No China Stimulus? Time To Buy

Sky falls, you feel like

It's a beautiful day

Don't let it get away

– U2

Do not buy Chinese stocks because you think a large fiscal stimulus is coming. Buy Chinese stocks because a large fiscal stimulus is not needed.

The bull case for Chinese equities is not that stimulus will rescue the economy. The bull case for Chinese equities is that households are sitting on US$20 trillion in deposits with nowhere to go.

The controlled demolition of the property sector is ongoing. Regulators have curtailed wealth management products and their implicit guarantees.

Capital controls prevent easy access to foreign assets. And the coming flood of high-tech hardware companies in clean energy, semiconductors, aerospace, robotics and biotech will need a vibrant equity market to get off the ground.

China's economic transformation will be ill-served by flood-the-zone stimulus which – if we recall – is what got us the real estate bubble and subsequent“three red lines” credit restrictions in the first place. What China's economic transformation needs is better implementation of“establish the new before abolishing the old.”

What should we make of China's recent stimulus measures? The grab bag of goodies – reserve requirement ratio (RRR) cut, lowered interest/mortgage rates, special local bond sales, cash for clunker programs – are all bullets pointing in the same direction. But the firepower falls well short of a bazooka.

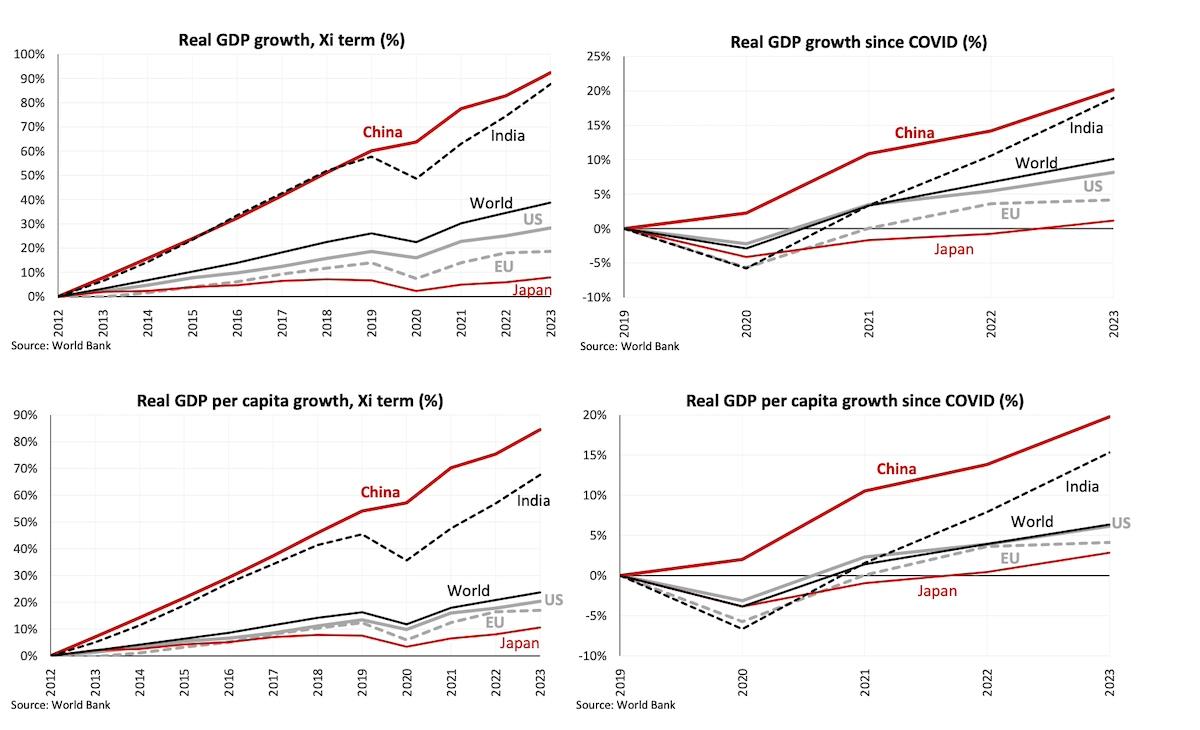

Trillions of renminbi (RMB) in fiscal stimulus have been dangled but apparently withheld given the non-meeting held by the National Development and Reform Commission (NDRC) after the holidays. What has been offered will help China achieve 5% gross domestic product (GDP) growth this year, hardly a lofty goal.

The only interesting policy is the People's Bank of China's (PBOC) unexpected support for equity markets through 1) a collateral replacement scheme to increase risk assets at institutional investors and 2) a program to encourage bank lending for share buybacks.

While some attribute this to an effort to juice consumer confidence, the likelier motivation is an effort by the PBoC to redeploy some of China's $20 trillion in household bank deposits.

China's roaring stock market in the past couple of weeks has given the basket of policies a vote of confidence. Note that domestic markets are behaving far more rationally than international markets.

China's exchanges took one week off from October 1-7for National Day holidays – enough time for international markets to spin wild and unbridled fantasies about fiscal stimulus of RMB2 trillion, RMB4 trillion, RMB6 trillion and RMB10 trillion.

The subsequent whiplash in Chinese equities traded in Hong Kong and through international ETFs occurred in Shanghai and Shenzhen after markets reopened.

Perfectly attributing domestic market confidence is of course impossible. Low valuations from beaten down stocks provide a natural floor.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment