Why Gift Cards Fall Into A Gap In The 2-Tier Banking Regulation System − And A Brief History Of Why That Gap Exists

The reason why has its roots in the start of the national banking system proposed by Abraham Lincoln and created by Congress in 1863.

Until the mid-Civil War, the U.S. didn't have its own federal currency. Banks were free to create their own paper money, subject only to state law, which varied dramatically. One-third of all paper money circulating before the Civil War was likely counterfeit , resulting in currency mayhem.

Lincoln's goal was to create the nation's first federal paper currency – national bank notes that only newly approved national banks could issue, subject to regulation by the United States' first financial regulator, the Office of the Comptroller of the Currency .

To secure the new federal currency, these national banks were required to purchase interest-bearing U.S. government bonds from the U.S. Treasury.

An illustration showing federal currency being printed in the U.S. Treasury, from the 1874 book 'Ten Years in Washington' by Mary Clemmer Ames. Bettmann via Getty Images

This financed the Union Army, but it accidentally created a dual banking system . At the time, the wartime Congress thought state-chartered banks would go away, choosing to become national banks that could issue federal currency.

Congress was wrong.

The ensuing dual banking system, with no single regulator in charge of policing all banks, still exists today.

State banks couldn't issue the new federal currency. Soon, Congress enacted a federal tax on state bank paper currency in an attempt to drive state banks out of business.

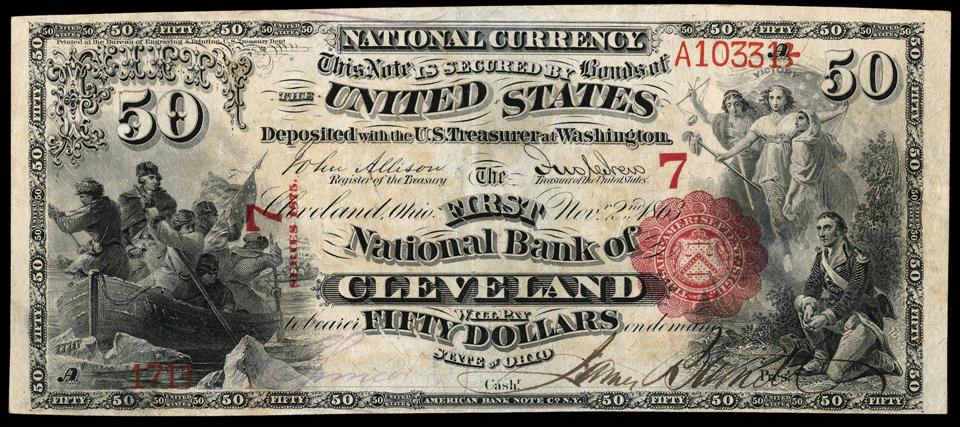

A national bank note issued by the First National Bank of Cleveland in 1863, the first year national banks could issue currency under the National Bank Act. This U.S. national currency was protected by collateral; in this case, bonds. U.S. Office of the Comptroller of the Currency

To stay in business, state banks needed to issue new financial products. The first one, which came during the Civil War , was what eventually became known as the check .

Since then, state and federal regulators have competed to find ways to earn different streams of income.

Again and again, as criminals began finding ways to defraud banks, Congress and regulators addressed the complaints, but piecemeal. And in this game of regulatory“whack-a-mole,” banks attempted to stay at least one step ahead.

A 'race to the bottom'In 2009, then-Senate Banking Committee Chair Christopher Dodd called banking regulation a“race to the bottom .”

When credit card abuses came to light, Congress amended the Truth in Lending Act , causing the Federal Reserve to change Regulation Z , which protects consumers from unfair lending practices. The adjustment required banks to provide refunds for transactions that credit card holders hadn't authorized. This led to losses to banks' bottom lines.

Banks then created debit cards. When consumers began to lose money through debit card fraud, Congress passed amendments to the Electronic Fund Transfer Act , causing the Fed to adjust Regulation E , which protects consumers from unauthorized or incorrect electronic fund transfers. This adjustment added similar consumer protections for fraudulent debit card transactions.

But by then, the industry was moving to a new payment innovation – gift cards, served up without the fraud protections for consumers offered by debit and credit cards, even though many of those gift cards have the word“debit” printed on them.

Today, regulators and Congress are still trying to catch up to the fraudsters.

Read The Conversation's investigation into gift card fraud here: Gift card scams generate billions for fraudsters and industry as regulators fail to protect consumers − and how one 83-year-old fell into the 'fear bubble'

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment