MSME Access To Finance Strengthened Through Credit And Equity Schemes: Minister Karandlaje

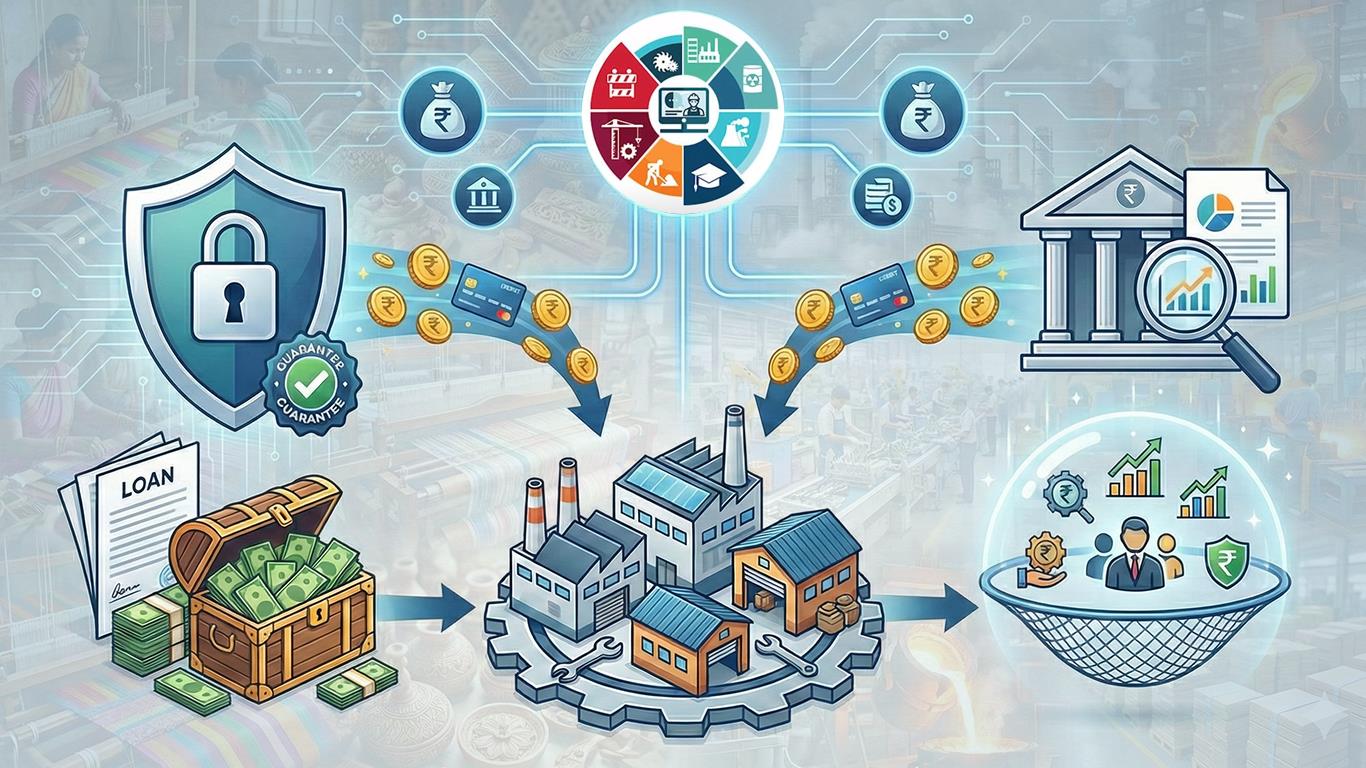

Under the Emergency Credit Line Guarantee Scheme (ECLGS), launched in May 2020 as part of the Aatmanirbhar Bharat Abhiyaan, 1.13 crore guarantees worth Rs 2.42 lakh crore were extended to MSMEs till its closure on March 31, 2023.

A State Bank of India study noted that 14.6 lakh MSME accounts, largely micro and small units, were saved due to the scheme.

Credit Guarantee Expanded

To further ease credit access, the Credit Guarantee Scheme (CGS) for Micro and Small Enterprises was revamped from April 2023 following a Rs 9,000 crore corpus infusion into Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

The guarantee limit was raised from Rs 2 crore to Rs 5 crore, and the annual guarantee fee cut by 50 per cent. From April 2025, the ceiling has been further enhanced to Rs 10 crore.

Since inception in 2000, a total of 1.35 credit guarantees amounting to Rs 12.39 lakh cr have been approved under the scheme.

The Self Reliant India (SRI) Fund, aimed at providing equity financing to MSMEs, targets a corpus of Rs 50,000 crore, including Rs 10,000 crore from the government. As of December 31, 2025, 69 daughter funds have supported 693 MSMEs with investments totalling Rs 16,260 crore.

Employment and Artisan Support

The Prime Minister's Employment Generation Programme (PMEGP) has assisted 10.73 lakh micro enterprises since FY09, providing margin money subsidy of Rs 29,305 crore and generating employment for 87.4 lakh people.

Meanwhile, the PM Vishwakarma Scheme, launched in September 2023, has registered 30 lakh artisans across 18 traditional trades. Loans worth Rs 4,670.73 crore have been sanctioned to 5.42 lakh beneficiaries, with collateral-free credit of up to Rs 3 lakh and interest subvention of up to 8 per cent.

Monitoring and Oversight

The Ministry said it regularly reviews scheme performance through stakeholder consultations and has launched an integrated MSME Dashboard, linked via application programming interface (APIs) with major schemes, to improve monitoring and implementation.

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment