Mortgaging Property With Bank For Loan Not Money-Laundering: HC

“...in order to constitute an offence of money-laundering as defined under Section 3

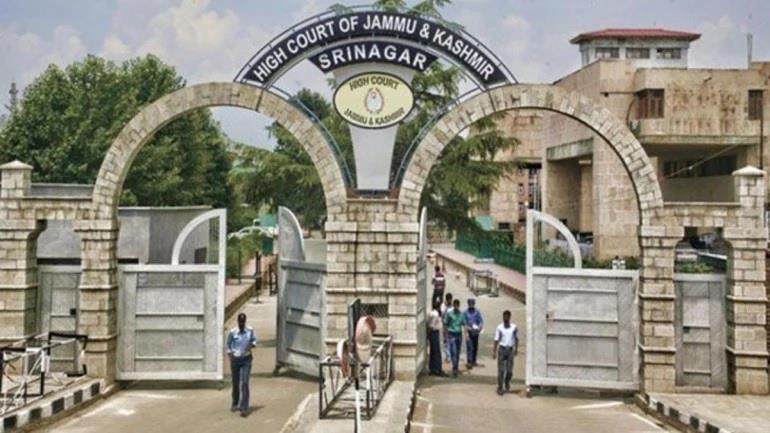

(of the Prevention of MoneyLaundering Act, 2002), the most important thing is that there must be an activity connected with the“proceeds of crime”, which proceeds of crime in terms of the aforesaid definition would mean any property derived or obtained directly or indirectly by any person as a result of criminal activity relating to a scheduled offence or the value of any such property,” a bench of Justice Javed Iqbal Wani said.

“Thus, in order to constitute an offence under Section 3 of PMLA, Section 2(1)(u) is to be read together with Section 3 of PMLA to find out whether the ingredients of the offence of money-laundering are made out or not.”

ADVERTISEMENT

When read so, the court said, the offence of money-laundering can be said to have been committed by fulfilment of following conditions: i. Scheduled offence must have been committed; ii. Commission of scheduled offence must have resulted in some“proceeds of crime”; iii. Person accused of money-laundering must have indulged in an activity connected with such“proceeds of crime”.

“It needs to be mentioned here that the activity connected with the“proceeds of crime” attributed to an accused must be the voluntary act of the accused.”

The Court was hearing a plea by Hilal Ahmad Mir and Abdul Hamid Hajam who stated in their petition that they have been working as Chairman and Secretary of a registered Co-operative Society, namely, River Jhelum Co-operative House Building Society

which had proposed to develop a satellite township at Shivpora, Srinagar on a big plot of land. They said that the land was proposed to be purchased by the Society from its land owners for the development of the township.

Mir, one of the petitioners said that he approached the Jammu and Kashmir State Co-operative for grant of financial assistance by way of loan of Rs. 300 crores in favour of the Society for enabling it to acquire the identified land from its owners and its subsequent development for establishment of the satellite township.

The Bank after considering the financial viability of the project and financial interests of the Bank, agreed to finance the project to the extent of Rs. 250 crores and subsequently in the first instance, the Bank released an amount of Rs. 223 crores as loan and directly transferred the same in the accounts of 18 land owners against the land in question measuring 257 Kanal and 18 Marlas in estate Shivpora, the petitioners said.

The land owners consequently executed an irrevocable power of attorney in favour of Mir in order to facilitate the transfer of the land in the name of the Society.

Subsequently, they said, a“frivolous” investigation was initiated in the matter by the Anti Corruption Bureau

after registering FIR No. 4/2020 for commission of offences punishable under Sections 120-B, 420, 467, 471 RPC read with Section 5(2) of J&K Prevention of Corruption Act, wherein the crux of the allegations against the petitioners-Mir and

Hajam and other co-accused therein the FIR was that the they had falsely claimed that the Society was a registered Society and succeeded in obtaining a loan of Rs. 250 crores from the Bank on false premise while alleging further that the loan had been sanctioned by the Bank illegally and fraudulently without following the Standard Operating Procedure, proper documentation, KYC norms and also without obtaining tangible security with further allegation that the whole exercise had been undertaken by the petitioners at the behest and instance of the then Chairman of the Bank, namely, Mohammad Shafi Dar, who sought quashment of proceedings in a separate petition.

Meanwhile ACB filed chargesheet against the petitioners along with the other accused persons.

“It is pertinent to mention here and as has been noticed in the preceding paras as well, that during the course of investigation, land in question as also the Bank accounts of 18 land owners, in whose accounts the loan amount had been directly transferred/credited by the Bank were attached to prevent the land owners from withdrawing the money so transferred/credited,” the court said, adding,“the said attachment of the Bank accounts of the land owners became subject matter of the litigation before the Apex Court, wherein the Apex Court passed orders to facilitate the land owners the withdrawal of the said money, having been deposited/credited in their accounts in lieu of the land having been perpetually leased out in favour of the Society.”

Having regard to the position obtaining in the matter, the court said, the alleged offence manifestly has not resulted in any“proceed of crime” in favour of the petitioners (Mir and Hajam).

“A-fortiori, it cannot be said that the petitioners have indulged in any activity connected with the“proceeds of crime” for unless there are“proceeds of crime”, there cannot be any activity about the“proceeds of crime”, in that, existence of“proceeds of crime” pursuant to the predicate offence is sine qua non for commission of offence of money-laundering, to be precise that if there is no money or property, a question of money-laundering would not arise,” the court said.

Admittedly, the court said, no money was transferred to the accounts of the petitioners, therefore, there was no occasion for the petitioners to indulge in any activity associated with the so called“proceeds of crime” as the money that has been released out of the sanctioned loan, which is described as the“proceeds of crime” in the complaint, had admittedly been transferred/credited directly into the accounts of the land owners and the petitioners had never been in possession or control of the said money, which is alleged to have been laundered.

“As has been pointed out earlier, in order to constitute the offence of money-laundering, it is imperative that one should be first in possession of the“proceeds of crime” and then engage in an activity to project it as untainted property, which however, is missing in the instant case,” the court said, adding,“In the instant case,“proceeds of crime” in favour of the petitioners would have arisen only had the petitioners developed the plots in the colony and sold them to earn profit in the process, in that, the said profits would have been the“proceeds of crime” and any activity related to such profits may have resulted in money-laundering, which stage in the instant case has not reached.”

Thus, the court said, none of the ingredients of the offence of money-laundering against the petitioners is found to be existing in the present case.“...more so in view of the fact that an act of mortgaging the property with the Bank for securing the loan that is said to have been obtained fraudulently without following Banking rules and regulations cannot by any stretch of imagination be termed as money-laundering and that the act of the petitioners herein of having fraudulently secured loan for development and establishment of satellite township by submitting false documents, at the most makes out a case for forgery or Bank fraud,” the court said and quashed the complaint filed as regards the petitioners by the Enforcement Directorate before designated court.

Follow this link to join our WhatsApp group : Join Now

| Be Part of Quality Journalism |

| Quality journalism takes a lot of time, money and hard work to produce and despite all the hardships we still do it. Our reporters and editors are working overtime in Kashmir and beyond to cover what you care about, break big stories, and expose injustices that can change lives. Today more people are reading Kashmir Observer than ever, but only a handful are paying while advertising revenues are falling fast. |

| ACT NOW |

| MONTHLY | Rs 100 | |

| YEARLY | Rs 1000 | |

| LIFETIME | Rs 10000 | |

CLICK FOR DETAILS

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment