Using the Rising Wedge Pattern in Forex Trading

(MENAFN- DailyFX) The rising wedge is a popular reversal pattern that is predictive in nature and can give traders a clue to the direction and distance of the next price move.

Rising wedges appear regularly in the financial markets and traders gravitate towards the pattern because of its simplicity in identification and application. This article will explain how to spot a rising wedge on forex charts and how to trade them.

Learn to trade the Rising Wedge: Main Talking PointsWhat is a rising wedge pattern? How to identify a rising wedge pattern on forex charts How to trade forex with the rising wedge pattern Advantages and limitations of the rising wedge pattern What is a rising wedge pattern?The forex rising wedge(also known as the ascending wedge)pattern is a powerful consolidation price pattern formed when price is bound between two risingtrend lines . It is considered a bearish chart formation which can indicate both reversal and continuation patterns – depending on location and trend bias. Regardless of where the rising wedge appears, traders should always maintain the guideline that this pattern is inherently bearish in nature (see image below).

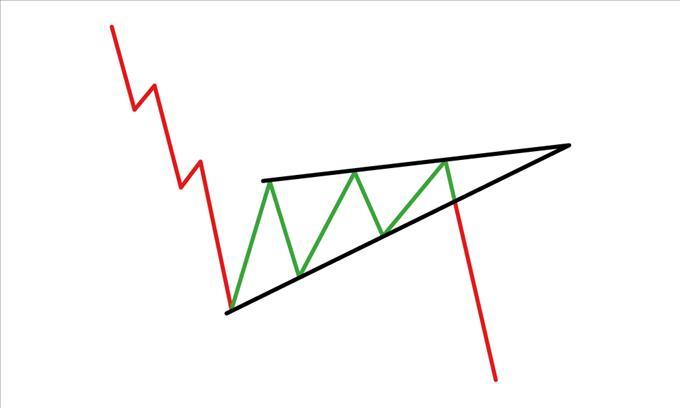

Falling wedge pattern

The falling (descending) wedge differentiates itself from the rising wedge by the slant of the triangle. The falling wedge declines downwards between two converging trend lines to reach an apex point which is respected as a bullish pattern (see image below).

How to identify a Rising Wedge Pattern on Forex Charts

How to identify a Rising Wedge Pattern on Forex ChartsThe rising wedge pattern is interpreted as both a bearish continuation and bearish reversal pattern which gives rise to some confusion in the identification of the pattern. Both scenarios contain a different set of observation dynamics which must be taken into consideration.

Continuation Pattern:

Established downtrend Rising wedge consolidation formation Linking higher highs and lower lows using a trend line assembling towards a narrowing point Confirm divergence between price and volume using volume function -MACDmay also be used Overbought signal can be confirmed by othertechnical toolslikeoscillators Look for break belowsupportforshort entryReversal Pattern:

Established uptrend Rising wedge consolidation formation Linking higher highs and lower lows using a trend line assembling towards a narrowing point Confirm divergence between price and volume using volume function - MACD may also be used Overbought signal can be confirmed by other technical tools like oscillators Look for break below support for short entryHow to Trade the Rising Wedge PatternThe rising wedge forex pattern is linked with both continuation and reversal patterns as mentioned above. The example below shows the formation of a rising wedge on a forex pair depicting a continuation.

EUR/USDrising wedge forex chart pattern:

The chart above shows a rising wedge 'continuation' pattern after a determined downtrend. The rising wedge is outlined by the blue dashed lines showing diminishing bull strength in the uptrend. Confirmation of the uptrend waning in strength can be seen using the volume tool on the chart which depicts fading volume in concurrence with the ascending price in the market. This is known as divergence, showing that the upward movement is coming to an end.

Theentrypoint (labelled) occurs once the trend support line of the rising wedge has been breached. There are two common methods of entry:

Wait for a candle close below the support trend line before entry Enter into the short position as soon as the price breaks the support line, regardless of the candle closeThestoplevel as highlighted on the chart is elected from the high point of the rising wedge located on the resistance trend line. This identification point makes it relatively simple to locate the stop level for novice traders. Thelimitin this example was taken from the previous swing low giving this trade an extremely positiverisk-reward ratio .

Advantages and Limitations of the Rising WedgeAdvantages | Disadvantages |

Easy to identify for more experienced traders | Can be ambiguous to novice traders |

Occurs frequently within financial markets | Often identified incorrectly |

Defines clear stop, entry and limit levels | Requires additional confirmation using other technical indicators and oscillators |

Opportunity for favourable risk-reward ratios | Can signify reversal or continuation patterns |

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment