A Crypto Hedge Fund Moves Nfts Worth Millions To A Single Wallet, Prompting Speculation Of A Bankruptcy-Induced Fire Sale

The biggest question in the crypto industry these days seems to be where in the world are Su Zhu and Kyle Davies? The duo, founders of the Singapore-based cryptocurrency hedge fund Three Arrows Capital (3AC), which was forced into liquidation proceedings on June 27, have reportedly been avoiding court proceedings and their current location remains unknown.

Creditors are now asking a New York bankruptcy court to freeze 3AC's estimated $3 billion in assets, which are largely in the form of cash, cryptocurrency and NFTs, citing concerns that they may be“transferred or otherwise disposed of.” Fueling these concerns, and raising speculation that a fire sale of high-priced NFTs may be in the works, Starry Night Capital, the NFT off-shoot of 3AC, moved much of its multimillion-dollar collection to a single wallet last month.

According to open-source data, NFTs from the Starry Night Capital account were transferred to a wallet listed as AEB785. Several of the transfers started on June 14, two days before the Financial Times first reported that Three Arrows had failed to meet a margin call on a $670 million loan.

That new wallet now holds several highly valued NFTS, perhaps worth millions, include works by artists such as Erick Calderon of Art Blocks and Mad Dog Jones, among others. One piece by Dimitri Cherniak, entitled, was bought last October for 800 ETH, or more than $2 million at the time.

The crypto fund's venture into NFTs came at the peak of the market in August of 2021, when the company partnered with the pseudonymous NFT collector, Vincent Van Dough —who has so far not commented on the scandal, despite remaining relatively active on Twitter—to launch Starry Night Capital. The group initially aimed to raise $100 million that it said would be used to create an educational platform for NFTs, alongside a physical gallery in a major city, neither of which came to fruition.

Over the past year, Starry Night Capital spent $21 million to acquire 457 virtual assets. But based on recent estimates prepared by DappRadar using on-chain data , the holdings transferred to the AEB785 wallet now have an estimated net worth of just $3.89 million.

According to CoinMetrics researcher, Kyle Waters, Starry Night Capital's collection at one point accounted for 10% of the total volume on SuperRare, the sixth largest NFT platform by market cap.

“The new wallet seems to have some linkage to other 3AC wallets,” Waters wrote on Twitter, adding that“it's unclear so far what's going on (at worst case, gearing up for some sort of liquidation/OTC [Over the Counter] block trade of NFTs?”

In an ominous move, the sole institutional backer of Starry Night's holdings, the UK-based KR1 fund, has written off their investment entirely. KR1 bought $5 million of“Class Starry Night Shares” in the British Virgin Islands-registered Three Arrows Fund Ltd, although it is unclear if such a company actually exists, CoinDesk reported . Those shares were 100% impaired according to a recent earnings statement issued by KR1.

If Starr Night's NFT collection were to be sold off at today, when crypto art prices have cratered, the vast majority of the works would make considerably less than what they were acquired for.

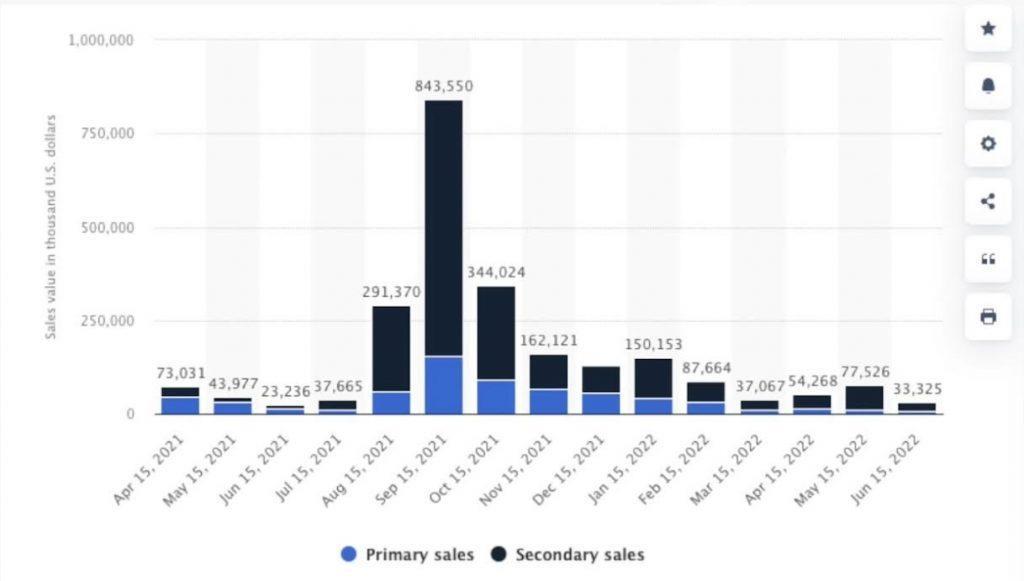

Total value of sales involving a non-fungible token (NFT) in the art segment worldwide over the previous 30 days from April 15, 2021 to June 15, 2022. According to data from Statista.

In addition to freezing the fund's assets, creditors are asking the court to compel the founders to list the fund's assets, including the wallets it controls, bank accounts, cash and digital assets, as well as any derivatives contracts, securities, accounts receivable, and company records. Lawyers acting on behalf of creditors said that Zhu and Davies“have not yet begun to cooperate” with liquidation proceedings, according to

Founded in 2012, 3AC's downfall seems to stem from Ponzi-esque activity that included borrowing from various lending platforms to payoff the interest on earlier loans. The fund's downfall has caused ripple effects across the crypto-sphere, with liquidity concerns hitting other companies, including the lending firm Celsius, the cryptocurrency exchange CoinFlex, and the digital asset brokerage Voyager Digital, all of which had dealings with 3AC.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment