403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Oil Climbs 2%, Notches Weekly Gains Ahead of OPEC+ Decision

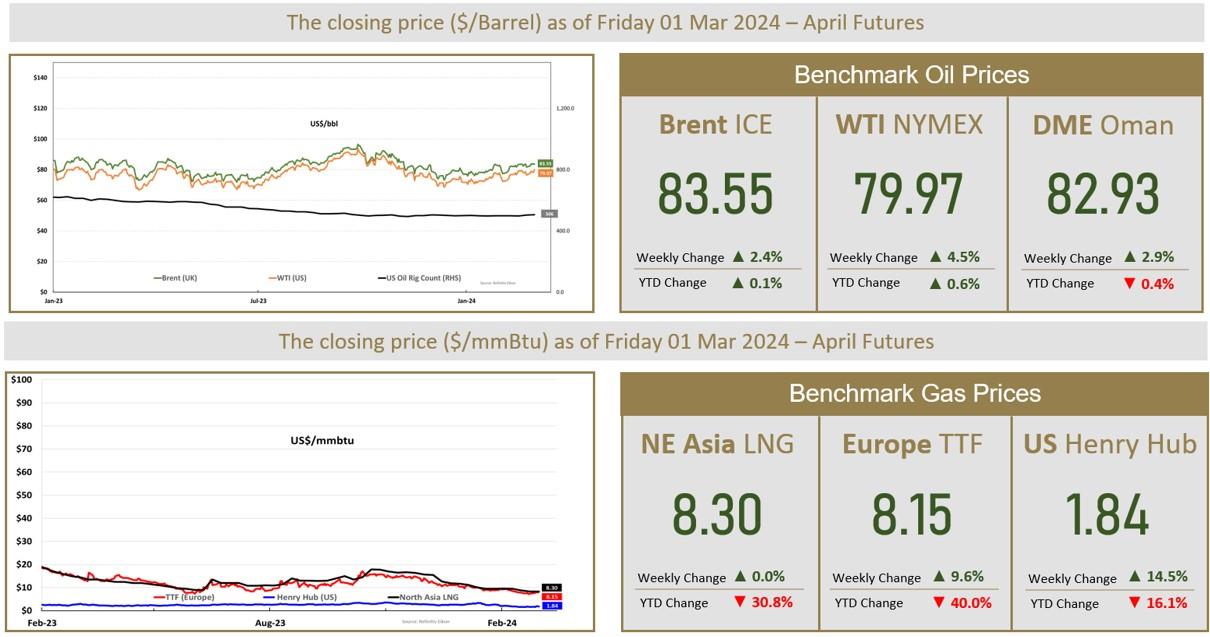

(MENAFN- The Al-Attiyah Foundation) Oil prices rose 2% on Friday and posted weekly gains as traders awaited an OPEC+ decision on supply agreements for the second quarter while also weighing fresh U.S., European and Chinese economic data. Brent futures settled $1.64 higher, or 2%, at $83.55 a barrel. U.S. West Texas Intermediate (WTI) rose $1.71, or 2.19%, to $79.97 a barrel. For the week, Brent added around 2.4% following the switch in contract months, while WTI gained more than 4.5%. A decision on extending OPEC+ cuts is expected in the first week of March, sources have said, with individual countries expected to announce their decisions. Meanwhile, geopolitical tension in the Red Sea also lifted prices on Friday. The leader of Yemen's Houthis said on Thursday the group would introduce military "surprises" in the region. Houthis have repeatedly launched drones and missiles against international commercial shipping since mid-November, acting in solidarity with Palestinians against Israel's military actions in Gaza. U.S. energy firms added oil and natural gas rigs for a second straight week, energy services firm Baker Hughes said in its closely followed report on Friday. The oil rig count, an early indication of future output, rose by three to 506 last week.

Asia Spot LNG Prices Flat as Ample Inventories Weigh

Asian spot liquefied natural gas (LNG) was flat last week to trend at a near three-year low as high inventories kept prices capped, though the slump in prices has attracted some spot demand. The average LNG price for April delivery into north-east Asia remained at $8.30 per million British thermal units (mmBtu), its weakest level since mid-April 2021. LNG imports are seen growing 8.1% to 77.11 million tons this year, below 2021's record of 78.93 million tons, despite a significant increase in LNG port receiving capacity over the last year. In Europe, gas prices saw some gains earlier this week amid an increase to an unplanned outage at a Norwegian gas field, but inventories in the region remain ample. Europe experienced mild temperatures in February which contributed to higher gas inventories compared to 2023. This trend is expected to continue through the summer if we don't see any major supply outage, analysts said. In the U.S., natural gas futures dipped on Friday on sufficient fuel in storage and lower heating demand, but prices marked their best week in over a month as voluntary production reductions are likely underway. Despite the declines on Friday, natural gas prices gained about 14.5% last week.

By: The Al-Attiyah Foundation.

Asia Spot LNG Prices Flat as Ample Inventories Weigh

Asian spot liquefied natural gas (LNG) was flat last week to trend at a near three-year low as high inventories kept prices capped, though the slump in prices has attracted some spot demand. The average LNG price for April delivery into north-east Asia remained at $8.30 per million British thermal units (mmBtu), its weakest level since mid-April 2021. LNG imports are seen growing 8.1% to 77.11 million tons this year, below 2021's record of 78.93 million tons, despite a significant increase in LNG port receiving capacity over the last year. In Europe, gas prices saw some gains earlier this week amid an increase to an unplanned outage at a Norwegian gas field, but inventories in the region remain ample. Europe experienced mild temperatures in February which contributed to higher gas inventories compared to 2023. This trend is expected to continue through the summer if we don't see any major supply outage, analysts said. In the U.S., natural gas futures dipped on Friday on sufficient fuel in storage and lower heating demand, but prices marked their best week in over a month as voluntary production reductions are likely underway. Despite the declines on Friday, natural gas prices gained about 14.5% last week.

By: The Al-Attiyah Foundation.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment