The Little Known Secret Of Buying Gold At A Discount

(MENAFN- Baystreet.ca) Gold-mining juniors now rule the day.

And the secret to their success is discount gold.

The real leverage for higher gold prices isn't hiding in plainsight. It's hiding in the massive mineral reserves of junior miners.

Those miners have recently become the lynch pin for the survivalof the entire industry.

And there are only three things an investor needs to know in thisscenario:

1) Discount gold is what you getwhen you buy shares in a gold company that has proven resources but issignificantly undervalued at today's gold prices.

2) Some of these juniors are sittingon gold reserves that could determine whether or not the biggest miners inNorth America are able to staunch the decline in output.

3) Not all juniors are equal.

What's discount gold today, won't be discount gold tomorrow.

Take African Gold Group ( TSX:AGG.V ,OTCMKTS:AGGFF ), forinstance: It's sitting on 2.2 million ounces of mineralresources in Mali, and according to a recent report , it hasdrilled less than 10% of its almost 260 km2 of concessions. Thecompany's Kobada mine is located right in the middle of one of the hottestmining venues in the world at this moment, and relative to many mines, thecompany is practically able to scrape the gold from the surface, resulting incomparatively low production costs.

But what's really interesting is that AGG only has a market cap ofaround $12 million but is sitting on gold reserves worth billions.

The thing is …

Investorsaren't the only ones looking for discount gold: North America's biggest minersare on the hunt, too.

The Hunt forDiscount Gold

Senior minors are runningout of gold to mine.

Their answer to that is amassive M & A push, so they're looking for the right juniors to buy out toreplenish their reserves.

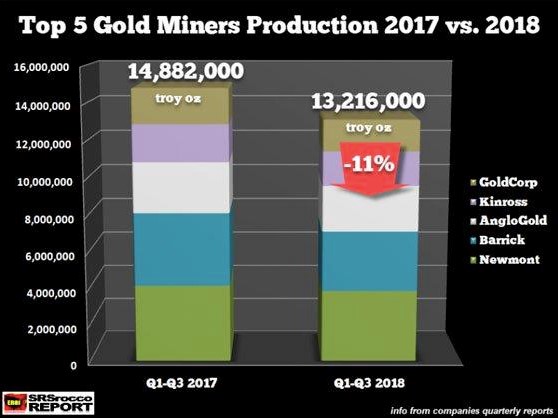

The hunt began in earnestin 2016, when gold output fell for the first time since 2008.

Two years later, the trend was set in stone, thanks to ‘peak gold'.

Nothing made the situation clearer thanthe $18.3-billion mega merger of Barrick Gold (NYSE:GOLD) and Randgold in 2018,followed by the Newmont Mining's (NYSE:NEM) acquisition of Goldcorp Inc.(NYSE:GG) earlier this year.

But now it's about the juniors.

The cheapest way for big miners to growis by scooping up juniors who have big reserves, low-cost production and plentyof upside.

Infact, as far back as 2017, big miners were on the hunt for the right juniors.By the first half of 2017, they had invested nearly $300 million in juniorexploration companies—the highest level of investment in a decade.

Nearly half of all the equity raised byjunior miners on the Canadian TSX exchange came from senior miners in 2017.

Now the game seems to have shifted toacquiring junior miners outright, or gradually, through a series of "microdeals".

All the big miners are doing it. It'sthe only way they can reverse the decline.

So, who will be the next acquisitiontarget?

That depends on the size of thereserves, how easy they are to produce and cost setup ...

Welcome to Mali

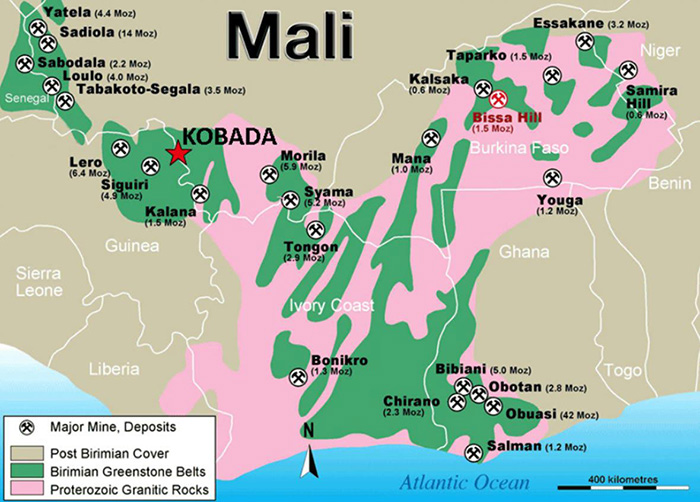

Mali is the third-largest producer ofgold in all of Africa, and the Birimian Greenstone Belt is the giant sweet spothere. It's a massive gold belt that spans 350,000 square kilometers, stretchingacross seven countries.

AfricanGold Group's Kobada Projectisright in the heart of this.

Some 2.2 million ounces in mineralreserves has already been proved up in a 2016 feasibility study, and asmentioned before, the drilling at Kobada has focused on a tiny fraction of259km2 of prospective concessions. These 2.2 million ounces, worth some 3.3billion dollars at today's gold prices, could be just the tip of the iceberg.Geologists have identified numerous other shear zones through test drilling andregional geology techniques, and African Gold Group ( TSX:AGG.V ,OTCMKTS:AGGFF ) owns all of it.

Anothermajor advantage for African Gold Group is that the gold is very close tosurface, and easy to mine. That means it will be low-cost and highly scalable.

The deepest hole AGG has had to drill so far has only been 300 meters.

So, what about the discount gold?

African Gold Corp estimates all-in LOMsustaining cash operating costs at $788/Oz Au.

Right now, gold prices are still soaring, and promising to hit the $1500mark.

With a market cap of only ~$11 million, that is some seriouslydiscounted gold.

It also makes AGG a potential target for the big miners who are huntingfor new gold.

But this is where the management question comes into play …

The Undisputed King of Discount Gold

Discount depends as much on who's behind as it does on massive reserves.

In June, African Gold Group ( TSX:AGG.V ,OTCMKTS:AGGFF )reshaped its board of directors and management team, and brought onlegendary mining figure and financier,StanBharti , of Forbes Manhattan, as Chairman of the Board, President and CEO.

If Bharti is interested, so will be investors. Big miners are likely tohave already pricked up their ears.

That's because Bharti knows the value of discount gold more than anyone,and he has even made it work in the middle of a financial crisis.

Not only has Bharti been in Mali already for over a decade, but he's alreadyturned around one company there for 20X profit.

In 2008, Bharti's Forbes & Manhattan acquired Avion inMali for $20 million, turned it around and sold it to Endeavour for $500million in 2012. That Mali mine is Endeavour's main asset today.

The rest of the new board and senior team is also a discount goldsuccess story that includes the former Canadian foreign minister, the HonorablePeter Pettigrew; Sir Sam Jonah, former Anglo Gold Ashanti CEO; Bruce Humphrey,former Goldcorp COO and Daniel Callow, a Glencore Africa veteran.

They've done it before when the setup for discount goldwasn't nearly as brilliant as it is today.

Never Better for Discount Gold

Africa Gold Corp's ( TSX:AGG.V ,OTCMKTS:AGGFF )timing is excellent.

Major miners are gunning for junior prospects. The world'scentral banks are hoarding gold at a record pace. Talk about the Gold Standardis no longer just fluff. And major world powers are making every effort todisengage from the US dollar.

All of this has seen the world's most precious metal make prodigious runs tomulti-year highs.

And gold is about to soar even higher, thanks to new threats coming out ofWashington for another round of tariffs on Chinese goods by September. Thatnews has already shot gold up to new six-year highs:

While soaring gold prices might heal the hurt for some of the bigminers, they won't do anything to replenish those dwindling reserves. No matterhow much gold is selling for, you still can't get it out of the ground if youdon't have it.

For the first time in history, this is a junior game all the way, andthe next acquisition will be the one that has the best discount gold setup.

For investors, that means finding the undervalued gem before the bigminers swoop in.

It's what Stan Bharti was looking for--and found. It means following theBharti trail, which tends to lead to great discount gold.

Five companies that could swoop in on the junior miner revolution:

First Majestic Silver (NYSE:AG)(TSE:FR)

Though First Majestic recently took a significant blow, as a strong dollarweighed on precious metals resulting in a poor quarterly earnings report,there's still a lot of bullishness surrounding the stock. Adding to thenegative numbers, however, was a string of highly valuable acquisitions whichare likely to turn around for the metals giant in the mid-to-long-term.

While it's primary focus remains on silver mining, it does hold a number ofgold assets, as well. Additionally, silver tends to follow gold's lead whenwider markets begin to look shaky. And with analysts sounding the alarms of aglobal economic slowdown, both metals are likely to regain popularity amonginvestors.

Further boosting its portfolio, the company also entered a share-repurchaseprogram, as it feels that its stock is. at the moment, undervalued, and willbenefit all shareholders by increasing the value of the stock.

Seabridge Gold Inc. (NYSE:SA) (TSX:SEA)

Seabridge is an ambitious young company taking the industry by storm. It has aunique strategy of acquiring promising properties while precious metals pricesare low, expanding through exploration, and then putting them up for grabs asprices head upward again.

The company owns four core assets in Canada; the KSM project, which is one ofthe world's largest underdeveloped projects measured by reserves, CourageousLake, a historically renowned property, and Iskut, a product of a recentacquisition by Seabridge.

Recently, Seabridge closed a major extension deal to continue expansion at itsKSM project. CEO Rudi Fronk stated: "We are pleased that our EACertificate has been renewed until 2024 under the same terms and conditions,reaffirming the Government of British Columbia's support for KSM and therobustness of the original 2014 EA."

Great Panther Mining (NYSE:GPR) (GPR:TO)

Based in Vancouver, Great Panther is active in Brazil and Mexico where itexplores for silver, gold, lead, and zinc ores. The second half of 2018 hasbeen tough for the midcap miner, but its share price doubled last month,shortly after the acquisition of Beadell resources, which ads another 200,000gold equivalent ounces to its reserve base.

According to a recent statement in the press, the focus in the near-term willbe on the integration of the Brazilian operations, the continued optimizationof the Tucano gold mine, and advancing an exploration program to unlock thesignificant exploration potential of Tucano."

Now the company has managed to bump production and add to its reserves, thenear-term catalyst needs to come from higher gold and silver prices.

IAMGOLD(NYSE:IAG)(TSE:IMG )

IAMGOLD is a fast-growing mid-tier gold miner with the ambition to become amajor gold miner. The company produced some 214,000 ounces in Q1 2017 from itsoperations in South America and Africa. In June, this promising miner closed adeal with Japanese commodity giant Sumimoto to develop an Ontario gold project.The company saw its stock price fall earlier this year, but is poised for gainsas gold is rallying.

Teck Resources (NYSE:TECK) (TSX:TECK)

Teck could be one of the best-diversified miners out there, with a broadportfolio of Copper, Zinc, Energy, Gold, Silver and Molybdenum assets.Its free cash flow and a lower volatility outlook for base metals incombination with a potential trade war breakthrough could send the stock higherin H2 of this year.

Teck's share price stabilized last year and many investment banks now see thestock as undervalued. Low prices for Canadian crude and disappointing basemetals prices weighed on Q4 earnings.

Despite its struggles, however, Teck Resources recently received a favorableinvestment rating from Fitch and Moody's, and will likely benefit from itsupgraded score. "Having investment grade ratings is veryimportant to us and confirms the strong financial position of the company,"said Don Lindsay, President and CEO. "We are very pleased to receive thissecond credit rating upgrade."

By. Joao Piexe

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paidadvertisement. Oilprice.com, Advanced Media Solutions Ltd, and their owners,managers, employees, and assigns (collectively "the Publisher") is often paidby one or more of the profiled companies or a third party to disseminate thesetypes of communications. In this case, the Publisher has been compensatedby2227929 Ontario Inc. to conduct investor awareness advertising and marketingconcerning African Gold Group. Inc.2227929 Ontario Inc. paid the Publisherfifty thousand US dollars to produce and disseminate this and other similararticles and certain banner ads.This compensation should be viewed as a majorconflict with our ability to be unbiased.

Readers should beware that third parties, profiledcompanies, and/or their affiliates may liquidate shares of the profiledcompanies at any time, including at or near the time you receive thiscommunication, which has the potential to hurt share prices. Frequentlycompanies profiled in our articles experience a large increase in volume andshare price during the course of investor awareness marketing, which often endsas soon as the investor awareness marketing ceases. The investor awarenessmarketing may be as brief as one day, after which a large decrease in volumeand share price may likely occur.

This communication is not, and should not be construed tobe, an offer to sell or a solicitation of an offer to buy any security. Neitherthis communication nor the Publisher purport to provide a complete analysis ofany company or its financial position. The Publisher is not, and does notpurport to be, a broker-dealer or registered investment adviser. Thiscommunication is not, and should not be construed to be, personalizedinvestment advice directed to or appropriate for any particular investor. Any investmentshould be made only after consulting a professional investment advisor and onlyafter reviewing the financial statements and other pertinent corporateinformation about the company. Further, readers are advised to read andcarefully consider the Risk Factors identified and discussed in the advertisedcompany's SEC, SEDAR and/or other government filings. Investing in securities,particularly microcap securities, is speculative and carries a high degree ofrisk. Past performance does not guarantee future results. This communication isbased on information generally available to the public, and does not containany material, non-public information. The information on which it is based isbelieved to be reliable. Nevertheless, the Publisher cannot guarantee theaccuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Oilprice.com ownsshares and/or stock options of the featured companies and therefore has anadditional incentive to see the featured companies' stock perform well. The ownerof Oilprice.com has no present intention to sell any of the issuer's securitiesin the near future but does not undertake any obligation to notify the marketwhen it decides to buy or sell shares of the issuer in the market. The owner ofOilprice.com will be buying and selling shares of the featured company for itsown profit. This is why we stress that you conduct extensive due diligence aswell as seek the advice of your financial advisor or a registered broker-dealerbefore investing in any securities.

FORWARD LOOKING STATEMENTS. This publication containsforward-looking statements, including statements regarding expected continualgrowth of the featured companies and/or industry. The Publisher notes thatstatements contained herein that look forward in time, which include everythingother than historical information, involve risks and uncertainties that mayaffect the companies' actual results of operations. Factors that could causeactual results to differ include, but are not limited to, changing governmentallaws and policies, the success of the company's gold exploration and extractionactivities, the size and growth of the market for the companies' products andservices, the companies' ability to fund its capital requirements in the nearterm and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading thiscommunication, you acknowledge that you have read and understand thisdisclaimer, and further that to the greatest extent permitted under law, yourelease the Publisher, its affiliates, assigns and successors from any and allliability, damages, and injury from this communication. You further warrantthat you are solely responsible for any financial outcome that may come fromyour investment decisions.

TERMS OF USE. By reading this communication you agreethat you have reviewed and fully agree to the Terms of Use found herehttp://oilprice.com/terms-and-conditions Ifyou do not agree to the Terms of Usehttp://oilprice.com/terms-and-conditions ,please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is thePublisher's trademark. All other trademarks used in this communication are theproperty of their respective trademark holders. The Publisher is notaffiliated, connected, or associated with, and is not sponsored, approved, ororiginated by, the trademark holders unless otherwise stated. No claim is madeby the Publisher to any rights in any third-party trademarks.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment