In Defense Of Chinese Deflation

Don't need no credit card to ride this train

– Huey Lewis and the News

“What's so bad about deflation?” President Xi Jinping said, according to the Wall Street Journal.“Don't people like it when things are cheaper?”

This (possibly apocryphal) nugget has been circulating in social and mainstream media as dreams of Japanification once again tickle the fantasies of even highly credentialed economists and pundits.

Old tropes and buzzwords are being flung with gleeful abandon – balance sheet recession, deflationary spiral , lost decade – as President Xi has so obviously demonstrated rank economic ignorance.

Or has he? Han Feizi also asks the same question,“What's so bad about deflation?” and will go so far as to hazard a startling opinion,“People definitely like it when things are cheaper!”

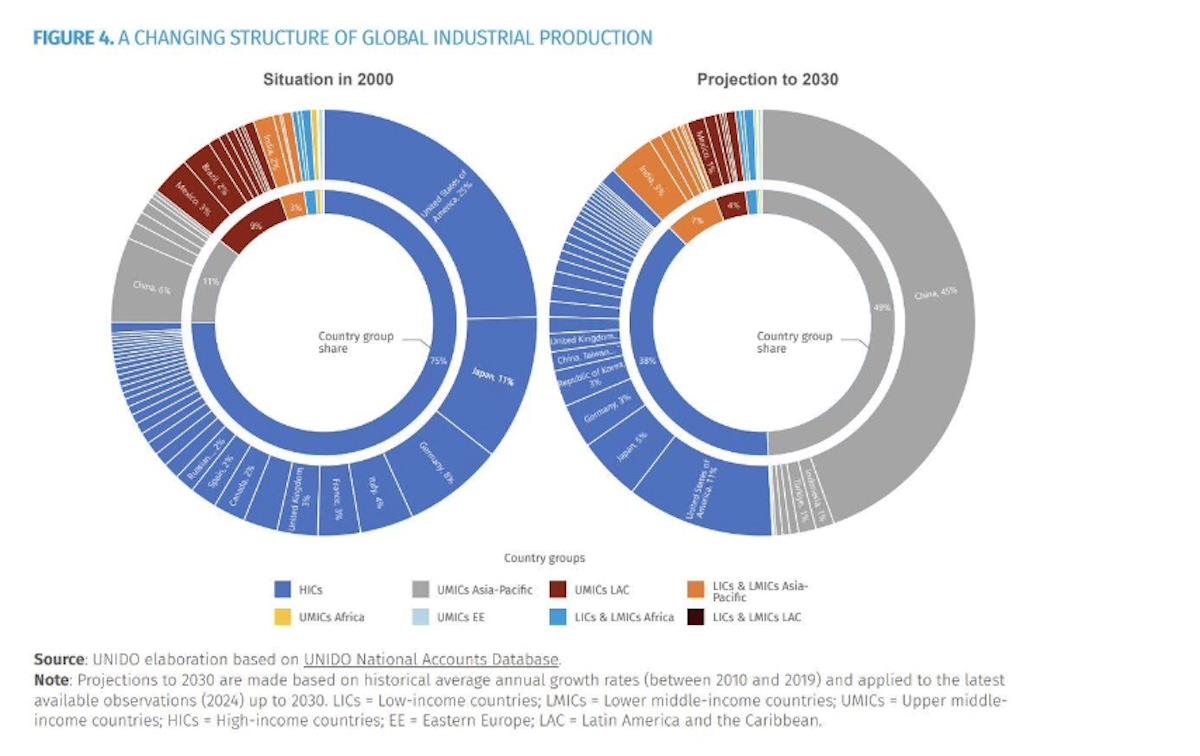

Every economist should be asking this question as China doubles down on its manufacturing sector, which, according to the UN, is on track to reach 45% of the global total in 2030 (up from 30% in 2022).

No, China is not turning Japanese. Deflation in China's case is not analogous to what Japan saw in the mid-1990s, but is, in fact, its wholesale opposite.

Japan's deflation was a result of a negative demand shock – the popping of its bubble economy. At the time, Japan was the world's most expensive economy, topping the Economists' Big Mac index, among other indicators. The bursting of the bubble shifted the demand curve in, resulting in lower aggregate demand and lower prices.

China's current deflation is a result of a positive supply shock as credit has been redirected from the property sector into advanced manufacturing. Prices in China are currently among the cheapest in the world. Automation and advanced manufacturing have shifted the supply curve out, resulting in higher aggregate supply and lower prices.

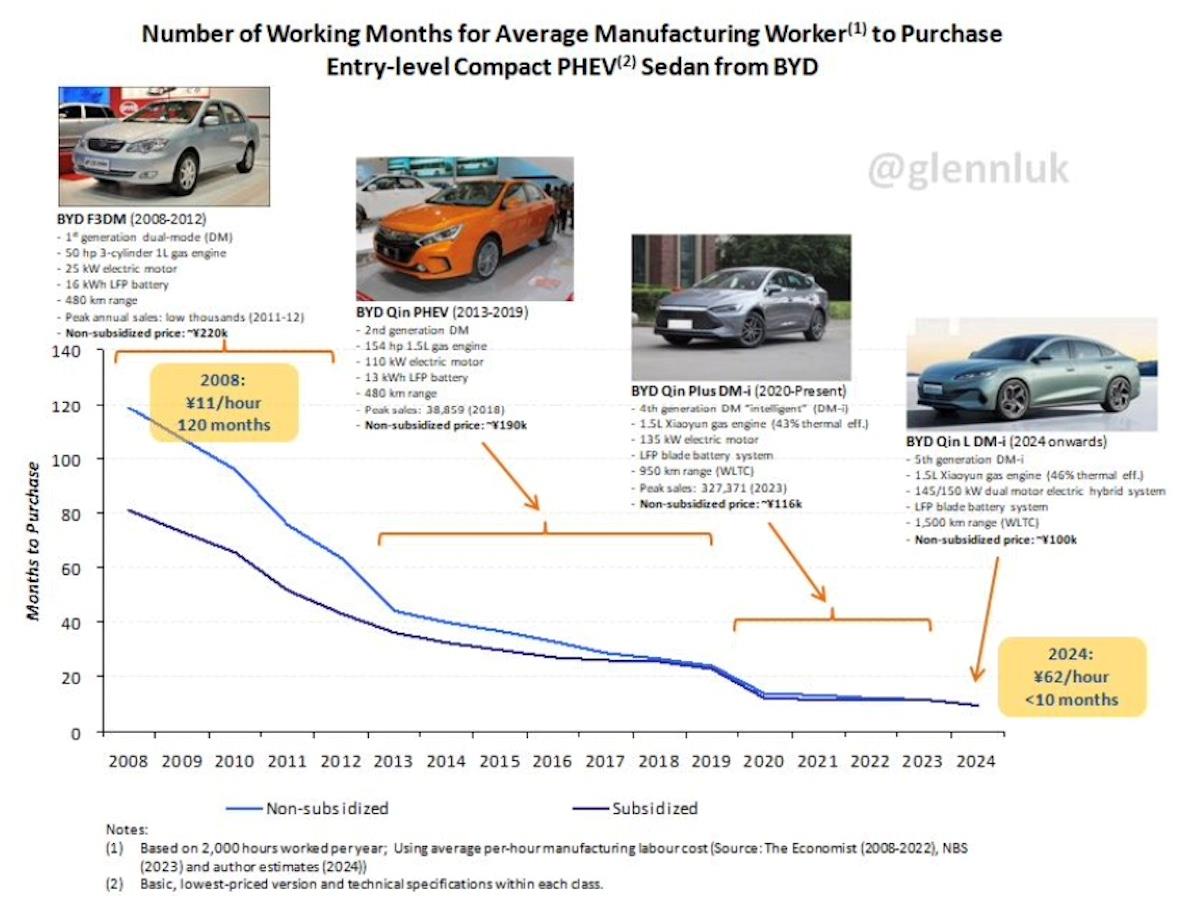

China's auto industry is the poster boy for this development as surging investment and unbridled competition among new EV entrants flood the market with whizzbang models of ever higher performance and more innovative features.

In 2024, the average new car sales price in China was about RMB180,000 (~US$25,000), which bought a mid-level trimmed BYD Han large sedan. In 2020, the average new car sales price in China was RMB150,000 (~$22,000), which was good for a compact Toyota Corolla. The BYD Han was also introduced in 2020 with an entry-level price of RMB233,000 (~$34,000).

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment