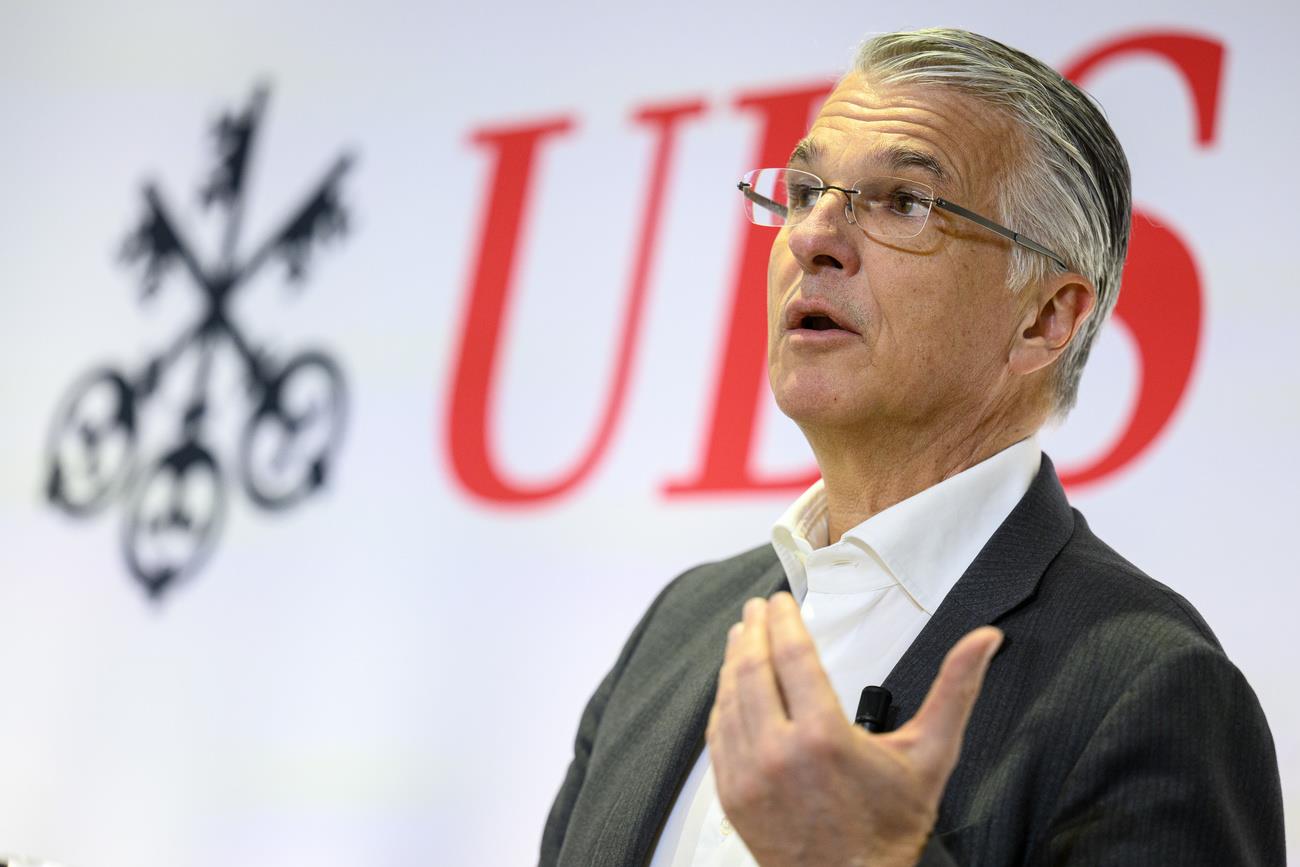

UBS CEO Earned Salary Of CHF14.4 Million In 2023

Ermotti was appointed on April 1, 2023 to lead the process of integrating former rival Credit Suisse, which was taken over by UBS in dramatic fashion in March 2023. Ermotti's predecessor Ralph Hamers earned CHF12.6 million as CEO for the whole of 2022.

According to UBS's annual report published on Thursday, Ermotti's salary was comprised of CHF2.1 million fixed salary and CHF12.3 million variable salary payments, with the latter referred to as a performance bonus.

+ Would Switzerland be better off without a giant global bank?

Expanded board post-takeoverA total of CHF140.3 million was paid to the entire executive board of Switzerland's largest bank in 2023, compared to CHF106.9 million the year before. Of this, CHF108.3 million was attributable to performance bonuses, compared to CHF81.1 million in 2022.

UBS said that this increase reflected the change in structure of the group's executive board to support the Credit Suisse integration, including four additional members. At the end of 2023, its executive board had 15 members.

“The payment structure for all employees, including the executive board, remained largely unchanged despite the acquisition of Credit Suisse in 2023,” said UBS, adding that neither the positive nor the negative financial effects of the takeover had been included in the report.

More responsibilities for board directorsColm Kelleher, who has been chairman of UBS's board of directors since April 2022, will receive CHF4.7 million for his second year in the role until the next annual general meeting on April 24. In his first year, he received CHF4.8 million.

The entire board of directors, consisting of 12 members, earned CHF15.2 million in 2023, including subsidiary fees, significantly more than the CHF12.6 million in 2022.

Following the takeover of Credit Suisse, the roles of certain members of the board were expanded in 2023 to include additional duties on the boards of key subsidiary firms, according to the bank's report. It said that these appointments were important to ensure strong oversight of the subsidiaries in line with UBS Group's governance principles, as well as facilitating the integration of Credit Suisse entities into UBS.

More Debate Hosted by: Matthew Allen Does a giant UBS offer more risk or reward?UBS is targeting growth after taking over Credit Suisse. Does that offer more prosperity or risk to Switzerland'

Join the discussion Mar 27, 2024 1 Comments View the discussion Loyalty bonusesIn addition, loyalty bonuses were paid in 2023 to encourage employee retention, which UBS said was common in the event of a takeover to retain people in key positions.

Overall, the bank said that the retention payments, which totalled CHF736 million, were rather low compared to the industry standard for an takeover of this size. According to the bank, they accounted for 3% of total personnel costs in 2023.

Meanwhile, there was no separate remuneration report for the Credit Suisse AG subsidiary as this is now part of the UBS Group, the bank said, and subsidiaries are not obliged to report separately.

Adapted from German by DeepL/kp

This news story has been written and carefully fact-checked by an external editorial team. At SWI swissinfo we select the most relevant news for an international audience and use automatic translation tools such as DeepL to translate it into English. Providing you with automatically translated news gives us the time to write more in-depth articles.

If you want to know more about how we work, have a look

here ,

and if you have feedback on this news story please write to

... .

Get the most important news from Switzerland in your inbox.

Daily

EmailThe SBC Privacy Policy provides additional information on how your data is processed.

I consent to the use of my data for the SWI swissinfo newsletter.

Articles in this story- Does a giant UBS offer more risk or reward?

In compliance with the JTI standards

More: SWI swissinfo certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here . Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at ... .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment