A Tale Of Two Bubbles

The Biden administration in Washington and the Kishida government in Tokyo both pursued the same unsustainable policy, ballooning the government balance sheet to push up asset prices.

By July 31, when the Bank of Japan raised its short-term interest rate to 0.25% from zero and announced that it would“taper” its purchases of government bonds, the central bank owned half the outstanding float of Japanese government bonds.

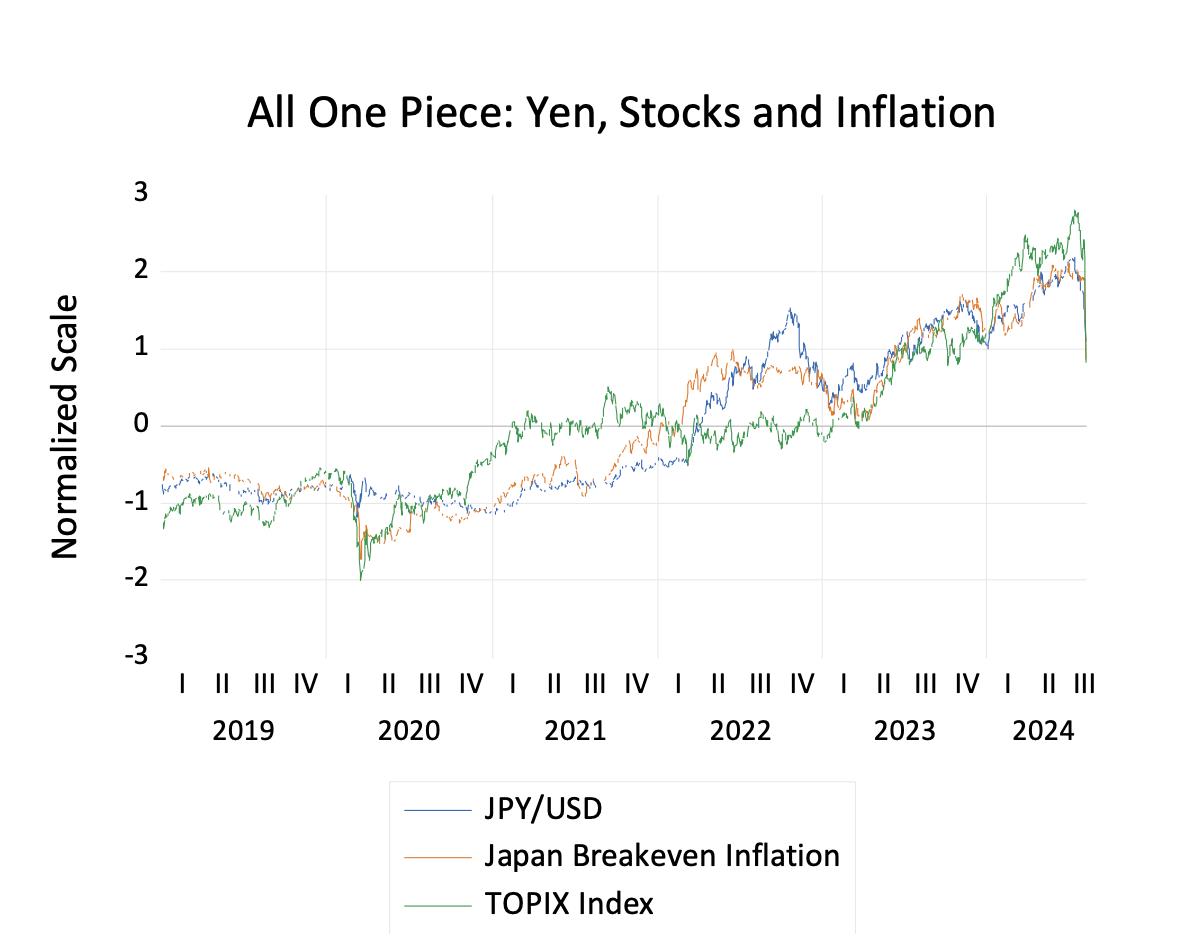

Japan's debt-buying binge pushed up inflation expectations, weakened the yen and buoyed Japan's stock market during the past three years.

A lower yen translated foreign earnings into a larger sum of local currency and inflation reduced real wages, causing a transfer of national income to corporations away from households.

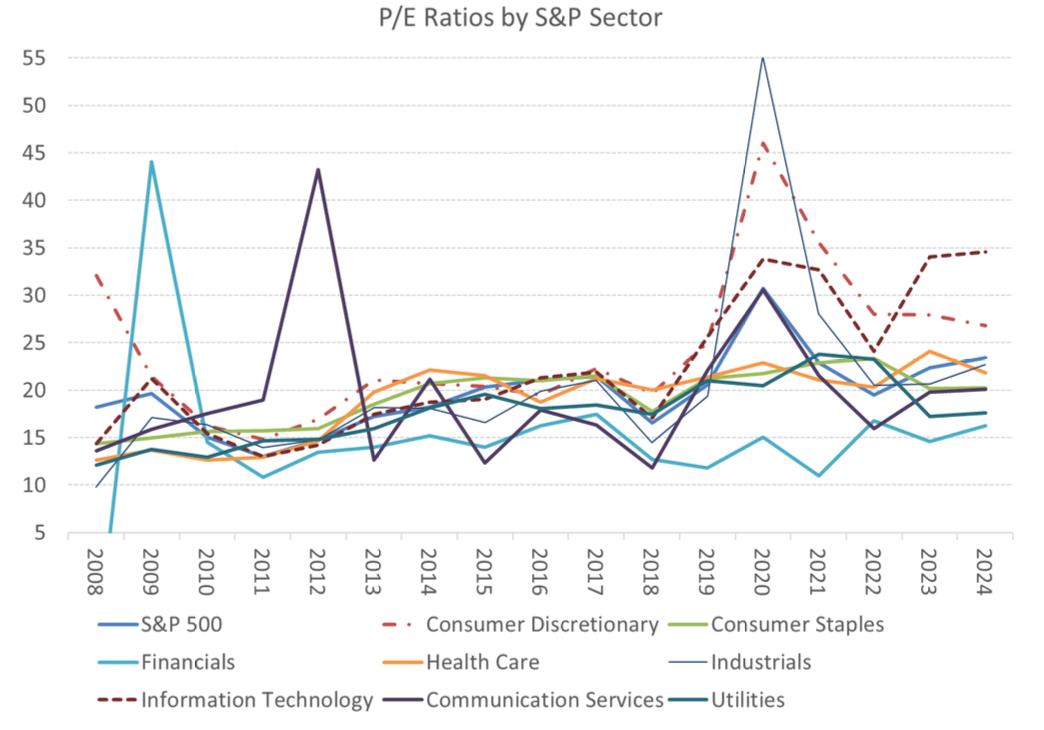

Graphic: Asia Times

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment