Why Poland's External Position Is Beginning To Deteriorate

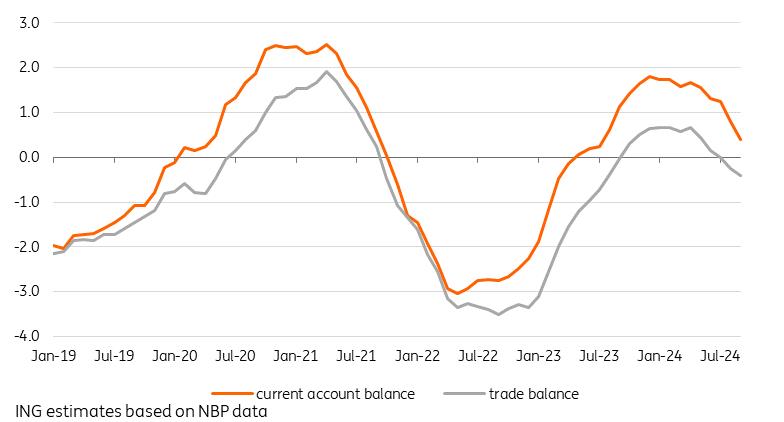

In September, Poland's current account closed with a deficit of €1434m after a deficit of €2731m in August, and was close to consensus (-€1500m). According to our estimates, on a 12-month basis, the current account surplus narrowed to 0.4% of GDP after September from 0.8% of GDP after August. September was the fifth consecutive month with a trade deficit (€690m), although this was clearly lower than the €2244m seen in August, with exports up 0.5% year-on-yearand imports rebounding by 5.1% YoY.

As for the components of the current account, apart from the trade deficit, the other categories were very similar in September to the values registered in August. We saw a traditionally high surplus in services (€3028m), a large deficit in the income balance (€-3235m) and a significant deficit in secondary income (€-537m).

In the trade balance, exports are suffering from weak external demand from the euro area – in particular, Germany's GDP growth, which is oscillating around 0%. Import spending is driven by domestic demand (particularly consumption) and is probably still related to military spending. On a 12-month basis, we estimate that the trade balance deteriorated to -0.4% of GDP in September after -0.3% of GDP after August.

Neither hard data from Germany (GDP or industrial production) nor soft confidence indicators (PMI or yesterday's ZEW investor sentiment index) bode well for a rapid improvement in Poland's external environment. A slight rebound was perhaps indicated by stronger German orders and Polish PMI recently. Possible decisions by the incoming US administration on tariffs on China and Europe are also an important risk – although the experience of 2018-19 shows that the mere uncertainty surrounding tariffs has a stronger chilling effect on economic activity in Europe than the final decision to impose tariffs. The situation in Germany will be further complicated, at least for the next six months, by the break-up of the government coalition and the likely Bundestag elections in February 2025.

The National Bank of Poland's press release, which refers to trade turnover expressed in PLN (-6.5% YoY decline in exports), shows that declines in exports were recorded in all six categories of goods. The deepest declines were seen in capital goods, means of transport and intermediate goods. Export declines were dominated by the automotive sector, with sales of electric batteries and passenger cars weakening considerably. As for imports, which decreased by 2.1% YoY in PLN terms, a downward trend was recorded in the supply of goods and capital products. On the other hand, imports of consumer goods increased – in particular, imports of durables and new and used passenger cars. These trends have been evident for many months.

The continuation of the deterioration in the trade balance is moderately negative for the zloty, with the current account balance still in a slight surplus in 12-month terms and the trade balance already recording a small deficit. On the other hand, the zloty is positively influenced by the expected increase in the interest rate disparity between Poland and the euro area as the European Central Bank continues its cycle of rate cuts and the NBP has no room to cut rates until the second quarter of 2025.

An additional supportive factor for the zloty exchange rate is the expected GDP outperformance in Poland vs the rest of EU, as well as the prospect of a significant inflow of EU funds under the National Recovery Plan and the traditional 2021-27 cohesion policy budget. In December, the government expects the next payment from the Recovery and Resilience Facility of over €9bn. However, the absorption of RRF funds by final beneficiaries is still relatively slow.

Poland's current account and trade balances, % of GDP

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment