Asia AM Digest: US Holiday Put Focus on Asia as Nikkei 225 Rose

On Monday, US financial markets were closed for the President's Day holiday. This probably had traders focusing their attention on what was going on outside of the world's largest economy. In Japan, the gapped higher and rose about 2 percent. This brought the index to a level just shy of a 2-week high.

A rosy day in Asia undermined the attractiveness of anti-risk currencies such as the Japanese Yen and . They were the worst performing majors. Given the illiquid trading conditions, things might have ended up worse for these currencies if it were not for the retreat in stocks during Europe's session afterwards.Indeed, the Stoxx 50 experienced its first decline in four days falling roughly 0.55%. Meanwhile, the fared a little worse dropping more than 0.6%. This pessimistic trading environment also robbed some of the gains seen in sentiment-linked currencies such as the from Asia's session.

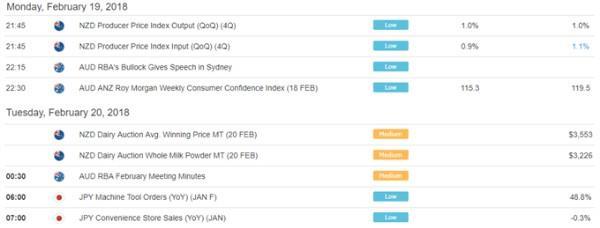

Looking ahead, the RBA's minutes from February's monetary policy announcement will cross the wires early into Tuesday's session. As we mentioned last week, the details of the report will probably for now.DailyFX Economic Calendar: Asia Pacific (all times in GMT)

DailyFX Webinar Calendar to register (all times in GMT)IG Client Sentiment Index Chart of the Day:

to learn more about the IG Client Sentiment IndexRetail trader data shows 75.8% of USD/JPY traders are net-long with the ratio of traders long to short at 3.14 to 1. In fact, traders have remained net-long since Dec 29 when / traded near 113.244; price has moved 5.9% lower since then. The number of traders net-long is 14.5% higher than yesterday and 36.4% higher from last week, while the number of traders net-short is 2.8% lower than yesterday and 15.0% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bearish contrarian trading bias.Five Things Traders are Reading:

by Christopher Vecchio, Sr. Currency Strategist by Tyler Yell, CMT, Forex Trading Instructor and CMT by DailyFX Research Team by Tyler Yell, CMT, Forex Trading Instructor and CMT by Nick Cawley, Analyst To get the Asia AM Digest every day,

To get the US AM Digest every day,To get both reports daily,

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment