Bank Indonesia Keeps Rates Steady Again To Ensure Fx Stability

| 5.75% | BI policy rate |

| As expected |

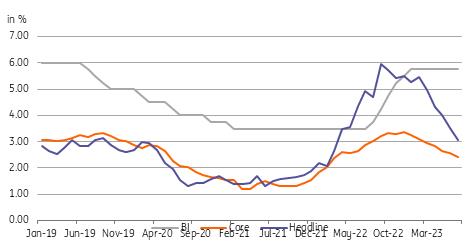

Bank Indonesia (BI) maintained policy rates at 5.75% today, a move widely expected by market participants. The central bank maintained its current outlook for growth (4.5-5.3% year-on-year) but indicated that global economic uncertainty remained high. BI also maintained its outlook for the external sector with the current account forecast to settle between 0.4% to -0.4% of GDP.

This is the seventh consecutive meeting in which BI Governor Perry Warjiyo has maintained the policy rate at 5.75%, despite moderating inflation (July inflation was 3.1%YoY), in a likely attempt to support the IDR. The currency has been under pressure of late, in part due to anxiety over theFederal Reserve's policy path, with the IDR down 0.85% for the month.

The trade balance, which had been a key support for the IDR in 2022, has remained in surpbut is now much smaller compared to last year's record high of $7.5bn reported in April 2022. With the trade surpno longer able to provide the same amount of support this year, Indonesia has implemented new regulations on export earnings, requiring a portion to be retained onshore.

BI holds for yet another meeting

Badan Pusat Statistik and Bank Indonesia BI continues balancing act and unveils new securities to help steady IDR

BI held rates unchanged today with an eye to FX stability. A much tighter interest rate differential (25bp) with the Fed's policy rate and a fading trade surphas resulted in pressure on the IDR. Thus, despite a much more favourable inflation environment, BI has been unable to cut policy rates from its current 5.75%.

Warjiyo does appear to be mindful of the growth outlook with exports likely facing a challenging landscape. Thus, he opted to refrain from hiking policy rates to help provide some support to growth while relying on intervention, the ongoing Operation Twist, while unveiling a new set of securities to attract foreign inflows to help steady the IDR.

We expect BI to continue to resort to these measures to support the rupiah in the near term, holding off on rate hikes for now to ensure growth momentum can be sustained for the rest of the year.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment