Qatar's POS Transactions Surge By 20% To QR9.49Bn In December

Doha, Qatar: Qatar's point of sale (POS) and e-commerce transactions saw an upward trajectory in December last year, Qatar Central Bank (QCB) data revealed, yesterday.

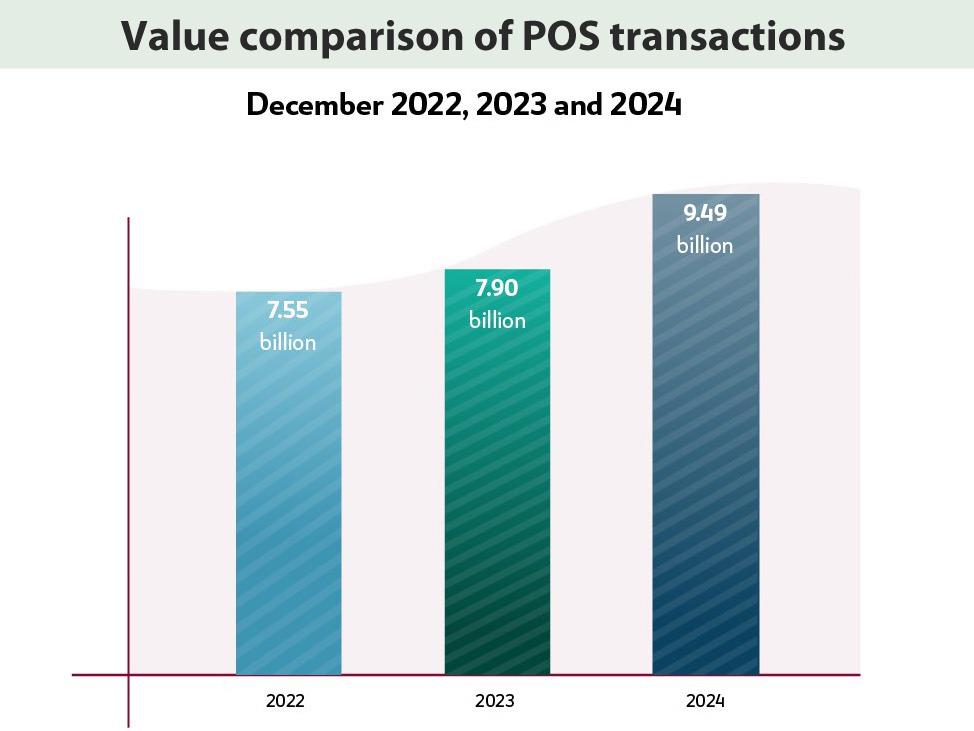

The surge was registered as point of sale transactions were valued at QR9.49bn in December 2024 compared to QR7.90bn in December 2023 and QR2.755bn in December 2022 recording a growth of 20 percent and 25 percent respectively.

The volume of point of sale transactions stood at 43.97 million in December last year, while it was 33.85 million in December in 2023 and 32.06 million in the same month in 2022 recording an increase of 30 percent and 37 percent respectively.

The number of point of sale devices in Qatar totalled 75,779 in December last year compared with 64,032 in December 2023 and 64,675 in December 2022.

POS solution provides innovative, secure, and highly efficient payment processing services as it supports contactless card transactions, eWallet, mobile POS (mPOS), QR code scanner, and online billing and settlement.

The data also revealed the total count of active cards in Qatar in December. The number of active debit cards stood at 2,446,327 while the credit cards and prepaid cards totalled, 766,649 and 774,099 respectively in December last year.

Meanwhile the volume of e-commerce transactions reached 8.59 million in December 2024 with a value of QR4.11bn showing a year-on-year surge in value of e-commerce transactions by 32 percent and 50 percent in December 2023 and 2022 respectively.

The volume of e-commerce transactions in Qatar reached 5.98 million and 4.97 million in December 2023 and 2022 respectively.

The e-commerce market in Qatar is showing healthy growth. Over the coming years, the country's e-commerce industry is poised for substantial growth with forecasts predicting a compound annual growth rate (CAGR) of 9.40 percent by 2028.

The drive for increased e-commerce adoption will contribute to economic development, providing a viable new bridge to consumers to improve business efficiency, expand trade, investment opportunities, foster innovation, diversity and competitiveness.

Since unveiling in 2008 Qatar has been following the Qatar National Vision 2030 (QNV) long-term development plan, which outlines the objective of economic diversification, with financial services – including banking – playing a pivotal role in this endeavour.

Consistent with this vision, the Qatar Central Bank itself has published a series of long-term strategies with the release of the Third Financial Sector Strategic Plan. This plan for the sector aligns with and complements the broader goals of the (NDS-3).

The Third Financial Sector Strategic Plan prioritises banking as one of its four strategic pillars, alongside insurance, capital markets and the digital ecosystem.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment