition.

Additionally, a slowdown in economic growth will have more widespread effects, the credit rating agency noted.

The chemical, automotive, and technology sectors are expected to be "likely the most affected," as they face rising competition and diminishing growth prospects.

The chemical industry, benefiting from a significant trade surplus with the US, may experience difficulties due to heightened global competition.

Meanwhile, automotive manufacturers are confronting risks in their supply chains. Telecom equipment producers will also face increased costs to localize production.

Alcohol manufacturers are anticipated to increase prices to counteract the tariff effects, which could harm sales, especially in lower-priced segments.

Other industries, like hotels, restaurants, as well as consumer goods producers, will likely experience revenue declines due to reduced consumer spending.

Healthcare firms, such as pharmaceutical companies, might struggle with challenges stemming from slower economic growth and trade barriers.

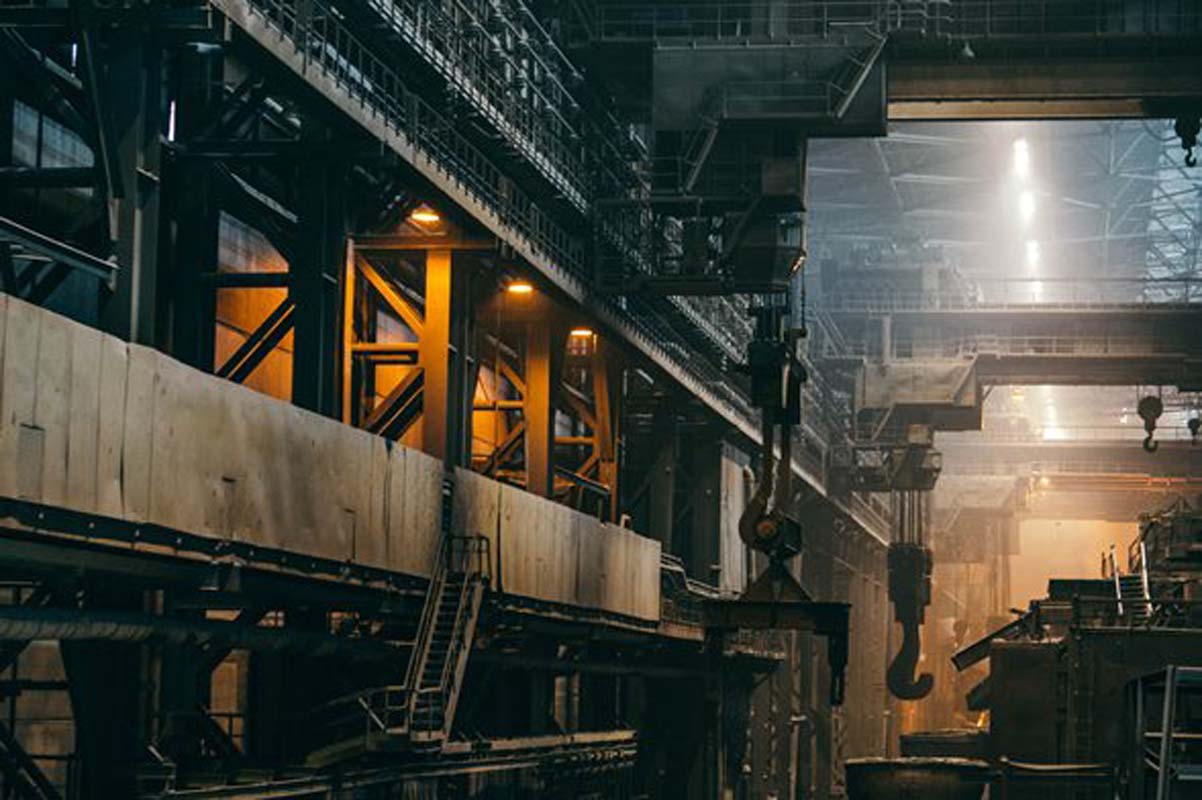

Similarly, the metals, mining, and oil sectors will deal with reduced demand and cost pressures.

The primary consequences for affected sectors will be influenced by trade exposure and intensified competition.

Additionally, a slowdown in economic growth will have more widespread effects, the credit rating agency noted.

The chemical, automotive, and technology sectors are expected to be "likely the most affected," as they face rising competition and diminishing growth prospects.

The chemical industry, benefiting from a significant trade surplus with the US, may experience difficulties due to heightened global competition.

Meanwhile, automotive manufacturers are confronting risks in their supply chains. Telecom equipment producers will also face increased costs to localize production.

Alcohol manufacturers are anticipated to increase prices to counteract the tariff effects, which could harm sales, especially in lower-priced segments.

Other industries, like hotels, restaurants, as well as consumer goods producers, will likely experience revenue declines due to reduced consumer spending.

Healthcare firms, such as pharmaceutical companies, might struggle with challenges stemming from slower economic growth and trade barriers.

Similarly, the metals, mining, and oil sectors will deal with reduced demand and cost pressures.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment