G10 FX Valuation Round-Up

Our Behavioural Equilibrium Exchange Rate (BEER) model estimates the real medium-term fair value of G10 currencies using productivity, terms of trades (the price of exports divided by the price of imports), current account balances (as % of GDP) and government spending (as % of GDP). We use quarterly OECD and national account data. Historically, our model has proven to have a good explanatory power (R-squared around 0.55-0.80 across different G10 pairs) and the terms of trade differential has, on average, been the factor explaining most fair value moves.

The aim of the model is to estimate mis-valuation based solely on economic fundamentals – those that generally explain long-term FX fluctuations – therefore stripping out market factors, such as interest rates and equities. However, commodity prices play an important role bearing on the model's outputs as they influence terms of trade and current account differentials.

Latest BEER model results

Source: ING

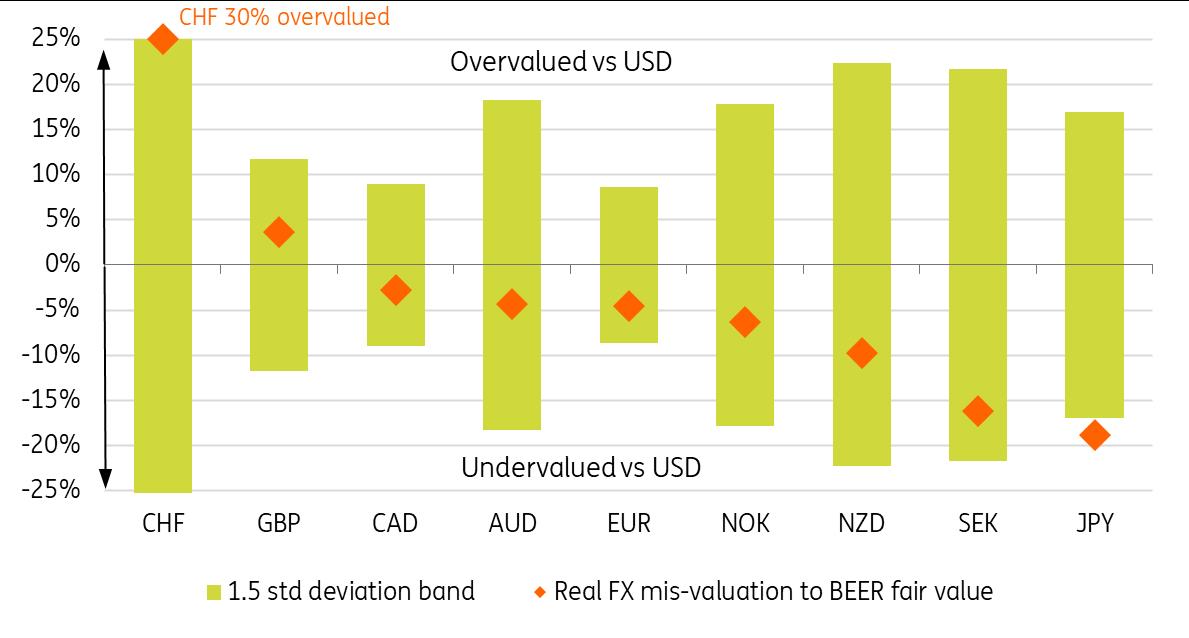

The chart above summarises our results using third-quarter data and up-to-date real FX levels vs USD. We normally consider a currency to be severely misvalued beyond the 1.5 standard deviation bound, as that statistically points to a correction in the direction of the fair value. Since the misvaluation is a function of both the fair value and real spot rates, the convergence can occur via either a spot move or a fair value move. The second case encompasses a situation where markets price in a deterioration in economic fundamentals which ends up materialising over the medium term.

Yen stands out on the undervaluation sideThe Swiss franc is a structurally overvalued currency – as is often remarked by the Swiss National Bank – and our BEER model results do not imply any specific move in CHF.

What clearly stands out in our November BEER update is the yen, which we estimate to be 18% undervalued in real terms vs USD, beyond the 1.5 standard deviation lower-bound. That is almost entirely explained by the USD-JPY interest rate gap that has consistently pressured the yen. Unlike in 2022, when the energy prices caused a deterioration in Japan's terms of trade position, there are significantly less structural economic headwinds justifying such a cheap yen for the moment.

This result feeds into our view that USD/JPY has large downside potential in the long run. Still, since we see President-elect Donald Trump's policy mix resulting in a shallower easing path by the Federal Reserve, we remain rather cautious on how far relatively strong fundamentals can offset the pressure from wide rate differentials. These are medium to long-term exchange equilibrium estimates, meaning a pair can trade in moderate undervaluation territory for several quarters.

EUR/USD would look quite cheap at parityIn the rest of the G10, there are no misvaluations beyond the 1.5 standard deviation line. SEK remains quite cheap (around 11% undervalued versus the EUR), but we believe a recovery will be delayed further by the Riksbank's aggressive easing cycle.

Part of SEK's undervaluation boils down to the generalised stabilisation in economic fundamentals – mostly, the terms of trade – for European countries relative to the US, following 2022's commodity-led sharp terms of trade deterioration. As shown below, the euro is indeed enjoying a slight improvement in the terms of trade differential relative to the US and, by extension, a stable fair value.

EUR/USD fair value has stabilised after a big decline Source: ING, MacrobondDue to its lower volatility, EUR/USD has a history of much smaller misvaluation swings compared to most other G10 peers, meaning the 1.5 standard deviation band is also tighter (+/- 9%). EUR/USD is currently 5% undervalued in real terms, meaning a move to parity from around a 1.05 spot could trigger alarms of stretched misvaluation in our BEER model. That is barring a material further deterioration in the terms of trade, which is the contributor to EUR's fair value that is most susceptible to shorter-term volatility. In simpler terms, we would need to see a commodity price shock to justify nominal EUR/USD consistently below parity within the next year or so, and that is not our base case.

This consideration is embedded in our latest EUR/USD forecast . We estimate that EUR/USD will trade below 1.05 throughout 2025-26 on the back of Trump's policy agenda and large European Central Bank cuts, but in line with the BEER model results, we do not project a sustainable move below parity. We target 1.02 for year-end 2025 and 1.05 for the longer term.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment