Historian Claims Swiss Banks May Hold Further Second World War Secrets

-

Français

fr

Nazisme: zones d'ombre dans les archives des banques, dit Perrenoud

Original

Read more: Nazisme: zones d'ombre dans les archives des banques, dit Perrenou

+Get the most important news from Switzerland in your inbox

“The Bergier Commission uncovered so much documentation that we couldn't go through it all in the five years of our mandate, which ran from 1996-2001,” the historian told the Le Temps newspaper on Tuesday.

He made the remarks after news at the weekend that Swiss bank UBS is working with an independent ombudsman to shed light on Nazi-linked accounts. This followed a Wall Street Journal newspaper report that some accounts at collapsed bank Credit Suisse, which UBS bought in 2023, had not been disclosed in earlier investigations.

The WSJ cited a December 2024 letter from the ombudsman to the US Senate which said his probe had uncovered a cache of client files marked“American blacklist”, a designation for those trading with Nazi-affiliated entities, and revealed signs of a cover-up during past reviews.

More More Credit Suisse Nazi ties 'ran deeper than thought': media reportThis content was published on Jan 4, 2025 Credit Suisse is alleged to have withheld details of its historic links with World War II-era Nazi clients, says the Wall Street Journal.

Read more: Credit Suisse Nazi ties 'ran deeper than thought': media reporFormer United States prosecutor Neil Barofsky is sifting through 3,600 boxes of files that were not seen by two investigatory panels in the 1990s, the newspaper reports.

Credit Suisse appointed Barofsky as an independent ombudsman to probe Nazi-era links in 2021, but later removed him from the position. Barofsky was reinstated in 2023 after Credit Suisse was acquired by rival UBS in an emergency takeover earlier that year

Lack of time and cooperationPerrenoud said the Bergier investigation in the late 1990s had been“under pressure” to complete its work as a federal decree was only valid until December 31, 2001.

In addition to the time pressures, they also faced a lack of cooperation, he lamented.

“In some cases we suspected [a] withholding [of information], but we weren't informed and we didn't have the proof,” Perrenoud told Le Temps.

+Read more about the Holocaust assets controversy

The commission could have sent police inspectors to check, he added, but“there was the risk of destroying archives, as attested by the Meili affair in the UBS case”.

'Not exhaustive' work at UBSFormer UBS security guard Christoph Meili saved important archives from destruction in January 1997. In the context of the dormant assets affair, the Swiss government had enacted provisions guaranteeing access to the documents for researchers from the Bergier and Volcker commissions. The decree specified that the documents were not to be destroyed or made inaccessible.

Perrenoud noted that the banks were very late in handing over archives to the Bergier Commission.

“For example, at the end of our work, UBS sent us new customer information. We then realised that the inventory we had received in 1997 was notoriously incomplete,” he said.“We'd have to do the work in the UBS archives; it wasn't exhaustive.”

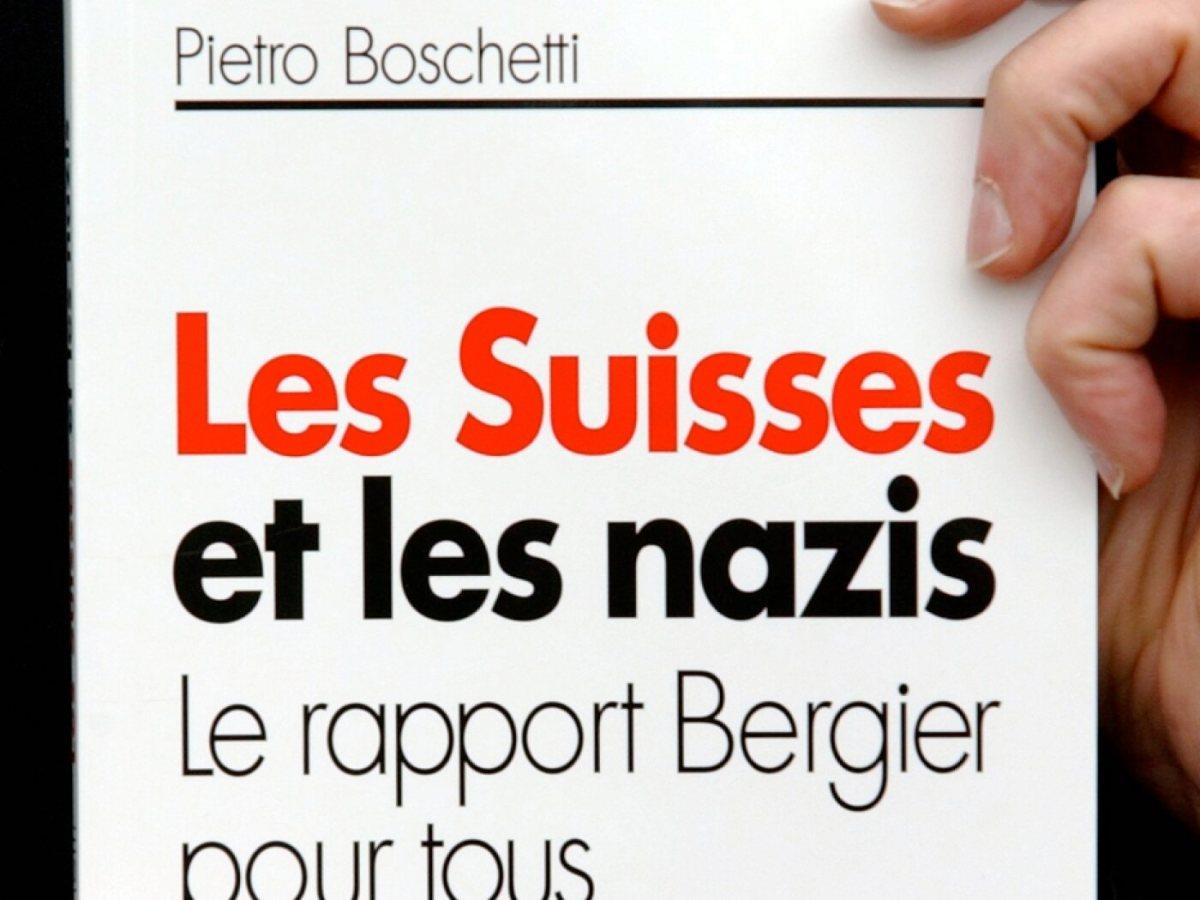

The Bergier Commission was set up by the Federal Council in December 1996 to shed light on unclaimed assets and Switzerland's role during the Second World War. In March 2002, it published a final report, along with dozens of studies.

Translated from French by DeepL/sb

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment