Iraqi Market Marks A Milestone, Closing At An All-Time High

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News .

Market Marks a Milestone, Closing at an All-time High

The equity market, as measured by the Rabee Securities U. S. Dollar Equity Index (RSISX USD Index), marked a significant milestone in October by closing at an all-time monthly high, surpassing the January 2014 peak by 1.7%. The RSISX USD Index was up 17.6% for the month and is up 37.7% for the year.

The promising aspect of the market's strong momentum of the last two months with October's 17.7% increase, on the back of August's 11.6% increase, was that it was matched by meaningful increases in trading volumes in which the average daily turnover for the two months was twice that of the preceding four-month pull-back.

However, irrespective of whether the market over the next few months rallies further, consolidates, or pulls back, its overall trajectory is determined by the dynamics that are transforming the Iraqi economy.

Foremost among them is the cumulative positive effects of the relative stability that the country has enjoyed over the past few years, creating a more stable and predictable macroeconomic framework for businesses and individuals to operate in and plan for capital investments on a scale last seen in the 1970's and early 1980's before the onset of the decades of conflict.

Other key dynamics are the expansionary 2023 and 2024 budgets that are boosting the non-oil economy , and the structural changes in the financial sector that are accelerating the adoption of banking and bringing about a transformation of the sector and its role in the economy.

The combination, in turn, is providing the wherewithal for the leading companies in the country to deliver outstanding profit growth . These dynamics are long-term in the making and should continue to unfold over the next few years, as discussed here in the market's outlook for 2024 , following a gangbuster 2023 in which the market was up 97.2%.

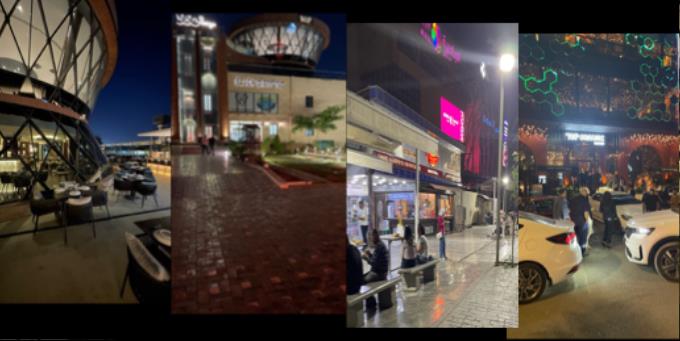

Given the heightened fears of a widening of the current Middle East conflict, the images below, reflect the argument that the Iraqi equity market's rally follows from its discounting the powerful dynamics discussed here, and as argued here over the last few month with the most recent being "Market Rallies as Conflict Escalates ". These images were taken by the author prior to, and after the Israeli attack on Iran on October 26th, and reflect the prosperity and normality that Baghdad, has enjoyed over the last few years, and continues to enjoy.

Selected evening scenes in Baghdad

(Left: The first two are of "360 Lounge Alwiyah" on top of "Black Diamond" health club in Kharada, the third is of "Ali Al Lami" burger joint, a Baghdadi icon in Jadriya, and the fourth of "Top Organic" restaurant in Yarmouk)

Selected morning and afternoon scenes in Baghdad

(Left: First two of "Tales of Clay" exhibition at the Iraqi Artists Society, third image of "360 Lounge Alwiyah", and fourth image of Rowad Street in Mansour)

The equity market, as measured by the Rabee Securities U. S. Dollar Equity Index (RSISX USD Index), having surpassed its 2014 peak by 1.7%, has the potential to rally further reflecting the powerful dynamics discussed here. However, significant risks remain given Iraq's recent history of conflict, extreme leverage to volatile oil prices, as well as the risk that the widening of the current Middle East conflict will not be contained and evolve to destabilise the region.

Please click here to download Ahmed Tabaqchali's full report in pdf format .

Mr Tabaqchali (@AMTabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a Visiting Fellow at the LSE Middle East Centre, Senior Fellow at the Institute of Regional and International Studies (IRIS), and a Senior Non-resident Fellow at the Atlantic Council.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment