403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

The 600% jump in dollar loans that shows Saudi riyal aversion

(MENAFN- Gulf Times) Dollar borrowing in Saudi Arabia has surged seven-fold this year as the kingdom's companies switch out of increasingly expensive local currency-denominated loans.

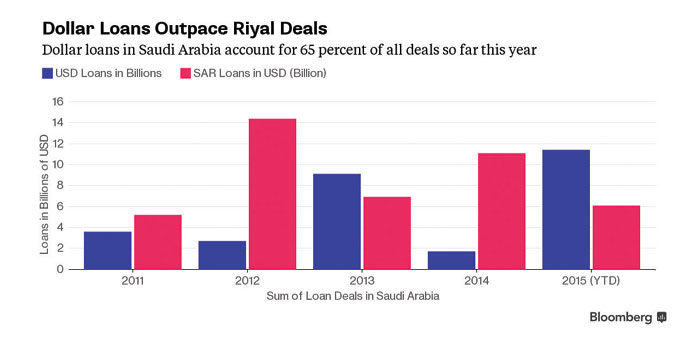

About 65% of all loans taken out in Saudi Arabia through September 8 were in dollars, compared with 13% for all of 2014, according to data compiled by Bloomberg. Borrowers raised more than $11bn in US currency, compared to $1.7bn for all of last year. Riyal borrowing fell 45%.

The shift underscores the knock-on effects of oil's 50% plunge in the past 12 months. Saudi Arabia, Opec's biggest crude exporter, is tapping local debt capital markets with long-term bonds for the first time in eight years to plug a growing budget deficit. That reduced bank liquidity and helped send the three-month Saudi Interbank Offered Rate, a benchmark used to price many Islamic and conventional loans, to its highest since November.

"Local liquidity is weakening, so they have to go and borrow in other currencies," said Apostolos Bantis, a Dubai-based credit analyst at Commerzbank AG. "If Saibor is rising faster than the US rates, then it makes more sense for Saudi borrowers to go externally and borrow at a cheaper rate." There aren't many risks as long as Saudi Arabia maintains its peg to the dollar, he said.

Saudi Arabian Oil Co and Jazan Gas Projects Co are among the biggest dollar-borrowers so far in 2015. Saudi Aramco raised $7bn in March and Jazan Gas tapped the market for $1.7bn in July.

While bets for a devaluation of the riyal reached the highest in more than a decade last month after China weakened the yuan, the kingdom's central bank Governor Fahad al-Mubarak has said the peg at 3.75 per dollar will remain as long as oil underpins the Saudi economy.

Saibor was at 0.8775% on September 8, compared with 0.332% for the London Interbank Offered Rate, which is used as a benchmark for many dollar loans. While comparatively high, the Saudi rate remains at a historically low level. It rose as high as 5.3% in 2006.

The preference for dollar-denominated borrowing may change when the US Federal Reserve increases interest rates for the first time since 2006, according to Commerzbank's Bantis.

"It all depends on how far the Fed will go," he said by phone on September 8. If rates keep rising, "maybe then they will have to look for other currencies, euros or Asian currencies," he said.

Traders are betting the Fed is on course to raise interest rates, with futures on September 8 showing a 60% probability of an increase before the end of 2015. They showed a 30% chance of a move in September. "At some point, the US rate hike will kick in, but many in Saudi Arabia anticipate that will not happen in September," John Sfakianakis, the Riyadh-based Middle East director at asset manager Ashmore Group, said by phone on September 8.

About 65% of all loans taken out in Saudi Arabia through September 8 were in dollars, compared with 13% for all of 2014, according to data compiled by Bloomberg. Borrowers raised more than $11bn in US currency, compared to $1.7bn for all of last year. Riyal borrowing fell 45%.

The shift underscores the knock-on effects of oil's 50% plunge in the past 12 months. Saudi Arabia, Opec's biggest crude exporter, is tapping local debt capital markets with long-term bonds for the first time in eight years to plug a growing budget deficit. That reduced bank liquidity and helped send the three-month Saudi Interbank Offered Rate, a benchmark used to price many Islamic and conventional loans, to its highest since November.

"Local liquidity is weakening, so they have to go and borrow in other currencies," said Apostolos Bantis, a Dubai-based credit analyst at Commerzbank AG. "If Saibor is rising faster than the US rates, then it makes more sense for Saudi borrowers to go externally and borrow at a cheaper rate." There aren't many risks as long as Saudi Arabia maintains its peg to the dollar, he said.

Saudi Arabian Oil Co and Jazan Gas Projects Co are among the biggest dollar-borrowers so far in 2015. Saudi Aramco raised $7bn in March and Jazan Gas tapped the market for $1.7bn in July.

While bets for a devaluation of the riyal reached the highest in more than a decade last month after China weakened the yuan, the kingdom's central bank Governor Fahad al-Mubarak has said the peg at 3.75 per dollar will remain as long as oil underpins the Saudi economy.

Saibor was at 0.8775% on September 8, compared with 0.332% for the London Interbank Offered Rate, which is used as a benchmark for many dollar loans. While comparatively high, the Saudi rate remains at a historically low level. It rose as high as 5.3% in 2006.

The preference for dollar-denominated borrowing may change when the US Federal Reserve increases interest rates for the first time since 2006, according to Commerzbank's Bantis.

"It all depends on how far the Fed will go," he said by phone on September 8. If rates keep rising, "maybe then they will have to look for other currencies, euros or Asian currencies," he said.

Traders are betting the Fed is on course to raise interest rates, with futures on September 8 showing a 60% probability of an increase before the end of 2015. They showed a 30% chance of a move in September. "At some point, the US rate hike will kick in, but many in Saudi Arabia anticipate that will not happen in September," John Sfakianakis, the Riyadh-based Middle East director at asset manager Ashmore Group, said by phone on September 8.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment