Trident Maiden Ore Reserve Underpins New Low-Cost Development

| Metric |

|

Base case # |

Spot case (A$3,400/oz) |

| Pre-production max. capital drawdown |

A$m |

19 |

15 |

| AISC (life of mine) |

A$/oz |

1,578 |

1,592 |

| Mine life (LOM) |

yrs |

5.5 |

5.5 |

| Average annual UG production |

koz |

37 |

37 |

| Average annual free cash flow |

A$m |

29 |

53 |

| NPV7 (pre-tax) |

A$m |

100 |

198 |

| IRR (pre-tax) |

% |

146 |

327 |

| |

| # Base case price assumptions aligned with Ore Reserve – A$2,700/oz for underground, A$3,200/oz for open pit. |

| Financial |

-

Approvals well progressed; first ore targeted mid-2025

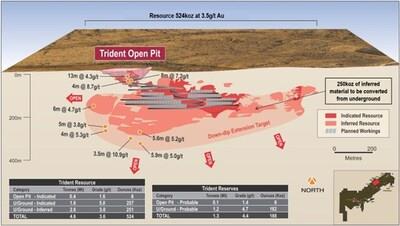

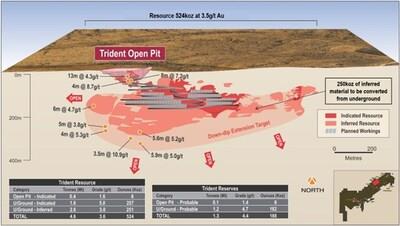

Trident's Resources and Reserves are:

-

Mineral Resource estimate: 4.6Mt at 3.5 g/t Au for 524koz

Ore Reserve estimate: 1.3Mt at 4.5 g/t Au for 188koz

The production profile underpinning the production target is supported by 85% of probable Ore Reserves and 15% of inferred material.

There is a low level of geological confidence associated with inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of indicated Mineral Resources or that the production target itself will be realised. The Inferred material does not have a material effect on the technical and economic viability of the Project.

PERTH, Australia, July 22, 2024 /PRNewswire/ -

Catalyst Metals Limited (Catalyst or the Company) (ASX: CYL) is pleased to announce the maiden Ore Reserve Estimate (ORE) for the Trident Deposit ("Trident" or the "Project"). The ORE forms the basis for Catalyst's updated development plan for Trident.

The Trident ORE is 1.3 Mt at 4.5 g/t Au for 188koz and includes an open pit ORE of 0.1Mt at 1.4g/t Au for 6koz.

Supporting this ORE is a maiden Mineral Resource Estimate at the Trident open pit of 0.4Mt at 1.6g/t for 16koz Au.

Figure 1: Trident long section with new mine development plan (CNW Group/Catalyst Metals LTD.)

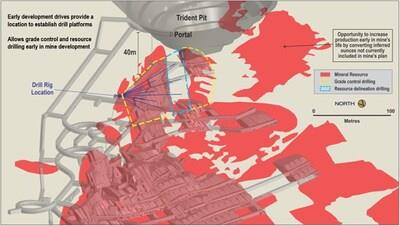

Figure 2 – Trident Development: New mine plan showing reduced development required to service grade control ventilation needs (CNW Group/Catalyst Metals LTD.)

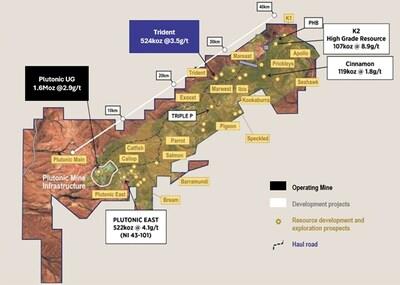

Figure 3: Plutonic Belt showing location of Trident and other deposits on the Plutonic Gold Belt (CNW Group/Catalyst Metals LTD.)

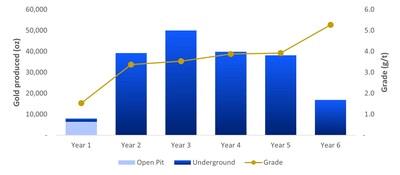

Figure 4: Annual gold production and grade profile (CNW Group/Catalyst Metals LTD.)

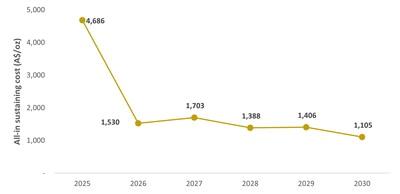

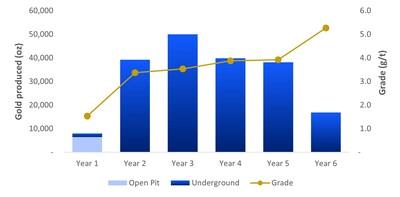

Figure 5: All-in sustaining cost over initial life of mine (CNW Group/Catalyst Metals LTD.)

Figure 6: Annual processing and recoveries (NB: Mining rate equal to processing rate - all ores processed as and when mined) (CNW Group/Catalyst Metals LTD.)

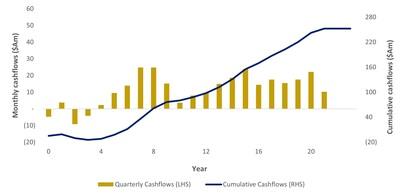

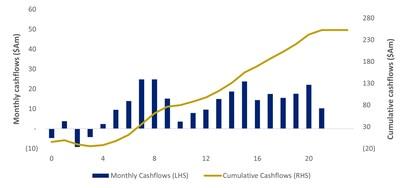

Figure 7: Quarterly & Cumulative cashflows at A$3,400/oz (CNW Group/Catalyst Metals LTD.)

Figure 8: Annual gold production and grade profile (CNW Group/Catalyst Metals LTD.)

Figure 9: Quarterly & Cumulative cashflows at A$3,400/oz (CNW Group/Catalyst Metals LTD.)

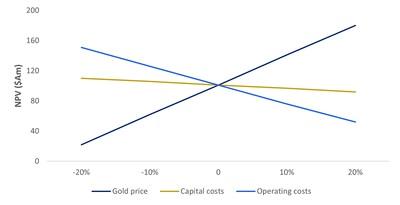

Figure 10: NPV sensitivity to key inputs (CNW Group/Catalyst Metals LTD.)

This small open pit will be the basis of Catalyst's new development strategy and the Trident underground portal will be established within this pit.

This development plan significantly changes the upfront capital profile for Trident.

At A$3,200/oz gold prices, the open pit generates positive net cashflow from 6koz of gold. These cashflows offset Trident pre-production capital costs and reduce the upfront cash drawdown to $15m, from $36m noted in the Catalyst's Trident Scoping Study1.

Surface mining is scheduled over a period of seven months (817k BCM in total movement) with the underground scheduled thereafter for 58 months (total Project life of 65 months). Only Indicated Mineral Resource is extracted within the open pit (Ore Reserve of 6.4koz) with the underground Production Target LOM containing 15% Inferred Mineral Resources (Ore Reserve of 182koz and Production Target LOM of 212koz).

The ore is then to be trucked down the pre-existing haul road to the Plutonic ROM before processing through the existing Plutonic Plant. The Plutonic plant has spare mill capacity to process Trident's ore. No further capital is required to process this ore through the plant.

The Trident Operation will use other shared infrastructure with the Plutonic Operation located ~25

km to the south-west – including administration, travel and accommodation services.

Not considered in this Trident development strategy are the impact of cashflows currently being generated from existing Catalyst operations. These cashflows will further assist the company in managing Trident's development.

While Catalyst has been reducing debt and improving its balance sheet from operating cashflow, it has also managed to lower the capital costs of two near term development projects – Plutonic East and Trident. This has led to a more balanced company with an attractive organic growth profile.

| _________________________ |

| 1 Refer to Catalyst Metals' |

Catalyst's Managing Director & CEO, James Champion de Crespigny, commented:

"The stable operating platform at Plutonic has afforded our team the time to optimise Trident's development. As a result, we have seen the capital requirements for the development of this new

underground mine reduce significantly.

"Last week we announced the capital costs to restart the Plutonic East

underground were also reducing. These two near term low cost development projects, and Catalyst improving balance sheet, make for both a more balanced company well positioned to materiality increase gold production."

Trident Development History

Catalyst acquired the Trident project through its acquisition of ASX listed Vango Mining in 2023. Vango had previously completed a pre-feasibility study on Trident's Resource – at the time estimated to be 400koz @ 8 g/t Au.

In July 2023, soon after acquisition, Catalyst released a Scoping Study contemplating a decline from the existing Marwest pit into the Trident orebody. This was based on the then Resource, ie. 400koz at 8 g/t Au.

Subsequently, Catalyst drilled 44 diamond holes, allowing it to update the Mineral Resource. That updated resource – 508koz at 3.7 g/t gold – is the basis for this study.

Catalyst has spent a further A$5m on project development works – Resource, hydrology, geotechnical and metallurgical drilling along with accompanying study and permitting activities.

Continuously improving operating performance at Plutonic since the release of the July 2023 Scoping Study has provided time for Catalyst to evaluate alternative development options.

One of the alternative options Catalyst has evaluated, and now intends to move forward with, is a small open pit (or large box cut), followed by a portal and decline directly above the Trident underground orebody.

A box cut to support this development option was similar in capital cost to the Marwest decline option evaluated in the July 2023 Scoping Study however it presented a lower execution risk.

A drill campaign was then initiated in 2024 so to better understand the extent of known mineralisation in the area proposed for the box cut. Encouragingly, the results of this drilling delineated a small open pit Ore Reserve which at a A$3,200/oz gold price generates positive cashflow. This Reserve sits within the large box cut or small open pit shown in Figure 1.

This new approach to Trident's development results in the portal being within 30m of the orebody. It makes for a more manageable project for Catalyst; it reduces up front capital expenditure and has lower cash drawdown. More importantly however, the revised portal location better positions the mine for future grade control drilling, ventilation, haulage and in-mine resource development and exploration.

Summary of consulting parties used in Trident Ore Reserve and Development Plan

Catalyst engaged multiple different consultants in preparing Trident's development plan. They comprise:

| # |

Consultant |

Discipline |

| 1 |

Entech |

Mine design and engineering |

| 2 |

Peter O'Bryan and Associates Pty Ltd |

Geotechnical |

| 3 |

RPM |

Environment and permitting |

| 4 |

IMO, Metlab and Extreme Metallurgy |

Metallurgical studies |

| 5 |

MineBuild |

Permitting and mine readiness studies |

| 6 |

Cube Consulting |

Geology/Resources |

Table 1:

Key metrics for Trident Production Target

| |

|

Base case # |

Spot case (A$3,400/oz) |

| Pre-production cash drawdown |

$Am |

19 |

15 |

| AISC (life of mine) |

A$/oz |

1,578 |

1,592 |

| Life of mine (LOM) |

yrs |

5.5 |

5.5 |

| Payback (after open pit ceases) |

yrs |

1.9 |

1.4 |

| Inferred Resource in LOM |

% |

15 |

15 |

| Inferred Resource in payback period |

% |

10 |

12 |

| Average annual UG production |

koz |

37 |

37 |

| Average annual free cash flow |

$Am |

29 |

53 |

| NPV7 (pre-tax) |

$Am |

100 |

198 |

| IRR (pre-tax) |

% |

146 |

327 |

| |

| # Base case price assumptions aligned with Ore Reserve. |

| Financial figures shown pre-tax due to Trident being only one satellite deposit within Catalyst's broader portfolio. |

The production profile underpinning the Production Target is supported by 85% of Probable Ore Reserves and 15% of inferred Mineral Resource.

There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the Production Target itself will be realised. The Inferred material does not have a material effect on the technical and economic viability of the Project.

Production and cost estimates of the Trident project are outlined below.

Table 2: Life of mine operating costs Trident development

| Operating costs (Life of Mine) |

Value ($ million) |

Value ($/t ore) |

| Total Open Pit |

15 |

102 |

| Ore development |

39 |

25 |

| Stoping |

71 |

46 |

| Mine Services and Overheads |

113 |

73 |

| Surface Haulage |

15 |

10 |

| Grade Control |

12 |

8 |

| Processing |

32 |

21 |

| General and Administration |

7 |

4 |

| Total Underground |

303 |

188 |

Table 3:

Life of mine capital costs Trident development

| Capital (Life of Mine) |

Value ($ million) |

Value ($/t ore) |

| Infrastructure |

16 |

11 |

| Decline |

11 |

7 |

| Access, Ventilation, Escapeway |

4 |

3 |

| Mine Overheads |

14 |

9 |

| Tailings Sustaining |

5 |

3 |

| Total |

51 |

33 |

Trident Mineral Resources

Table 4:

Trident Mineral Resource Estimate (includes Trident Underground MRE previously reported)

| Deposit |

Measured |

Indicated |

Inferred |

Total |

||||||||

| Tonnes |

Grade |

Gold (koz) |

Tonnes |

Grade |

Gold (koz) |

Tonnes |

Grade |

Gold (koz) |

Tonnes |

Grade |

Gold (koz) |

|

| Open Pit |

- |

- |

- |

0.4 |

1.6 |

16 |

- |

- |

- |

0.4 |

1.6 |

16 |

| Underground2 |

- |

- |

- |

1.6 |

5.0 |

257 |

2.6 |

3.0 |

251 |

4.2 |

3.7 |

508 |

| Total |

- |

- |

- |

2.0 |

4.2 |

273 |

2.6 |

3.0 |

251 |

4.6 |

3.5 |

524 |

| |

|

| Notes: |

|

| 1. |

Mineral Resource reported within Shape Optimiser (SO) shapes at 1.5g/t Au cut-off. |

| 2. |

Mineral Resources reported above 0.5 g/t Au within an open pit optimisation shell. Pit optimisation inputs include: |

| 3. |

Numbers may not add up due to rounding |

The Trident deposit sits approximately 25km to the north-east of the Plutonic Gold Mine.

The estimation approach for the open pit Trident MRE reported here was primarily based on domains defined by geological, structural and mineralisation characteristics.

This differs from the previous MRE approach where the continuity and volume of estimation domains were largely subjected to pseudo economic and mining criteria at an elevated cut-off grade.

The Catalyst estimation approach has allowed the full grade-tonnage distribution of the mineralised domains, including additional lower grade material, to be incorporated into the MRE.

The Trident MRE has been undertaken with a focus on delineating areas of the MRE with Reasonable Prospects for Eventual Economic Extraction (RPEEE).

An underground Shape Optimiser (SO) evaluation has been applied to ensure that only cohesive groups of blocks that satisfy RPEEE are included in the MRE.

| ______________________________ |

| 2 Refer to Catalyst Metals' |

Trident Ore Reserves

Table 5:

Trident Ore Reserve Estimate

| Deposit |

Proved |

Probable |

Total |

||||||

| Tonnes |

Grade |

Gold (koz) |

Tonnes |

Grade |

Gold (koz) |

Tonnes |

Grade |

Gold (koz) |

|

| Open Pit |

- |

- |

- |

0.1 |

1.4 |

6 |

0.1 |

1.4 |

6 |

| Underground |

- |

- |

- |

1.2 |

4.7 |

182 |

1.2 |

4.7 |

182 |

| Total |

- |

- |

- |

1.3 |

4.5 |

188 |

1.3 |

4.5 |

188 |

| Notes: |

|

| 1. |

Underground Ore Reserves are estimated at a 2.0 g/t Au cut-off (modified and diluted grade); |

| 2. |

Underground stope optimisation assumptions take into account operating mining, processing/haulage and G&A costs, excluding capital. |

| 3. |

Underground stope optimisations apply a 3.0m minimum mining width with 1.5m of total dilution in flat lying <40 degree dipping areas, and 1.0 m of dilution in steeper >40 degree dipping areas. |

| 4. |

Open pit Ore Reserves have a cut-off grade ranging from 0.6 - 0.7 g/t (modified and diluted grade), with dilution of 17% - 21% and mining recovery of 93%. |

| 5. |

The Ore Reserves are estimated using a Metallurgical Recovery = 83.5%; Royalties = 2.5%; Gold Price = AUD$2,700/oz. |

| 6. |

The open pit Ore Reserve does not qualify as a standalone Ore Reserve, and are reported as part of the total Trident Ore Reserve required for access to the underground. |

| 7. |

Numbers may not add up due to rounding. |

An Ore Reserve Estimation is the economically

mineable part of a Measured and/or Indicated Mineral Resource. It includes

diluting materials and allowances for losses, which may occur when the material is mined or extracted.

The declaration of Trident Ore Reserve Estimation is based on the Company's internal studies which demonstrate economic viability of the orebody. The Ore Reserves classification reflects the Competent Person's view of the deposit. Only Probable Ore Reserves have been declared and are based on Indicated Mineral Resources following consideration of modifying factors.

Additional information relating to the Reserve is provided in this announcement in accordance with ASX Listing Rule 5.9.1 (Section 13) and Section 4 JORC Code Table 1 which are both contained in this announcement.

1.

Mining

The Trident Mine Plan is based on extracting an initial small open pit (exploiting the near surface projection of Trident ore system) with subsequent portal and decline development into the Trident Underground Mine. There has been no historical mining of this ore system.

Surface mining is scheduled over a period of seven months (817k BCM in total movement) with the underground scheduled thereafter for 58 months (total Project life of 65 months). Only Indicated Mineral Resource is extracted within the open pit (Ore Reserve of 6.4koz) with the underground Production Target LOM containing 15% Inferred Mineral Resources (Ore Reserve of 182koz and Production Target LOM of 212koz). See Table 6 for full details.

Table 6: Trident Production Target LOM and Ore Reserve Summary

| Deposit |

Ore Reserve |

Production Target Life of Mine (LOM) |

||||

| Tonnes (Mt) |

Grade (g/t Au) |

Ounces (koz) |

Tonnes (Mt) |

Grade (g/t |

Ounces (koz) |

|

| Open Pit |

0.1 |

1.4 |

6 |

0.1 |

1.4 |

6 |

| Underground |

1.2 |

4.7 |

182 |

1.5 |

4.3 |

212 |

| Total |

1.3 |

4.5 |

188 |

1.6 |

4.2 |

218 |

| Note: Production Target is inclusive of Ore Reserve |

The Trident Operation will use shared infrastructure with the Plutonic Operation located ~25

km to the south-west. Shared infrastructure includes the Plutonic processing facility, administration, travel and accommodation services.

Entech Pty Ltd (Entech) were engaged by Catalyst Metals to undertake the design, scheduling, and costing of the underground mine and associated surface infrastructure. Mine Fill Pty Ltd (Mine Fill) were engaged to provide testwork, technical recommendations, and cost profiles for the proposed paste filling operation. Catalyst Metals completed the design, schedule, and costing associated with the open pit, with auditing completed by Entech.

Conventional mining methods and equipment specifications were forecasted for both the open pit and underground operations.

Trident West Open Pit Mining

Typical Western Australian 120

t digger and 60

t articulated trucking fleet parameters were used for the surface mining operation – including mining widths and ramp specifications. Typical open pit grade control and drill and blast activities were incorporated into the schedule. The schedule has assumed a percentage of oxide material would require blasting activities, as well as the lower horizons of the transitional / fresh interface having smooth wall blasting.

Dilution and ore loss parameters were applied on the basis of using three representative bench dig blocks and cross referencing this against in situ inventories. The subsequent mining modifying factors were then applied across the entire pit.

Geotechnical aspects were integrated into the mine plan, honouring the recommendations made by Peter O'Bryan and Associates Pty Ltd. Parameters were primarily based on a 2019 test work campaign as well as reference to historical open pit excavations within the region (Marwest and Mareast). The 2019 campaign involved drilling, logging, and testing from four dedicated geotechnical PQ3 holes within the walls of the proposed open pit. The waste rock landform has been designed outside of the 'Zone of Instability' plane per Department of Energy, Mines, Industry Regulation and Safety (DEMIRS) Guidelines, with a final rehabilitated slope angle of 17-19 degrees.

Due to the short-term nature of the open pit (with mining forecasted in 2025) a higher gold price of A$3,200 was used in the optimisation and subsequent mine plan / schedule. Full details on the inputs are displayed in Table 7.

Table 7: Economic Inputs – Trident West Open Pit

| Parameter / Input |

Value |

Comment |

| Gold price |

A$3,200/oz |

Equivalent to $ 102.9/gram |

| Private royalties |

N/A |

|

| WA State Royalty |

2.5 % NSR |

|

| Metallurgical recovery |

93% ox / 93% tr / |

Based on oxide state |

| Surface haulage |

$10.8/ore t |

Varied based on moisture content and haulage distance |

| Grade control |

$5.0/ore t |

Based on existing drilling density |

| Processing |

$19.88/ore t |

Oxide state varied |

| Direct Open Pit Mining |

$14.5/bcm |

Average cost for L&H, D&B and |

| Technical Services |

$6.4/ore t |

Mining Engineering, Survey and |

| Mobilisation / Demobilisation |

$494k / $130k |

Contractor |

Trident Underground Mining

The underground mine design, schedule and costings are representative of a typical Western Australian underground mine. Mining has been scheduled in various blocks to ensure multiple work fronts, with each block using a combination of top-down or bottom-up.

Production rates, fleet requirements, manning levels, and mining costs are built from a combination of inputs from first principles calculations, industry experience, and the existing Plutonic operation.

Mining operations were assumed to be owner-operator by Catalyst.

Dedicated geological, hydrology, backfill and geotechnical studies have been completed and form key input parameters for the mine design, schedule and costings.

The Trident orebody has two distinct geometrical aspects: a sub-horizontal orientation which dips between 20° and 30° and a sub-vertical orientation which dips at more than 60°. Resultantly sub level intervals of 10 and 15m vertically were chosen to accommodate the orebody characteristics and geotechnical recommendations.

The geotechnical work completed by Peter O'Bryan & Associates found that a stope hydraulic radius (HR) of 3.0

–

3.5 was recommended at Trident, given the anticipated ground conditions. The selected strike length of 10

m with sublevel spacing between 10

m and 15

m results in an HR range of ~3.0

–

3.5. This also accounts for the orebody dip and resulting hanging-wall span.

The below table displays mining factors associated with the two sub level inputs.

Table 8: MSO parameters

| Stoping Parameter |

10m level |

15m level |

| Stoping cut-off grade (g/t Au) |

2.0 |

2.0 |

| Minimum mining width (m) |

3.0 |

3.0 |

| Vertical level interval (m) |

10 |

15 |

| Section length (m) |

2.5 |

2.5 |

| |

|

|

| Minimum FW dip angle (°) |

40 |

40 |

An integrated

LOM design was prepared using Deswik mine planning software. To ensure overall mine production rates are achievable, activities associated with the mining works were scheduled in a logical sequence.

Longhole stoping with paste fill was selected as the preferred mining method at Trident.

This is a well-understood mechanised mining method used in mining operations globally.

It is proposed that longhole stoping with paste fill will use longitudinal extraction with multiple stopes taken in panels along strike. The proposed mining sequence will be a combination of bottom-up and top-down extraction.

The use of paste fill as a backfill method will allow more selectivity in extraction, higher extraction ratio which can be regulated with the paste fill cement content, as well as flexibility in extraction sequence, allowing multiple mining fronts to achieve higher production rates.

Table 9: Economic Inputs – Trident Underground

| Parameter / Input |

Value |

Comment |

| Gold price |

A$2,700/oz |

Equivalent to $86/gram |

| Private royalties |

N/A |

|

| WA State Royalty |

2.5 % NSR |

|

| Metallurgical recovery |

83.5% fresh |

|

| Surface haulage |

$9.8/ore t |

|

| Grade control |

$8.1 ore t |

Based on infilling to a 7.5m density |

| Processing |

$18.9/ ore t plus $3.5/ ore t |

Processing plus tailings dam replacement |

| G&A |

$1.39M / an |

|

| Paste Fill |

$88.0+10.3/m3 of paste |

Onsite dry tailings plant plus dry tailings reclaim costs |

| Direct Operating |

$152 / ore t |

Operating costs for underground mining (excluding paste fill) |

Modifying factors were applied to the

stope shapes during the optimisation process.

Table 10: Modifying Factors

| Parameter |

Dilution (%) |

Recovery (%) |

| Development ore headings |

No additional unplanned dilution above |

100 |

| <40° dipping stopes |

|

92.5 |

| >40° dipping stopes |

|

95 |

The dilution allowance at Trident is for unplanned dilution of the

stope shape, in addition to dilution from mining against paste fill. The schedule makes allowance for a 5% dilution factor for the vertical and horizontal exposures formed when mining against paste fill. This is additional to the dilution factored during the optimisation process.

During the optimisation process, dilution of 1.0

m of hanging-wall and 0.5

m of footwall was applied in the flatter-dipping 10

m sublevel stopes.

For the 15

m sublevel stopes, 0.5

m of dilution was allowed for on both hanging-wall and footwall.

Recovery allowances of 92.5% and 95% were applied to stopes in flat-dipping (orebody<40°) and steep-dipping (>40°) stoping areas, respectively.

These recovery factors allow for bogging losses, and in shallower-dipping stopes it is accepted that there will be minor additional ore loss.

Assumptions for mine equipment requirements have been derived from industry experience, benchmark rates, and first principles calculations. Table 11 provides a summary of the peak number of units required for mine development and production.

This represents the equipment necessary to perform the following duties:

-

Excavate the lateral and decline development in both ore and waste;

Install all ground support, including rockbolting and surface support;

Maintain the underground road surfaces;

Drill, charge and bog (including remote bogging) all stoping ore material;

Backfill material;

Drill slot rises for production stoping;

Install all underground services for development and production.

Table 11

| Equipment |

Maximum quantity |

| Sandvik DD422i Twin-boom jumbo |

2 |

| Sandvik LH517 Loader |

2 |

| Sandvik TH663i Truck |

2 |

| Sandvik DL432i Drill |

1 |

| Charmec MC605 Charge Up |

1 |

| Normet MF50VC Fibrecrete Sprayer |

1 |

| Normet LF700 Agitator Truck |

1 |

| Sandvik 34R Raisebore |

1 |

| Cat 12H Grader |

1 |

| Volvo VL120 UG IT |

1 |

| Volvo VL90 Workshop IT |

1 |

| Cat D4 Dozer |

1 |

| Cat 740 Watercart |

1 |

| Toyota Landcruiser Light Vehicle |

8 |

An integrated

LOM design was prepared using Deswik mine planning software. The software incorporates functionality to export all design and block model interrogation data, including volumes, tonnes, grades, and segment lengths, to the scheduler. Graphical sequencing is exported for the critical links between all development and production activities.

The mine is planned to produce at a peak rate of ~420,000

tpa, with an average peak stoping rate of ~40,000

t/month. The mine life is approximately five years, with peak production reached in the third year of production.

To ensure overall mine production rates are achievable, activities associated with the mining works were scheduled in a logical sequence.

The following major constraints on the underground scheduling are noted:

-

Ensure a smooth ramp-up to steady ore production;

Minimise variations in development rates and production to avoid additional project costs due to under-utilisation of equipment;

Establish capital development at an appropriate interval ahead of production activities to defer capital spend;

Commence stope production only once the main return airway and secondary egress is established.

2.

Metallurgy and Processing

Extensive metallurgical test work of the Project has been undertaken historically by previous owners.

This test work focused on gravity and cyanidation recovery.

Test work has been conducted on RC and diamond drilled fresh ore composites, and transitional and oxide composites.

Catalyst engaged Independent Metallurgical Operations (IMO) and its partner Metallurgy Pty Ltd (Metlab) to conduct a DFS-level testwork study designed by IMO and Extreme Metallurgy on presented diamond core samples. The aim of the program was to define the performance of the Trident Underground ore through the established Plutonic 1.8

Mtpa gravity/CIL plant.

Table 12: Sample Compositing Overview

| Met Sample ID |

Hole ID |

Selected Intervals (m) |

Interval |

Type/Origin |

Total Comp |

Test work |

| 23TRI MET001 |

TRD0037 |

145-146, 154-155, |

4 |

Half core |

20.3 |

BBWi only |

| TRD0038 |

136-137, 138-140, |

4 |

||||

| 23TRI MET002 |

TRD0047 |

132-133, 134-135, |

7 |

Half core |

16.71 |

|

| 23TRI MET003 |

TRD0050 |

180-181, 187-189, |

7 |

Half core |

16.45 |

|

| 23TRI MET004 |

TRD0046 |

138-152 |

14 |

Half core in |

35.35 |

BRWi only |

| 23TRI MET006 |

TRD0042 |

189-199 |

10 |

Coarse crush |

18.6 |

Head Assay, |

| 23TRI MET007 |

TRD0047 |

148-157 |

9 |

Half Core |

23.23 |

|

| 23TRI MET008 |

TRD0048 |

148-162 |

14 |

34.82 |

||

| 23TRI MET009 |

TRD0041 |

169-187 |

18 |

41.55 |

Bond Ball Work Index (BBWi) test work was conducted on MET001, 002 and 003 composites at a closed screen size of 106μm (Table 16).

The resulting BBWi's ranged from 11.65 to 13.34

kWhr/t indicating the ore is relatively soft and in line with the 2019 ALS program (Table 13). A single Bond Rod Work index (BRWi) test was conducted on MET004 returning a significantly higher value than the previous BBWi's implying an upfront SAG mill with scats crushing functionality will benefit overall comminution.

Below table 13 displays the gravity and cyanidation recovery testwork results.

Table 13: Gravity/Leach Test work Summary

| Composite |

Units |

TRI MET006 |

TRI MET007 |

TRI MET008 |

TRI MET009 |

||||

| Leach Test |

# |

LT01 |

LT02 |

LT03 |

LT04 |

LT05 |

LT06 |

LT07 |

LT08 |

| P80 Grind Size |

μm |

106 |

75 |

106 |

75 |

106 |

75 |

106 |

75 |

| Assayed Head Grade |

g/t |

4.25 |

4.25 |

2.91 |

2.91 |

12.12 |

12.11 |

2.44 |

2.45 |

| Calculated Head Grade |

g/t |

4.10 |

3.95 |

2.86 |

2.90 |

11.11 |

11.34 |

2.35 |

2.25 |

| Gravity Recovery |

% |

4.7 |

4.8 |

1.8 |

1.8 |

4.0 |

3.9 |

3.3 |

3.4 |

| 24hr Au Ext'n |

% |

80.5 |

84.5 |

74.7 |

74.7 |

81.4 |

79.7 |

78.4 |

85.2 |

| 48hr Au Ext'n |

% |

84.7 |

85.4 |

77.5 |

80.8 |

86.4 |

86.9 |

84.3 |

86.1 |

| Residue Grade |

g/t |

0.63 |

0.58 |

0.64 |

0.56 |

1.51 |

1.48 |

0.37 |

0.31 |

| Cyanide Consumption |

kg/t |

0.25 |

0.25 |

0.15 |

0.19 |

0.09 |

0.13 |

0.20 |

0.25 |

| Lime Consumption |

kg/t |

0.80 |

0.90 |

0.64 |

0.92 |

1.05 |

1.02 |

1.06 |

1.06 |

All composites displayed similar gravity and leach characteristics with only marginal improvement through a finer grind (P80 106 to 75μm). Composites with a lower bismuth content displayed the highest grind sensitivity.

Gravity recoveries were very low as was predicted through early mineralogical studies where visible gold was 1 to 2μm in size.

This will negate the need for a gravity circuit if treated solely.

Approximately 90% of the leachable component entered solution within the first 4 hours in most tests irrespective of grind size.

The dissolution curves did not plateau with leaching evident between 24 and 48hrs at conditions reflective of a typical CIL plant.

Historical test work was conducted at elevated cyanide concentrations (1000 – 2000

ppm CN) therefore likely inflated realistic recoveries.

The higher cyanide concentrations resulted in enhanced dissolution of gold from the bismuth and telluride sulphide minerals which was not the case at DFS leach conditions.

Lime and cyanide consumption rates were both very low when compared to Western Australian peers due to the excellent site water quality.

For DFS tests the free cyanide concentration after 48 hours still exceeded 300

ppm indicating that a lower initial cyanide concentration is possible for free milling ores.

The test work indicated that implementing an average 83.5% metallurgical recovery is both prudent and auditable. The recovery is reflective of the current Plutonic processing plant's capacity, grind sizing of 75

μm, as well as a Trident blend average percentage of 18%, however, further test work and optimisation of the processing plant could result in higher recoveries

Concentrations of silver and other deleterious elements have been noted as low across different ore types including fresh, transitional and weathered ore.

3.

Site Infrastructure

The surface infrastructure at Trident will be established close to the mining footprint. The accommodation village, airstrip and processing facilities are being shared with the existing Plutonic operation. Trident is located approximately 25km to the north-east of Plutonic.

The infrastructure requirements are based on input from Catalyst, Entech and other third-party consultants. Catalyst has generated the site layout in consultation with their operations team, considering effective implementation of the mine plan and safety or regulatory requirements.

Infrastructure specifications and costs have been sourced from vendor quotations based on the mine plan requirements.

Surface ore haulage at Trident consists of ore being transported from a nearby temporary ROM stockpile to the ROM stockpile at the Plutonic processing facility.

On the back haul, road trains will travel to the Rainbow Trout open pit and load with dry tailings which is transported to Trident's dry tailings storage for feed to the paste fill plant.

All road networks are existing, and cost allowance has been made for refurbishment and ongoing maintenance which are not anticipated to be significant works.

Allowance for diesel storage and dispensing facilities for mining activities has been included in the surface layout and cost estimate. The cost estimate also includes separate diesel storage facilities for power generation.

Mine water will be supplied from the Mareast open pit, which is located 2.3km east of the Trident portal. A pontoon-style pump will be installed in the pit lake, and to ensure that solids content is minimised, the pump will be located away from the discharge pipeline feeding the void. Mine water will be temporarily stored in a series of 50kL tanks which will then feed the underground mine.

Potable water supplies will be available from the Plutonic main administration and processing site. A regular water tank service will be scheduled to ensure sufficient supply.

The Trident paste facility will be located on the surface, above the surface expression of the deposit. Dry tailings will be carted to the facility for subsequent conditioning and use, with water supplied from the neighbouring Mareast open pit. The main underground power station, located adjacent to the paste plant, will provide power requirements.

A single surface magazine compound will be constructed for the Trident underground mine which will consist of a cleared area and fence. A surface magazine is available for use and is being relocated to Trident from the Plutonic operations.

All waste rock generated during underground mining is assumed to be trucked to surface for disposal on the waste dump. The Trident waste dump is an extension to the existing waste dump that was in place for the excavation of prior open pits.

4.

Environmental, Social Impact and Permitting

The Trident deposit is located in a previously mined area and Catalyst's proposed development footprint has been designed within existing disturbance envelopes to the extent possible.

All required baseline studies have been completed for the Trident Project and permitting and approvals are underway.

Western Australian legislation imposes limits and obligations on proponents without any approval requirements. This legislation includes:

-

Biodiversity Conservation Act 2016;

Contaminated Sites Act 2003;

Environmental Protection (Noise) Regulations 1997;

Environmental Protection (Controlled Waste) Regulations 2004;

Environmental Protection (Unauthorised Discharge) Regulations 2004;

Environmental Protection (NEPM-NPI) Regulations 1998;

Mine Rehabilitation Fund Act 2012.

The project has been designed to comply with environment regulations. A site compliance register that includes all statutory and reporting obligations will be developed as the project progresses to operations.

5.

Trident Operating and Capital Cost Estimate

Catalyst plans to mine the Trident deposit on an owner-operator basis. Given the similarities in operational framework between the existing Plutonic operations and Trident, Plutonic's historical mining costs have been used as an input to the mining cost estimate.

The Trident deposit's proximity to Plutonic allows many synergies, including existing infrastructure, an existing employee pool, and systems and structures in place to run an underground mining operation.

Costs related to mining activities such as the use of shotcrete and paste fill planned for Trident but not used at Plutonic, were estimated from vendor quotations. The capital infrastructure costs and operating costs not taken from the Plutonic cost base were estimated using recently obtained vendor quotations.

Table 14:

Trident Underground Infrastructure capital costs

| Description |

Value ($ million) |

| Mobilisation, Establishment, Power Generation |

8.8 |

| Raisebore Shaft Sinking |

0.1 |

| Primary Fan |

0.8 |

| Primary and Secondary Pumping |

0.6 |

| Substations |

0.8 |

| Safety Plant and Equipment |

0.4 |

| Survey Equipment |

0.3 |

| Paste Plant and Underground Reticulation |

3.9 |

| Total |

15.7 |

Table 15:

Trident Underground Sustaining capital costs

| Description |

Value ($ million) |

| Infrastructure |

16.5 |

| Decline |

10.9 |

| Cap Access |

1.8 |

| Ventilation |

1.5 |

| Escapeway |

0.2 |

| Other |

1.0 |

| Fleet |

3.5 |

| Operators |

8.0 |

| Capital Mine Services |

2.5 |

| Capital Mine Overheads |

1.8 |

| Total |

47.6 |

Table 16:

Trident Underground operating costs

| Description |

Value ($/t ore) |

| Ore Drive |

25.1 |

| Stope |

44.7 |

| Operators |

38.0 |

| Operating Mine Services |

12.1 |

| Operating Mine Overheads |

10.6 |

| Surface Haulage |

9.8 |

| Grade Control |

8.1 |

| Total Operating |

148.4 |

6.

Financial Evaluation

Mining cost estimates were developed by Entech and Catalyst using recent actual operating costs from the Plutonic Gold operations.

The rates were assembled as a fully variable schedule of rates, which were applied to mining physicals. A gold price of $2,700/oz for the underground and $3,200/oz for the open pit form the basis of the Base Case.

The Ore Reserve has been assessed across a reasonable sensitivity range and remains financially viable.

Financial viability is not reliant on any Inferred Mineral Resource.

Catalyst Spot Case adopts a $A3,400/oz gold price.

Management considers this a reasonable assumption which is lower than the spot price at the time of this announcement.

Table 17: Key metrics for Trident development

| |

|

Base case |

Spot case (A$3,400/oz) |

| NPV7 (Pre-tax) |

A$m |

100 |

198 |

| IRR (Pre-tax) |

% |

146 |

327 |

| Pre-production capital |

A$m |

19 |

15 |

| AISC (life of mine) |

A$/oz |

1,578 |

1,592 |

| Life of mine (LOM) |

yrs |

5.5 |

5.5 |

| Payback period |

yrs |

1.9 |

1.4 |

| Inferred Resource in LOM |

% |

15 |

15 |

| Inferred Resource in payback period |

% |

10 |

12 |

| Average annual production |

koz |

37 |

37 |

| Average annual free cash flow |

A$m |

29 |

53 |

| |

| # Base case price assumptions aligned with Ore Reserve. |

| Financial figures shown pre-tax due to Trident being only one satellite deposit within Catalyst's broader portfolio. |

The production profile underpinning the production target is supported by 85% of probable Ore Reserves and 15% of inferred material.

There is a low level of geological confidence associated with inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of indicated Mineral Resources or that the production target itself will be realised.

7.

Additional studies, timeline to development and future work plans

The approval process for Trident Underground is well underway, with the remaining permits expected to be granted in the second half of CY24. The company has progressed with approval studies and surveys for the open pit, with the expectation that submissions to the relevant Government departments will be undertaken in the third quarter of CY24.

The company will look to issue a tender process to suitable open pit contractors in the second half of CY24, with scheduled execution in the first half of CY25.

Pre-emptive dewatering activities are scheduled to commence in the fourth quarter of CY24, ensuring groundwater levels are reduced in the localised area for subsequent open pit and underground operations.

Additional work will be undertaken in respect of underground planning as Catalyst moves toward execution.

This will include additional optimisation of the mine plan to target higher grade areas of the mine earlier in its life, geotechnical studies and further studies to refine Catalyst's approach to the paste fill option.

8.

Funding

The Trident development has a maximum drawdown of $15m (at a A$3,400/oz gold price).

The Company considers that there is a reasonable basis to assume that future funding will be achievable based on the following:

-

The Project has demonstrated strong technical and economic fundamentals;

The Project generates robust cashflows at both current, and lower, gold prices;

The company is currently generating positive cashflows from existing operations; and

The Company and its Directors have a strong record of raising capital, both in debt and equity markets.

There is no certainty that Catalyst will be able to source funding when required and it is possible that such funding may be dilutive or otherwise affect the company's shares.

This announcement has been approved for release by the Board of Directors of Catalyst Metals Limited.

Competent person's statement

The information in the report to which this Mineral Resource Statement is attached that relates to the estimation and reporting of gold Mineral Resources at the Trident West Open Pit deposit is based on information compiled by Mr Andrew Finch, BSc, a Competent Person who is a current Member of Australian Institute of Geoscientists (MAIG 3827). Mr Finch, Geology Manager, at Catalyst Metals Ltd has sufficient experience relevant to the style of mineralisation and deposit type under consideration and to the activities being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Finch consents to the inclusion in the report of matters based on his information in the form and context in which it appears.

The information in this report that relates to Ore Reserves is based on and fairly represents information and supporting documentation compiled by Ross Moger BASc (Mining Engineering), a Competent Person who is a Member of the Australasian Institute of Mining and Metallurgy. Ross Moger is a full-time employee of Entech Pty Ltd. Ross Moger has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC 2012).

Ross Moger consents to the inclusion in the report of the matters based on his information in the form and context in which they are presented.

This Ore Reserve estimate has been compiled in accordance with the guidelines defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC 2012).

JORC 2012 Mineral Resources and Reserves

Catalyst confirms that it is not aware of any new information or data that materially affects the information included in the original market announcements and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcements continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Persons findings are presented have not been materially modified from the original market announcements.

| Section 1 Key Classification Criteria |

|

| Trident Deposit |

|

| (Criteria listed in the preceding section also apply to this section.) |

|

| |

|

| Criteria |

Commentary |

| Sampling techniques |

. . . . |

| Drilling techniques |

. . |

| Drill sample recovery |

. . . |

| Logging |

. . .

. o o |

| Sub-sampling techniques and sample preparation |

. . . . . . . . o o o o |

| Quality of assay data and laboratory tests |

. . . . . o o o o |

| Verification of sampling and assaying |

. . . . . |

| Location of data points |

. . . |

| Data spacing and distribution |

. . |

| Orientation of data in relation to geological structure |

. . |

| Sample security |

. . |

| Audits or reviews |

. . |

| Section 2 Reporting of Exploration Results |

|

| Trident Deposit |

|

| (Criteria listed in the preceding section also apply to this section.) |

|

| |

|

| Criteria |

Commentary |

| Mineral tenement and land tenure status |

. . . . . |

| Exploration done by other parties |

. . . . . |

| Geology |

. |

| Drill hole Information |

Catalyst drilling . . . . Vango Drilling . . . . Historical Drilling . . . |

| Data aggregation methods |

. |

| Relationship between mineralisation widths and intercept lengths |

. |

| Diagrams |

. |

| Balanced reporting |

. |

| Other substantive exploration data |

. |

| Further work |

. |

| Section 3 Estimation and Reporting of Mineral Resources |

|

| Trident Deposit |

|

| (Criteria listed in section 1, and where relevant in section 2, also apply to this section.) |

|

| |

|

| Criteria |

Commentary |

| Database integrity |

. . . . . o o o . . . |

| Site visits |

. |

| Geological interpretation |

. . . . . . . . . |

| Dimensions |

. |

| Estimation and modelling techniques |

. . Domain 1001 . . . . . . . . . . . . . . HG = 20 g/t Au MG = 4 g/t Au LG = 0.5 g/t Au . . . . . . . . . . Domain 1002 and 1003 . . . . . . . . . . . . . . |

| Moisture |

. |

| Cut-off parameters |

. . Wall Angles = Oxide 39°, Transitional 45°, Fresh 52° Mining Cost (AUD$) = $5.5/t ore Processing and Surface Haulage Costs (AUD$) = Oxide $48/t, Transitional $49/t, Fresh $51.4/t Site Administration Cost = Included in mining and processing cost Metallurgical Recovery = 95% Royalties = 2.5% . |

| Mining factors or assumptions |

. . |

| Metallurgical factors or assumptions |

. . |

| Environmental factors or assumptions |

. . |

| Bulk density |

. . . . |

| Classification |

. . . . . |

| Audits or reviews |

. . |

| Discussion of relative accuracy/ confidence |

. . |

| Section 4 Estimation and Reporting of Ore Reserves |

|

| Trident Reserve |

|

| (Criteria listed in section 1, and where relevant in sections 2 and 3, also apply to this section.) |

|

| |

|

| Criteria |

Commentary |

| Mineral Resource estimate for conversion to Ore Reserves |

. . |

| Site visits |

The Competent person has been to both the Trident and Plutonic mine sites in December 2022. |

| Study status |

Underground . . Open Pit . . . |

| Cut-off parameters |

. Underground . Open Pit . |

| Mining factors or assumptions |

Underground . . . . . . . . Open Pit . . . . . |

| Metallurgical factors or assumptions |

. . . Underground . . . Open Pit . . |

| Environmental |

. . . |

| Infrastructure |

. . . . |

| Costs |

Underground . . . Open Pit . . . . . |

| Revenue factors |

. . |

| Market assessment |

. . |

| Economic |

. . . |

| Social |

. . |

| Other |

. . |

| Classification |

. . |

| Audits or reviews |

. |

| Discussion of relative accuracy/ confidence |

. |

Catalyst Metals

Catalyst Metals produces +110koz of gold annually.

It controls three highly prospective gold belts and has a multi asset strategy.

It owns the 40km long Plutonic Gold Belt in Western Australia hosting the Plutonic gold mine and neighbouring underexplored, high-grade resources.

It also owns and operates the high-grade Henty Gold Mine in Tasmania which lies within the 25km Henty gold belt. Production to date is 1.4Moz @ 8.9 g/t.

Catalyst also controls +75km of strike length immediately north of the +22Moz Bendigo goldfield and home to high-grade, greenfield resources of 26 g/t Au, at Four Eagles.

Capital Structure

Shares o/s: 224.6m

Options: 3.4m

Rights: 5.9m

Cash: $22m

Debt: 2,220oz (via gold loan)

Board Members

David Jones AM

Non-Executive Chairman

James Champion de Crespigny

Managing Director & CEO

Robin Scrimgeour

Non-Executive Director

Bruce Kay

Non-Executive Director

Corporate Details

ASX: CYLE:[email protected]

SOURCE Catalyst Metals LTD.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment