The Missing Piece In US Chip Policy

The head of the semiconductor industry association of that country, along with several government officials, expressed criticism on a few aspects of the plan during a closed-door session.

However, one point of criticism was particularly emphatic: The Chinese are seeking to dominate the market for less advanced chips, mature nodes (25nm and above), and the CHIPS Act does not address that. The stated goal of the policy is chip supply chain independence for the United States.

The Chinese will dominate 50% of the less advanced chip market by 2030 and by this fact alone, the United States will lose out on the supply chain control that it is aiming for.

While the CHIPS Act is not a bad initiative - in fact, it's an excellent start - it is insufficient if the goal is to control our own chip manufacturing. We are funding companies that are investing heavily in profitable chips, yet our vulnerability concerning lower-tech, yet equally critical chips, persists.

These chips are fundamental components of critical everyday objects including medical instruments, cars, planes, and most importantly, military hardware.

The Chinese are taking the same economic strategy that they have repeatedly, but with a greater ferocity and a little more of a deliberate geopolitical angle than they usually do, that is, find a weak point in an industry, dominate the low-end, and then move up.

Their foundries, namely SMIC, the Chinese TSMC rival, are manufacturing the low-tech chips, before taking aim at more advanced nodes. The only difference here is that China sees semiconductors as a strategic good.

They have explicitly stated that besides the all-important domestic self-sufficiency, having a strategic chokehold on these low-end chips provides an edge for them in economic warfare with the US.

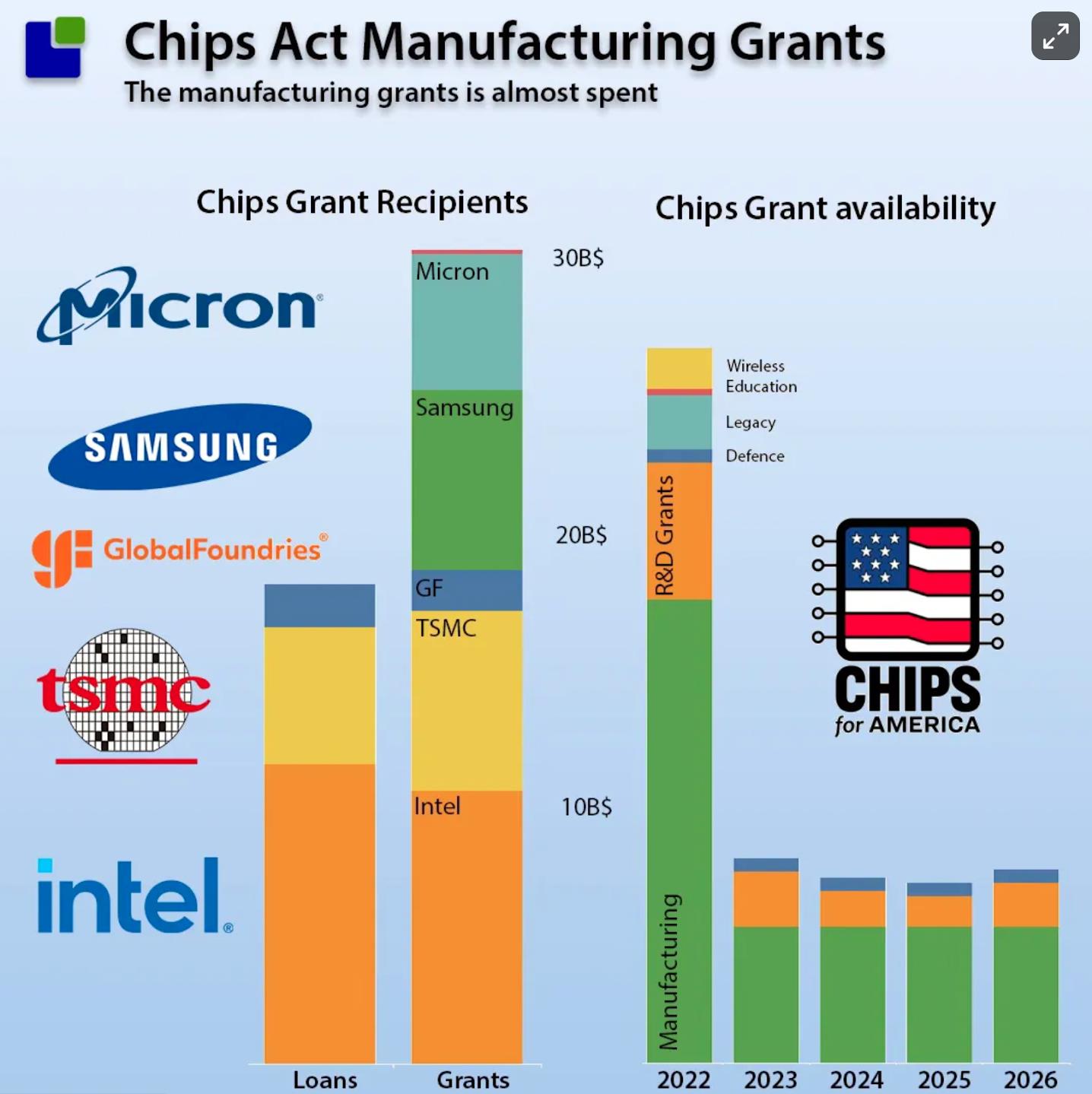

The US did earmark money for this but it has proven to be insufficient. CHIPS Act grant recipients do not have the right incentives and the government has not effectively provided them. Meanwhile, the Chinese are moving full steam ahead with their plan.

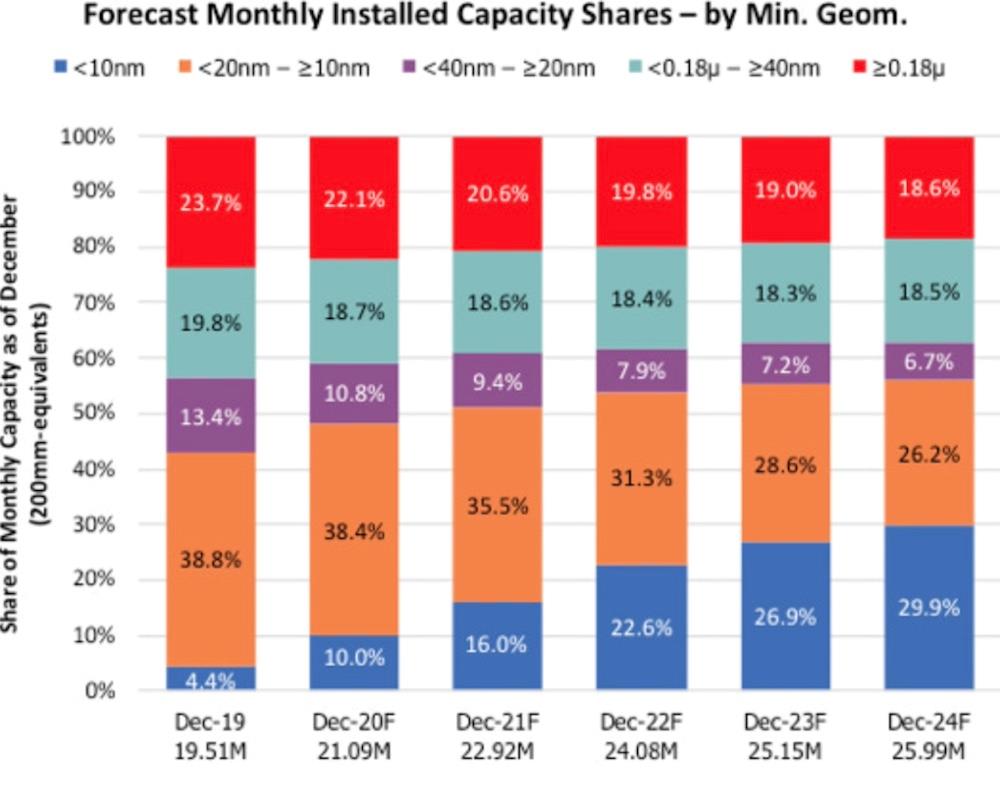

Source: TrendForce Market Research, 2023

The loss of control over higher node chips will not only compromise our consumer goods supply chain but pose a far more severe threat to our military supply chain. We already suffer from insufficient control over chip provenance within military applications, and the situation is worsening.

A military Humvee, for example, requires thousands of chips, from GPS to sensors to CPUs. The most advanced processor in a military device might use 14nm technology-equivalent to what an iPhone used in 2015-with most being far less sophisticated.

Losing control over our supply chain for these less advanced chips means losing control over our capability to produce essential military hardware.

We have neither a defensive nor offensive strategy. And we need both. Our defensive strategy should revolve around forcing companies that receive government grants for manufacturing to allocate to more mature nodes, even if it is unprofitable.

From an offensive perspective, we need a tighter sanctions and tariff regime, slowing down the Chinese as much as possible.

Technical and business contextThe semiconductor industry is as American as apple pie. We started it. We continue to have a dominant position in it in many many ways. Most of the important companies in the sector are American.

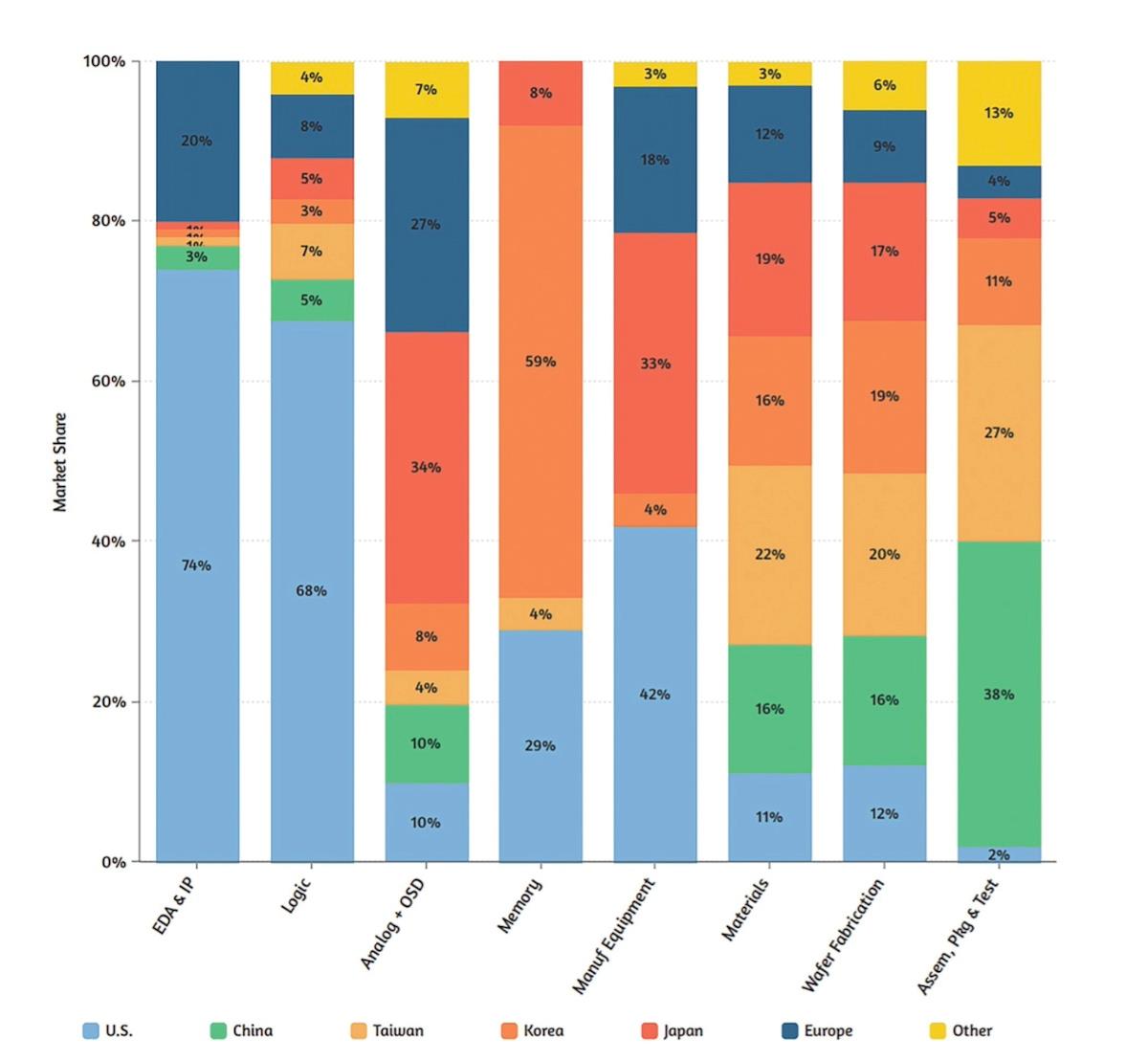

And we do still have a wildly dominant position in a few critical parts of it, which are not going away anytime soon. In terms of market share of chips, we design most of the world's chips, about 70% of them.

And we control the major tools and associated technologies, both physical tools (with the exception of ASML) and digital tools, like Cadence and Synopsys.

Source: Understanding Semiconductors: A Technical Guide for Non-Technical People, Richard, Corey, 2022

UK's 7th-gen fighter is the future of airpower

Fico shooter: not a lone wolf after all?

2 words explain China export 'surge': Global South

Only in chip manufacturing has our position slid. Outsourcing fabrication to foundries was an industry-wide decision. While a“fab” refers to any semiconductor manufacturing facility, a“foundry” specifically operates as a contract manufacturer available to all for chip production.

There are US fabs in the mix still, but we have primarily outsourced to foundries overseas like TSMC and UMC, both Taiwanese. Most of our foundries only produce chips for the company that owns them.

Fabrication capability is a critical part of having an independent semiconductor supply chain, which, especially with Taiwan's increasingly precarious position, we now desperately need.

For more on this, Chris Miller, in

“Chip Wars”, has written a detailed historical narrative about how American semiconductor companies moved from owning their own fabs to being fabless.

The primary reason for outsourcing chip fabrication is straightforward: it is immensely capital-intensive and often less profitable.

I've also mentioned node sizes several times. What does this term mean? Essentially, it means very little.“Node size” is primarily a marketing term. However, for our discussion, it refers to a generation of technology and a“process”-a combination of machinery, tooling, and techniques that collectively produce transistors with specific speeds and power consumption levels.

Smaller node sizes correspond to higher performance. The most modern GPUs and CPUs, which often feature in news stories, require quite small node sizes. That being said, the majority of the chips which allow for modern technologies are higher node sizes and less computationally intensive.

Let's break down some of the chips inside an advanced air-to-air missile and we can see why these higher node, less advanced chips are so fundamental.

- The radar system: These require communication equipment to receive targeting signals, also known as front-end components, which include multiple chips. While some of those chips within a single component might be extremely complex and high speed (including advanced materials, which are hard to fabricate), other simple chips like PLLs, which stabilize the signal, are fine to be at 65nm.

- Engine and propulsion systems: Again, here we might see two chips or a combined chip. Engines require continuous heat sensors and control systems to adjust the engine operation. One might include a heat sensor and microcontroller on the same chip, but quite often one separates them out. There is no reason why these need to be at a low node size and are often at 90nm to 180nm.

The most cutting-edge machinery is designed for the most cutting-edge, low node size, processes. Fabs always want to be ahead of the ball, so they devote resources to those cutting-edge processes, while machines for older processes depreciate in value.

TSMC is at such scale that they can keep depreciated equipment and facilities and continue using them, as they have some clever ways to squeeze cash out of these fully depreciated facilities.

However, for companies like Intel and GlobalFoundries, mature nodes generally do not fit into the margin structures. For the most part, American companies sell their old facilities and old equipment (sometimes to the Chinese).

One can see why. The economics of operating a modern fab are staggering. A reasonably sized fab might cost around US$5 billion in capital expenditures, which requires generating $50-$70 in revenue per second to achieve a 20% return at the outset.

Even after it depreciates, it still has to generate $30-$40. Producing a chip at 65nm might cost $5 per chip, necessitating the output of a large wafer every 30 to 60 seconds-a formidable challenge.

SMIC and China's StrategyChina's semiconductor strategy is driven by two main goals: the primary one being domestic self-sufficiency, viewing semiconductors as a critical national asset akin to strategic reserves of oil or food.

The secondary goal is to establish a strategic leverage point in the global supply chain through mastery of mature node chips, effectively creating a potential chokepoint that enhances their geopolitical leverage.

The Chinese simply do not face the same economic constraints that we do in achieving these goals:

State capital and cheap loans make the problem of capital outlays less intense. There is an expectation that the loans will be paid back, but the terms are negotiable. Profits are not as important, given that the stakeholders are the state, which has a different set of priorities. R&D is done for them. They are buying mostly used or old equipment (from the West).The ingredient that cannot be emphasized enough is the very deliberate Chinese economic strategy wherein strategic industries are catapulted forward with a blank check.

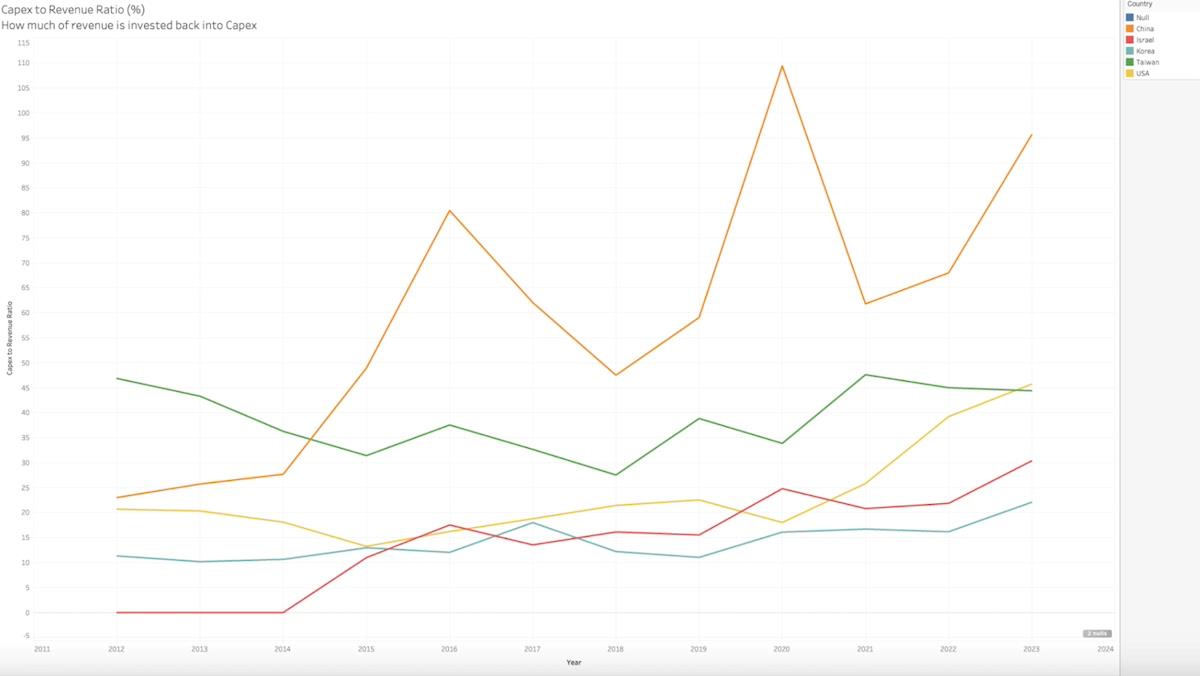

The graph below shows the capex-to-revenue ratio in the domestic semiconductor industry. The Chinese are going deep into the red on capex spend to push their chip industry forward.

Source: Claus Aasholm, SemiBizIntel, own research

SMIC has the goal of moving into more advanced nodes, but right now it's a struggle. SMIC is balancing between using the older Western equipment that they can still get access to and their own homegrown Chinese ecosystem, which is mostly just copied from the very same Western equipment.

And even if they did have access to the best Western equipment, they would not have the know-how to make it work for them.

Source: IC Insights (2022)

In the meantime, they are indeed swamping the mature node market. While the margins for individual mature node chips might be low, it sustains the business and it achieves the strategic goal of creating a chokepoint.

This deliberate“swamping”, and you can just read it in Xi's speech“Major Issues Concerning China's Strategies for Mid-to-Long-Term Economic and Social Development”, needs to be taken seriously.

CHIPS Act as response strategyThe CHIPS Act is essential in getting the US on the right path in terms of domestic chip production. We should not be totally dismissive of low node chips.

They are quite critical in light of the real risk of losing access to TSMC. However, the Act doesn't sufficiently address the balance needed in light of the aggressive Chinese strategy.

Coming back to the military supply chain, where an estimated 20-40% of chips used in our systems come from China. The sheer volume of components in military hardware makes it impractical to verify the origin of each chip, such as a generic microcontroller.

This is concerning, especially since some of these chips might originate from firms linked to the Chinese military, posing risks of side-channel and encryption attacks.

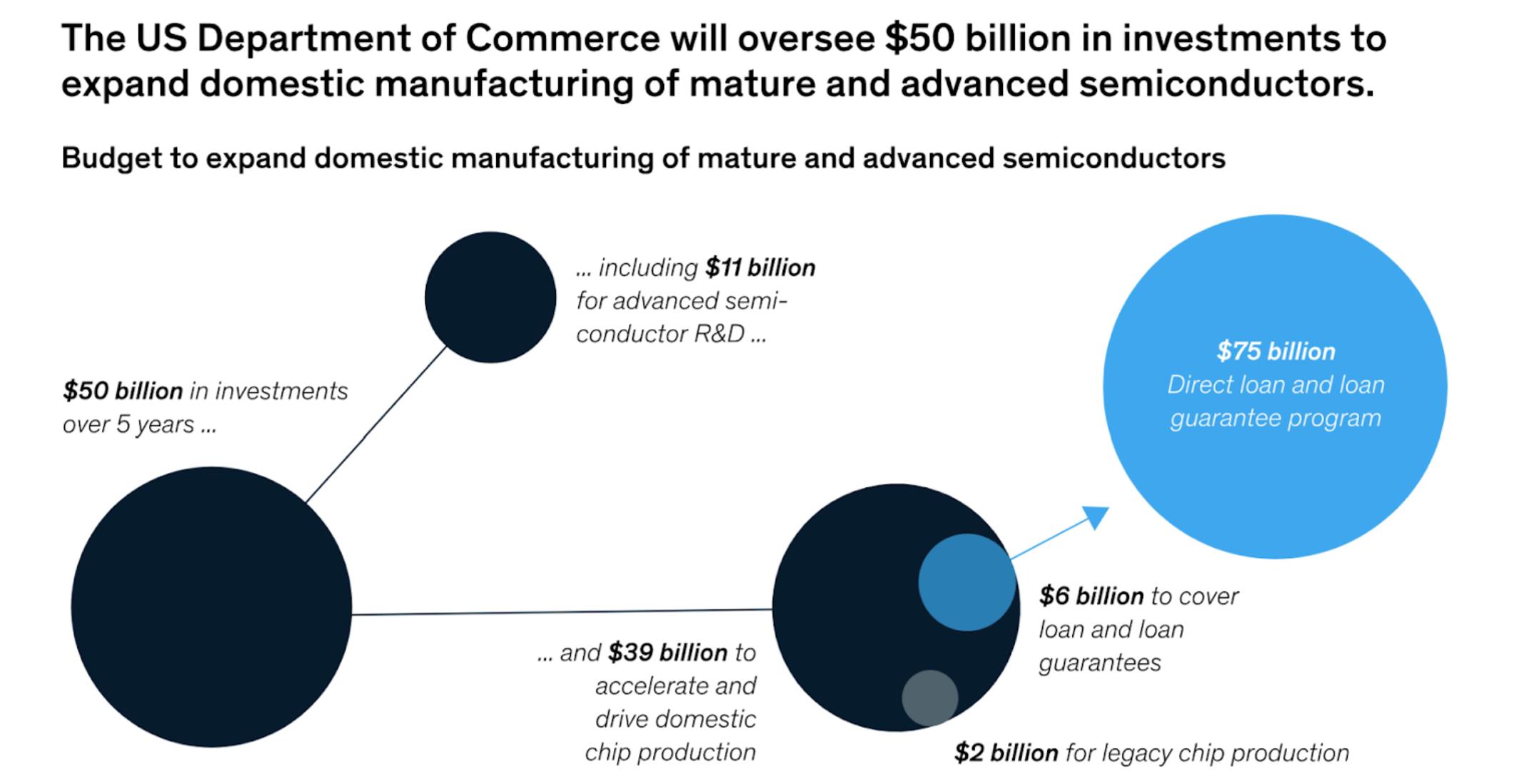

The CHIPS Act stimulates manufacturing through loans, grants, and subsidies for domestic and foreign companies to expand their fabrication capacity in the United States. The program seems to be working, despite initial skepticism that NIST or the Department of Congress could get anything done.

Source: Source: McKinsey, The CHIPS and Science Act: Here's what's in it, 2022

There is one thing missing: Mature nodes. Currently, only $2 billion has been given out in grants for mature nodes and somewhere between $8-$10 billion is earmarked for it eventually. Most of the money will go into leading-edge chips.

Not to be overly cynical, but the fact that Intel and GlobalFoundries definitely contributed to the contents of the bill should make it rather unsurprising that this was the outcome.

Source: Claus Aasholm

It's hard to make the economics of mature nodes work, in facilities that do not have incredible amounts of capacity/fully depreciated equipment and if it makes even less sense if the facility is new.

I'm all for public-private cooperation in designing economic policy and one might argue that friendshoring or pushing mature nodes when US capacity is already up and running might be a better strategy.

Those arguments would hold a lot more water if the Chinese were not acting so deliberately. We need to get more aggressive to respond effectively.

Offensive and defensive solutionsWe can attack the problem defensively and offensively. I'd recommend doing both in conjunction. The first two are table stakes. I'd call them defensive actions.

We need to earmark more money towards mature node chips. We need to become far more aggressive about supply chain monitoring for military chips.The second two are probably more painful. I'd call them offensive actions.

- We need to implement a more comprehensive tariff regime on Chinese chips of all node sizes. We have sanctioned equipment for leading-edge nodes, but we need to push this further, even into software tools like Cadence and Synopsys.

Sign up for one of our free newsletters

- The Daily ReportStart your day right with Asia Times' top stories AT Weekly ReportA weekly roundup of Asia Times' most-read stories

I do not think the first two in isolation will be sufficient, if only because in a race to the bottom on price, we will never win, especially as we are ramping up domestic production or figuring out friendshoring for chips.

The third is something that is not exactly pretty, but they will give our domestic chip industry price pressure a reprieve to ramp up. More than that, it will put financial pressure on SMIC.

The fourth is the most aggressive and definitely will be unpopular. Applied Materials makes about 45% of its revenue from China. Cutting it off from that market will be extremely painful and we will have to compensate them for that loss.

Critics will say“Well if we cut them off, they'll eventually build their own domestic competitors”, which is true, but, like tariffs, it is a blunt instrument to slow China down for us to get our domestic capacity up.

Chips are just one aspect of a larger economic and geopolitical battle we've been playing with China for the last two decades. We've been caught on a backfoot, out of naivete or lack of resolve, but at least on chips, we must reverse course.

Steven Glinert is founder and CEO of the Sphere Semi semiconductor startup. He lives between Singapore and the Bay Area.

This slightly abridged article was first published on Noah Smith's Noahpinion Substack and is republished with kind permission. Read the original and become a Noahopinion subscriber here.

Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment