Financial Services Market Is Set To Reach $37 Trillion In 2026 With The Increasing Adoption Of EMV Technology

Financial Services Global Market Report 2022– Market Size, Trends, And Global Forecast 2022-2026

The Business Research Company's Financial Services Global Market Report 2022 – Market Size, Trends, And Global Forecast 2022-2026

LONDON, GREATER LONDON, UK, March 25, 2022 /EINPresswire.com / -- The global payments industry has witnessed a rapid increase in the adoption of EMV technology shaping the global financial services market . This growth is driven by a higher level of data security offered by EMV chips and PIN cards as compared to traditional magnetic stripe cards. EMV is a security standard for various payment cards including debit, credit, charge, and prepaid cards.

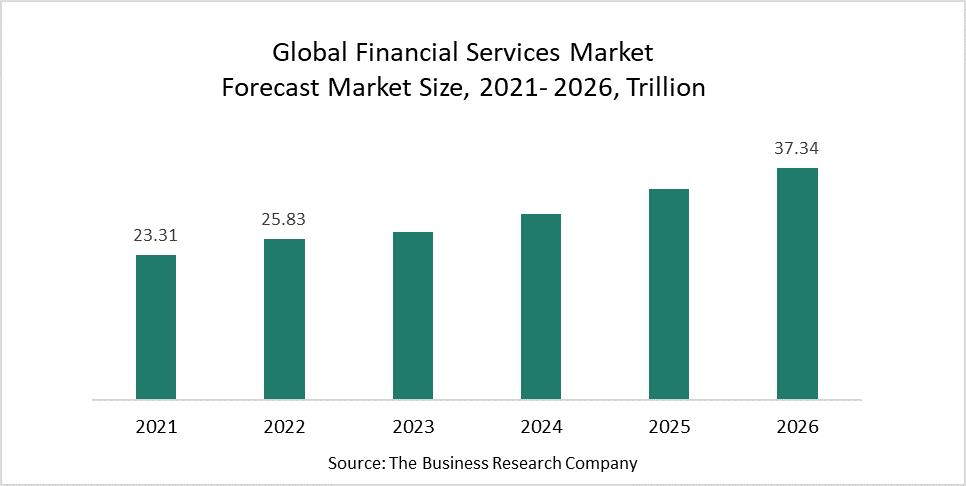

The global financial services market size is expected to grow from $23.31 trillion in 2021 to $25.83 trillion in 2022 at a compound annual growth rate (CAGR) of 10.8%. The global financial service market share is then expected to grow to $37.34 trillion in 2026 at a CAGR of 9.6%.

Read more on the Global Financial Services Market Report

Many wealth management companies are investing in big data analytics capabilities to generate insights around clients. Big data solutions are being implemented to deliver insights around client segments, product penetration, and analyze training program effectiveness. These technologies are being implemented to assess existing and prospective clients' inclination to purchase various products and services being offered by a wealth management company, their lifetime value, investment pattern, and the ability of the client to take risks. According to the financial services industry growth analysis, they are also helping wealth management companies to track business performance, increase client acquisition and retention rates, increase sales, and offer real-time investment advice. For instance, CargoMetrics, an investment firm based in Boston used Automatic Identification System (AIS), to collect data on commodity movement such as cargo location and cargo size to develop an analytics platform for trading commodities, currencies, and equity index funds. This tool was also sold to other hedge funds and wealth managers.

Major players covered in the global financial services industry are Allianz Group, Industrial and Commercial Bank of China, JPMorgan Chase & Co., Ping An Insurance, Axa Group, Anthem, Inc., Agricultural Bank Of China, China Life Insurance, China Construction Bank, and Centene.

Western Europe was the largest region in the global financial services market in 2021. North America was the second-largest region in the global financial services market. The regions covered in the financial services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

TBRC's global financial services market research report is segmented by type into lending and payments, insurance, reinsurance and insurance brokerage, investments, foreign exchange services, by size of business into small and medium business, large business, by end-user into individuals, corporates, government, investment institution.

Financial Services Global Market Report 2022 – By Type (Lending And Payments, Insurance, Reinsurance And Insurance Brokerage, Investments, Foreign Exchange Services), By Size Of Business (Small And Medium Business, Large Business), By End User (Individuals, Corporates, Government, Investment Institution) – Market Size, Trends, And Global Forecast 2022-2026 is one of a series of new reports from The Business Research Company that provides a financial services market overview, forecast financial services market size and growth for the whole market, financial services market segments, geographies, financial services market trends, financial services market drivers, restraints, leading competitors' revenues, profiles, and market shares.

Request for a Sample of the Global Financial Services Market Report:

Not what you were looking for? Here is a list of similar reports by The Business Research Company:

Lending And Payments Global Market Report 2022 – By Type (Lending, Cards And Payments), By Lending Channel (Offline, Online), By End User (B2B, B2C) – Market Size, Trends, And Global Forecast 2022-2026

Investments Global Market Report 2022 – By Type (Wealth Management, Securities Brokerage And Stock Exchange Services, Investment Banking), By End User (B2B, B2C), By Mode (Online, Offline) – Market Size, Trends, And Global Forecast 2022-2026

Blockchain In Banking And Financial Services Global Market Report 2022 – By Type (Public Blockchain, Private Blockchain), By Application (Fund Transaction Management, Real Time Loan Funding, Liquidity Management) – Market Size, Trends, And Global Forecast 2022-2026

Know More About The Business Research Company?

The Business Research Company is a market research and intelligence firm that excels in company, market, and consumer research. It has over 200 research professionals at its offices in India, the UK and the US, as well a network of trained researchers globally. It has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services and technology.

Read more about us at

Call us now for personal assistance with your purchase:

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email:

Check out our:

LinkedIn:

Twitter:

YouTube:

Blog:

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

Visit us on social media:

Facebook

Twitter

LinkedIn

Market Research Products, Services, Solutions For Your Business - TBRC

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment