Can US Deliver On Its '3-3-3' Economic Plan?

Doha, Qatar: The global growth outlook this year is largely determined by actions and choices decided by the recently inaugurated Trump administration in the US. In charge of the massive USD 30 trillion US economy, Trump has an ample mandate to adopt new policies and initiatives, given the solid majority of the Republicans in both the House and Senate, QNB said in its economic commentary.

Under the“Make America Great Again” (MAGA) and“America First” slogans, Trump promised more economic growth, de-regulation and less red tape in key industries, lower taxes for corporates and households, more public investments and subsidies for domestic manufacturing and defence, higher hydrocarbon production, and a strong protectionist stance on foreign trade. This is more or less in line with Trump's agenda during his first tenure in 2017-2021.

But economic conditions in the US are different now from when Trump initially took office in 2017. Potential GDP growth has already increased significantly in the last few years, the fiscal space is much more limited and the country had already gone through an“energy revolution” with the development of shale. Irrespectively of that, however, Trump's economic team, led by Treasury Secretary Scott Bessent, believes that it is possible to deliver on an aggressive plan that has been called“3-3-3”, standing for 3% GDP growth, 3% fiscal deficit and 3 additional million barrels per day domestic production of crude oil by 2028.

This week, we breakdown targets of the 3-3-3 plan to evaluate whether it is feasible and the odds of success, as well as the potential impact of the needed measures.

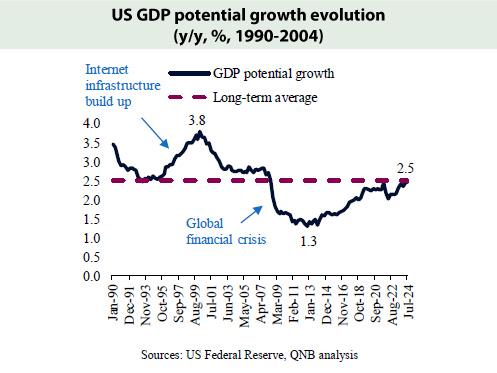

First, US growth has already seen significant progress in recent years with an acceleration of GDP potential. There is no reason to believe that a target of 3% is too high or unreasonable. In fact, GDP potential growth is already at 2.5%, back to the long-term average. We see the potential that Trump enacts a comprehensive pro-innovation, de-regulation agenda with existing investments in artificial intelligence (AI) continuing.

In recent quarters, large cloud service providers have doubled their capex programmes, suggesting that we may be only in the beginning of a once in a generation type of mega investment cycle in AI infrastructure. Accelerated technological adoption can create meaningful efficiency gains, further increasing productivity and GDP potential, as seen during the internet infrastructure build-up of the 1990s.

Second, the new economic team intends to deliver a significant fiscal consolidation plan that would narrow deficits to 3% by 2028.

The plan is aggressive, especially as Trump promised during his campaign that he will reduce corporate taxes from 21% to 15% and would further extend the 2017 tax cuts, which were set to expire at the end of this year.

Third, there is also a target to increase US energy production by 3 million barrels of oil equivalent per day.

The idea is that de-regulation, incentives and a shift from supporting and subsidizing renewable energies to a more neutral stance in terms of preferences for different energy sources would boost hydrocarbon producers.

However, the baseline for comparison for this additional 3 million barrels of oil equivalent is not very clear. Moreover, there are significant industry challenges in some key segments, such as crude oil production.

All in all, while we do see high odds of Trump delivering on the 3% GDP growth target, the fiscal consolidation target is, in our view, too aggressive, particularly in the context of new tax breaks and the desire for higher growth.

The energy target is more ambiguous and open to interpretation, being potentially achievable only if non-crude oil output are added to the equation of barrels of oil equivalent production.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment