Seeking Resources in 2 Former Mining Camps

March 16, 2022 (Investorideas.com Newswire) Go to any mining conference and you're likely to hear this adage: the best place to find a new mine is near an old mine. It's true. It's even more likely when metals prices are healthy and trending higher. One junior is seeking to outline resources in two former mining camps. The odds - and metals prices - just might be on its side.

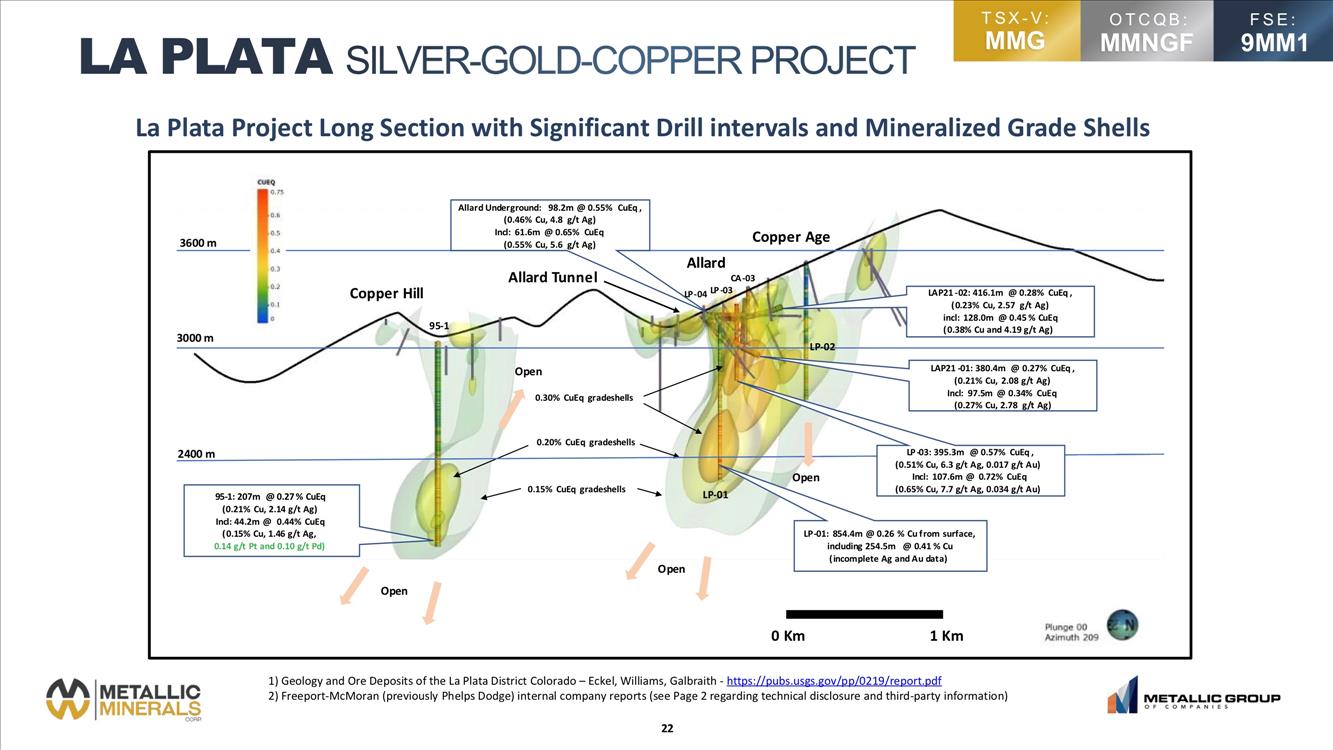

With spot prices for silver, gold, and copper trading near their respective five-year highs, Metallic Minerals Corp. (MMG:TSX; MMNGF:OTCQB) is going ahead with the first resource estimate on its La Plata silver-gold-copper project in southwestern Colorado after exploration drilling confirmed historical drill results by Rio Tinto, Freeport, and for good measure, added some gold, platinum, and palladium data.

The Vancouver-based junior has tasked geological consulting firm SGS Geoscience to put together the National Instrument 43-101-compliant estimate for La Plata.

High-grade gold and silver veins at more than 90 small-scale mines and prospects in the La Plata district were mined intermittently from the 1870s through the 1940s. Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) and Freeport-McMoRan Inc. (FCX:NYSE) (via Phelps Dodge) drilled more than 15,000 meters on the property and defined a large-scale mineralized porphyry system (typically lower grade but with better grade continuity).

One of the deepest holes drilled on the property intersected 378 meters of porphyry-style mineralization grading 0.62% copper equivalent (CuEq) [0.52% copper, 6.2 gram per tonne silver (6.2 g/t silver), and 0.06 gram per tonne gold (0.6 g/t gold), including 110 meters grading 0.82% copper equivalent (0.64% copper, 7.4 g/t silver, and 0.13 g/t gold)] with the hole ending in mineralization.

Based on holes like that and La Plata having seen little exploration work since Phelps Dodge sold the claims in 2002 (before it was acquired by Freeport in 2007), Metallic management believes the project has more secrets to reveal.

'The mining happened around the turn of the century, and then it was explored by some of the big miners, Rio Tinto and Freeport, in the 1950s through the 1970s. And we're kind of the first to come in and look at (La Plata) from a modern perspective,' Metallic CEO and Chairman Greg Johnson told Streetwise.

Management believes it can rapidly grow the known historical mineral resource at La Plata and expand the higher-grade zones in the broader porphyry and epithermal mineralized systems.

Metallic is working with Goldspot Discoveries Inc. (SPOT:TSX.V) , a Vancouver-based a software developer that uses geological and geophysical data, in tandem with artificial intelligence, to better 'understand' and learn about gold and other metal deposits. Together they have identified 16 high-grade epithermal-style and porphyry-style mineralized zones across La Plata for follow-up work during the 2022 field season.

Metallic's 2021 exploration work included 1,980 meters of diamond drilling; resampling of historical drill core; underground sampling from the Allard tunnel, a key area of previous exploration; and mapping and taking surface samples across the property.

Drill hole LAP21-01 intersected 380 meters of 0.27% CuEq (0.21% copper, 2.08 g/t silver, 0.025 g/t gold), including multiple significant intervals of higher-grade mineralization, while LAP21-02 intersected 416 meters of 0.28% CuEq (0.23% copper, 2.57 g/t silver, 0.026 g/t gold), including, 128 meters of 0.45% CuEq (0.38% copper, 4.19 g/t silver, 0.042 g/t gold).

Sampling in the Allard tunnel returned 98 meters of 0.55% CuEq (0.46% copper, 4.75 g/t Ag, 0.03 g/t Au), including 61.6 m of 0.65% CuEq (0.55% Cu, 5.55 g/t Ag, 0.03 g/t Au).

The mineralized system remains fully open to expansion at depth and along strike.

'The modelling work for the resource estimate on the Allard target is underway, and we look forward to reporting the results over the coming weeks, as well as further drill results from the Keno Silver project,' Johnson said.

Keno District Rich in History, Rich in Silver

Keno silver district in Yukon.

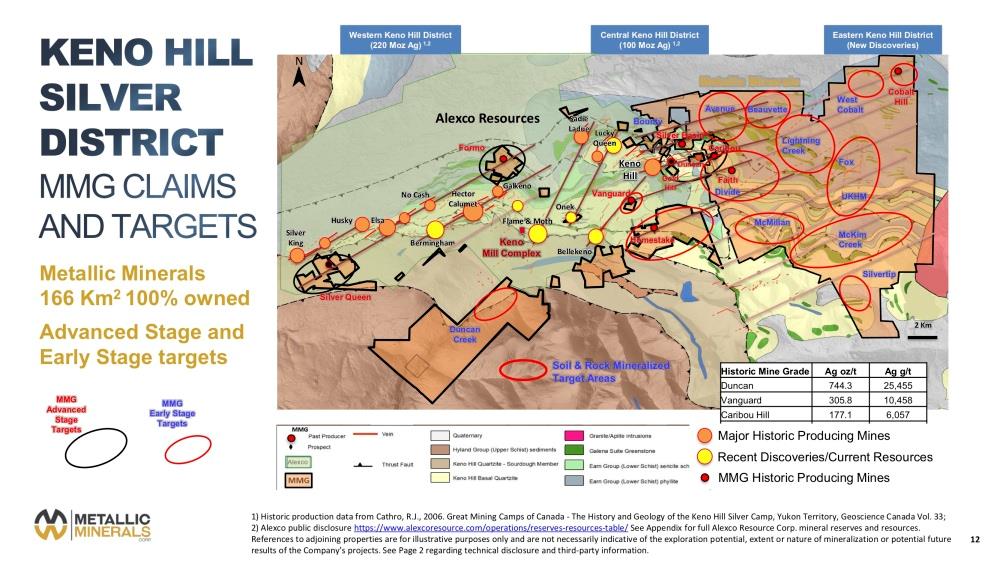

Keno is a silver 'district' in Yukon littered with high-grade silver-lead-zinc veins, some of them outcropping at surface, stretching across roughly 35 kilometers.

The western third of the district is controlled by Alexco Resource Corp. (AXU:NYSE.MKT; AXR:TSX) , which just restarted its Keno Hill silver mine, among the highest-grade silver mines in the world. Its reserve grades are 804 g/t silver or 1,035 g/t silver equivalent (AgEq).

Keno Hill is slated to produce more than 4 million ounces (4Moz) in 2022, with reserves in place for eight more years of production. Its life-of-mine, all-in sustaining costs are US$11.60 - higher than average - but part of that is due to a metals streaming contract with Wheaton Precious Metals Corp. whereby silver ounces were forward sold to fund construction.

The central third contains many mines from the past-producing Keno Hill camp. More than 10 mines, led by the Hector-Calumet mine with about 96 Moz silver (originally two separate mines that worked the same vein from both ends), produced more than 150 Moz silver in the district.

Metallic's 16,600-hectare flagship project, Keno Silver, occupies essentially the eastern half of the district, with additional claims to the south of Alexco on the west. Johnson says the well-defined, high-grade mineralized systems in the central and western parts of the district continue onto its land package, but Metallic management now believes there is significant potential to piece together deposits that could be mined as low-cost open pits.

'We're basically seeing the same geologic setting doesn't stop at the claim boundary as those structures continue. But the new thing is the recognition by our team, that not only do we have these super high-concentration (silver) structures, which would involve relatively narrow selective vein mining, but we've got broad areas that may be amenable to bulk tonnage,' Johnson told Streetwise.

He added: 'So surrounding those high-grade deposits, you've got material that's at lower grades, but there's a lot more of it. We made these bulk-tonnage discoveries in 2020, and we followed them up in 2021.'

32 Drill Holes Intersect Silver Mineralization

Vancouver-based Couloir Capital covers Metallic and sees promise in the initial drill results on Keno Silver. 'MMG completed two sets of major drilling programs in 2021, for which it has yet to release full assay results. Given that Keno Silver exhibits similar mineralization characteristics as Alexco's assets to the west, we see a potential upcoming catalyst in positive drill results,' a Couloir analyst wrote in a research report.

Metallic published results from 37 reverse-circulation holes totalling almost 3,000 meters into the Central Keno target area. Results are pending from the other 26 holes completed in the into East and West Keno in 2021.

Thirty-two of the 37 reverse-circulation holes intersected silver mineralization. Two ended short of their target depth due to ground conditions.

Highlights include: Hole KS21-47, which intersected 27.4 meters of 146 g/t silver equivalent1 ('AgEq'), including a high-grade interval of 3.05 meters at 1150.8 g/t AgEq (562.06 g/t silver, 1.48 g/t gold, 3% lead, 6.96% zinc).

And hole KS21-55 intersected 19.8 meters grading 119.1 g/t AgEq, including a high-grade interval of 1.52 meters at 1009.8 g/t AgEq. (147 g/t silver, 3.24% gold, 0.99% lead, 10.9% zinc).

Metallic is now updating its three-dimensional model based on the Central Keno results. The company is in the process of finalizing a list of top drill targets for what is expected to be a robust 2022 drilling season.

Metallic Could Become Takeover Target

Johnson spent years developing and drilling off NOVAGOLD Resources Inc.'s (NG:TSX; NG:NYSE.MKT) mammoth Donlin Creek gold project, now a 50-50 joint venture with Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) .

If Metallic can drill off enough ounces, Johnson sees Keno Silver - and possibly the entire district - becoming a takeover target.

'If we find something really interesting, Alexco becomes an obvious candidate for wanting to acquire it outright or to partner (with us). If we find something bigger, it probably attracts a bigger silver player and perhaps they even consolidate the whole district - buy both pieces to create a consolidated district,' Johnson told Streetwise.

Metallic also has a portfolio of unmined alluvial gold claims in the Klondike region of Yukon, the kind of properties mined on Discovery Channel's Gold Rush. Metallic will license the properties and book a royalty on any gold mined. Johnson says this will continue to be a source of non-dilutive financing.

Metallic is part of the Vancouver-based Metallic Group, which consists of three publicly traded mining exploration companies: Group Ten Metals Inc. (PGE:TSX; PGEZF:OTCQB; 5D32:FSE) , a growth stage nickel and platinum group elements explorer with a recently announced inaugural resource estimate on its Montana asset; Granite Creek Copper Ltd. (GCX:TSX; GCXXF:OTCQB) , a high-grade copper play in Yukon's Minto Copper District with a recently updated resource and upcoming PEA; and Metallic.

Couloir has a 'buy' rating on Metallic with a 12-month target of CA$0.68.

Metallic has about $2.6 million cash and trades in a 52-week range of CA$0.75 and CA$0.32.

Disclaimers

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Metallic Minerals Corp., Group Ten Metals Inc., and Granite Creek Copper Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Rio Tinto Plc, a company mentioned in this article.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment