China's April Manufacturing PMI Moderated To 50.4 But Still Points To Expansion For A Second Consecutive Month

| 50.4 | China April manufacturing PMI |

| As expected |

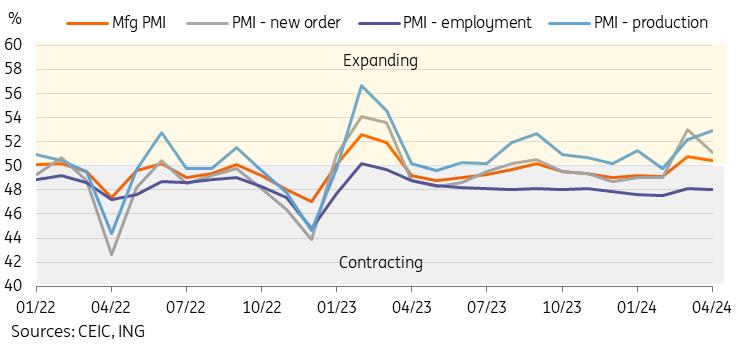

As expected, the April manufacturing PMI of 50.4 showed a slight moderation from March's strong 50.8 read, but remained in expansion territory, indicating that the recovery of industrial activity will continue into the second quarter. Year-to-date, manufacturing strength has been concentrated in the tech and auto sectors, with semiconductor manufacturing up 40% YoY in 1Q24.

In this month's PMI release, most subcategories pulled back slightly. But last month's trends continued. Most importantly, new orders (51.1) and new export orders (50.6) remained in expansion, indicating that the demand recovery seen in March's release was not just a blip. Employment (48.0) was little changed but remained in contraction for the 14th consecutive month, as there continues to be a mismatch between hiring demand and the labour supply.

The exceptions to this include the production subindex, which rose to 52.9 from 52.2, hitting a 13-month high, and sending a positive signal for April's industrial production data, as well as the purchasing price index, which surged to 54.0 from 50.5, which marked a 7-month high as well.

By firm size, encouragingly we saw the PMI above 50 for all firm sizes. The PMI for medium-sized enterprises hit a 14-month high of 50.7, while large-sized enterprises fell to a a 5-month low of 50.3.

Production and new orders supported the PMI while employment remained a drag

Non-manufacturing weakened as consumption appears to be softening

The decline in the non-manufacturing PMI was more pronounced, falling to 51.2 from 53.0, missing consensus forecasts and hitting a 3-month low. The non-manufacturing PMI paints a less rosy picture, with new business (46.3) remaining in contraction for the 12th consecutive month, and hitting a 16-month low. Employment (47.2) picked up but also remained in contraction territory for the 14th consecutive month. Though still well into expansion territory, the business expectations sub-index also hit a post-pandemic low of 57.2.

As we have touched upon numerous times in previous reports, after being the primary driver for economic growth in 2023, consumption activity is moderating in 2024 amid weak consumer confidence and negative wealth effects, and this will likely have a larger impact on the services sector in China. Including policy support for the services sector in conjunction with existing plans for boosting consumption via the "trade-in" programmes would not only offer a boost to near-term growth but would also be of benefit to China's long-term transition goals.

Non-manufacturing PMI slowed more than expected as new business slumped

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment