Asia AM Digest: Tariff Detail Boost Mood, All Eyes on White House

The Euro was one of the worst performing majors of Thursday's session despite initially being boosted by the . However, that was as far as the Euro got until President Mario Draghi gave a rather dovish speech shortly after at the news conference. There Mr. Draghi said that he sees rates at their present levels well beyond the end of QE, .

Meanwhile the Canadian Dollar outperformed, helped by news towards the end of the session that both Canada and Mexico will be exempted indefinitely from import tariffs. US President Donald Trump signed the proclamations to impose them on steel and aluminum soon after. He added that he is open to modifying tariffs on individual countries.The British Pound was down, hurt by news from UK officials saying that they see 'no Brexit deal until next year. January now seems to be the target date, which is closer to the March 2019 deadline for the UK to leave the EU. Such an outcome would leave less time for policymakers to approve the details of a withdrawal agreement, adding more uncertainty to the mix.

Softer tariff conditions noted in today's signing seemed to boost sentiment in the markets. Stocks ended in the green across Asia, Europe and the US. This dampened the appeal of anti-risk currencies such as the Swiss Franc .Keep an eye out for developments out of the White House early into Friday's session. Mr. Trump told reports that South Korea will make a major announcement today. On Tuesday, reports that North Korea could denuclearize boosted sentiment in the markets. A follow up to that could perhaps result in much of the same.

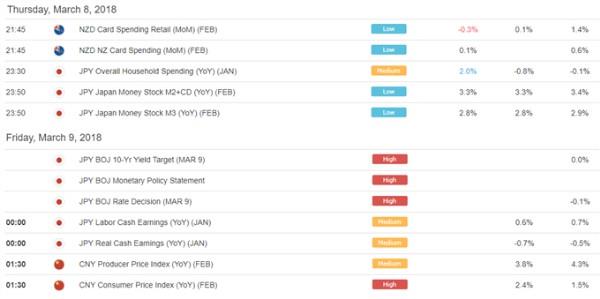

In addition, the Bank of Japan will release its March monetary policy meeting at an unspecified time. Just last week, Governor Haruhiko Kuroda by saying that the 'BoJ will be considering exit around fiscal 2019. Traders will be looking for any details and clarification about this development.DailyFX Economic Calendar: Asia Pacific (all times in GMT)

DailyFX Webinar Calendar to register (all times in GMT)IG Client Sentiment Index Chart of the Day: AUD/USD

to learn more about the IG Client Sentiment IndexRetail trader data shows 46.8% of AUD/USD traders are net-long with the ratio of traders short to long at 1.14 to 1. In fact, traders have remained net-short since Dec 19 when AUD / USD traded near 0.75664; price has moved 2.9% higher since then. The number of traders net-long is 5.1% higher than yesterday and 5.8% higher from last week, while the number of traders net-short is 3.1% lower than yesterday and 4.9% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/USD price trend may soon reverse lower despite the fact traders remain net-short.Five Things Traders are Reading:

by Christopher Vecchio, Sr. Currency Strategist by James Stanley, Currency Strategist by the DailyFX Research Team by Michael Boutros, Currency Strategist by David Song, Currency Analyst To get the Asia AM Digest every day,

To get the US AM Digest every day,To get both reports daily,

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment