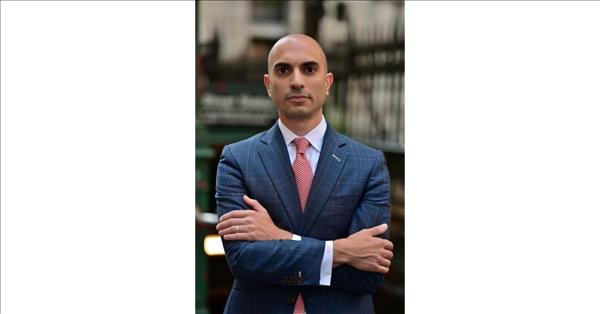

(MENAFN- EIN Presswire) Marc D. Fitapelli

I represent members of the US military who blindly trusted Mr. Craffy and lost significant portions of their net worth as a result. Call me at 800-767-8040 for a free consultation or to learn more.” - Marc D. Fitapelli, Esq. POINT PLEASANT BEACH, NEW JERSEY, USA, January 13, 2023 /einpresswire.com / -- MDF Law, a New York City based law firm, announces an investigation into former Monmouth Capital Management broker caz craffy . Craffy was barred by the Financial Industry Regulatory Authority, or FINRA, on December 8, 2022, after he refused to cooperate in an active investigation into his alleged misconduct. The FINRA Case ID is 2022076459301. A copy of the disciplinary action is attached to this press release.

According to Craffy's LinkedIn profile, he has been a major in the US Army since 2002. MDF Law's investigation has uncovered that the majority of Mr. Craffy's customers are other active and former members of the U.S. military, many of whom placed blind trust in Mr. Craffy. Moreover, in addition to the FINRA investigation, the U.S. Army is also investigating Mr. Craffy's business practices as a broker. That investigation is ongoing.

On November 11, 2022, the Financial Industry Regulatory Authority, or FINRA, announced that Caz Craffy was under investigation. The next day, November 11, 2022, he was terminated by his broker-dealer, Monmouth Capital. After Monmouth Capital terminated Mr. Craffy, it informed its customers that his accounts were being transferred internally to Raymond Clark, another broker associated with Monmouth in Point Pleasant Beach. Mr. Clark has a checkered regulatory history, which includes three disclosed customer settlements and two recent tax liens, one for $416,434.56. This is according to his public BrokerCheck report, which was last accessed on January 13, 2022.

In addition to the activity uncovered by FINRA's investigation, Mr. Craffy also allegedly concentrated his client's portfolios in speculative stocks without their permission or knowledge. These stocks included: RIOT Blockchain (RIOT), Upstart Holdings, Inc. (UPST), Bill.com (BILL), Netflix (NFLX), MicroStrategy Inc. (MSTR) and others. In addition to purchasing stocks without authorization, Craffy also made speculative bets on the same securities by buying options and other complex derivatives. Again, his customers were not made aware of this activity, or the tremendous risks associated with it.

MDF Law is a New York City based law firm that exclusively represents traditional and crypto currency investors. The firm is owned by attorney Marc Fitapelli, a seasoned litigator who has helped investors recover over $100 million from banks, insurance companies and other large financial institutions. Mr. Fitapelli already represents former customers of Mr. Craffy and invites other customers to call him at 800-767-8040 for a free and confidential consultation.

MDF Law's address is 28 Liberty Street, 30th Floor, New York, New York and its phone number is 800-767-8040.

ATTORNEY ADVERTISING

PRIOR RESULTS DO NOT GUARANTEE A SIMILAR OUTCOMEMarc Fitapelli

MDF Law

+1 212-203-9300

email us here

MENAFN13012023003118003196ID1105427311

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment