403

Sorry!!

Error! We're sorry, but the page you were

looking for doesn't exist.

Weekly Trading Forecast: Volatility Ahead on Key Data, US Tax Cut

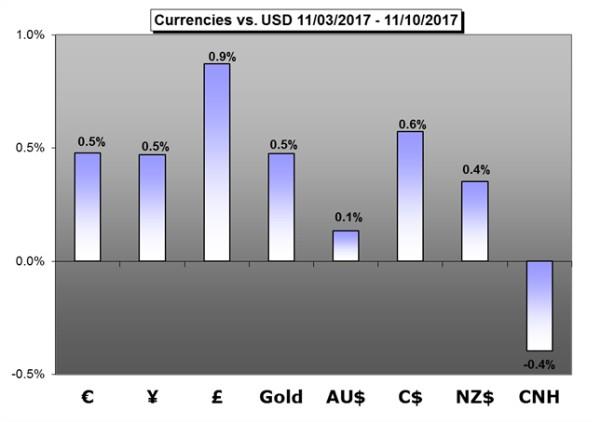

(MENAFN- DailyFX) financial markets look set for another volatile week as top-tier economic data flow amplifies price swings driven by speculation about US fiscal policy.

Forecast:

Politically inspired US Dollar volatility may be compounded by a high-profile speech from Fed Chair Janet Yellen as well as the release of CPI and retail sales statistics.Forecast:

The British Pound has been remarkably resilient despite a lack of progress on Brexit and turbulent domestic politics, suggesting the bulls have the upper hand.Forecast:

faces a growing risk of giving back the advance from the 2017-low (107.32) as the U.S. economic docket is expected to highlight a subdued outlook for inflation.Forecast:

The Australian Dollar has stopped sliding against its US cousin and settled into a broad range trade. The coming week offers few obvious signs that this will change.Forecast:

The Canadian Dollar is facing a host of negative headwinds with the currently the main supporting factor.Chinese Yuan Forecast:

Trump-Xi meeting has not only eased trade tensions but pushed China to make a big step forward in opening up its financial market; at the same time, the slowdown in private investment remains as a major concern.Crude Oil Forecast:

Crude Oil is displaying the longest bullish run since October of 2016 as a new factor brings in support to the market, political instability.Equities Forecast:

Global stocks put in the first notable pullback in months as reports of a delay to US tax cuts tempered recent bullish behavior. Is this the shift that will ultimately bring on reversal of years-old trends?Forecast:

Prices rebounded off support this week with key inflation data next week to make-or-break the advance. Here are the updated targets & invalidation levels that matter.See what live coverage is scheduled to cover key event risk for the FX and capital markets on the .

See how retail traders are positioning in the majors using the .

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Manuka Honey Market Report 2024, Industry Growth, Size, Share, Top Compan...

- Modular Kitchen Market 2024, Industry Growth, Share, Size, Key Players An...

- Acrylamide Production Cost Analysis Report: A Comprehensive Assessment Of...

- Fish Sauce Market 2024, Industry Trends, Growth, Demand And Analysis Repo...

- Australia Foreign Exchange Market Size, Growth, Industry Demand And Forec...

- Cold Pressed Oil Market Trends 2024, Leading Companies Share, Size And Fo...

- Pasta Sauce Market 2024, Industry Growth, Share, Size, Key Players Analys...

Comments

No comment