403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

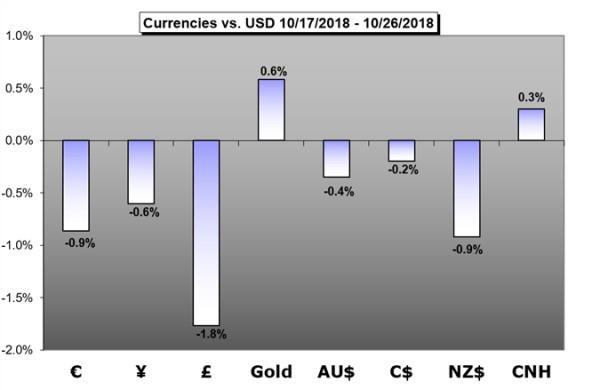

Weekly Fundamental Forecast: Risk Aversion Threatens to Define October with Capital and FX Markets on Edge

(MENAFN- DailyFX) A notable sense of fear spread through the financial system this past week. Where concern could be attributed to certain asset classes or a fleeting swoon previously, there was little denying the storm brewing through Friday. Now, as stability hangs in the balance, the masses are recognizing the long list of threats we have accumulated these past months.

A lull in key event risk exposed stocks to bigger adverse fundamental themes as the Japanese Yen rose. It may keep going, looking past the BoJ as the S & P 500 still remains vulnerable.

The Australian Dollar remains very short of fundamental support but, with AUD/USD close to 2018 lows again, may not be hammered any harder this week

Crude oil is working on its worst month since 2016 as risk sentiment soured significantly as October comes to a close and a mixed signal is coming from OPEC on potential production.

USD/CAD rallies to fresh monthly highs even as the Bank of Canada (BoC) delivers a hawkish rate-hike, and topside targets remain on the radar as it threatens the bearish trend from June.

A busy week for Sterling traders ahead but the overall market trend will continue to be dominated by Brexit, and that may not be good news for an under-the-cosh British Pound

The US Dollar looks likely to continue upward after hitting a 17-month high as its unrivaled liquidity continues to attract demand amid broad-based risk aversion.

Gold has been the beneficiary of a highly volatile equity market this month and the trend could continue if equities fail to stabilize.

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the .

See how retail traders are positioning in the majors using the

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment