Who Really Holds All The Cards: Trump Or The Bond Market?

Of these foreign holdings, Europe has $3.6 trillion, making it collectively the largest holder of US debt, larger than Japan (which holds $1.2 trillion ) or China (which owns around $700 billion ).

Could this financial exposure be turned into political leverage – a way for Europe to push back against Donald Trump's recent threats over Greenland and European sovereignty? Or, as the US president has claimed, does the US still “hold all the cards” in debt markets?

At the World Economic Forum in Davos recently, Trump threatened a “big retaliation” if European countries sold US assets as a response to tariff threats. When politicians talk about Europe“dumping” US government debt, it sounds like a simple, almost mechanical, act whereby political leaders make a decision and trillions of dollars' worth of bonds are sold. But that's not how financial markets actually work.

Latest stories India's strategic autonomy has become a liability Zumwalt's hypersonic reboot adds punch but not parity with China China's global leadership would be differentIn Europe, US government bonds aren't owned by governments. They're held by pension funds, insurance companies, banks and investment funds. These are independent financial institutions that manage the savings of millions of ordinary people. There is no single switch a government can flip to make all of these investors sell at once, even if it wanted to.

Even if governments are able to cajole European investors into selling their US Treasuries, there is the tricky question of where the money would go. The US Treasury market is the largest bond market in the world. There is no easy alternative home for the $3 trillion of US government bonds held by Europeans.

The euro area does have a large amount of government bonds and in principle they could absorb some reallocation. But shifting even a few trillion dollars at speed would drive prices sharply higher and yields sharply lower, creating enormous distortions.

Then there's the problem of self-harm. European banks, insurers and pension funds are packed with US Treasuries. A forced or panicked sell-off would punch a hole in their own balance sheets as prices fell sharply.

At the same time, if European institutions collectively opt to move all their investments out of dollars into euros the financial market shockwaves would be massive. The surge in demand would likely drive the euro sharply higher, making European exports more expensive and quite possibly tipping the economy into recession.

This is one reason China, despite years of tough talk, never actually followed through on threats to weaponize its Treasury holdings. In modern finance, trying to use these assets as a blunt political weapon tends to look a lot like mutually assured economic damage.

Why the bond market still has a voteSo does this mean Trump really does hold all the cards? Not quite. While European governments are highly unlikely to try to weaponize their holdings of US government debt, that does not mean the United States is free to ignore international investors.

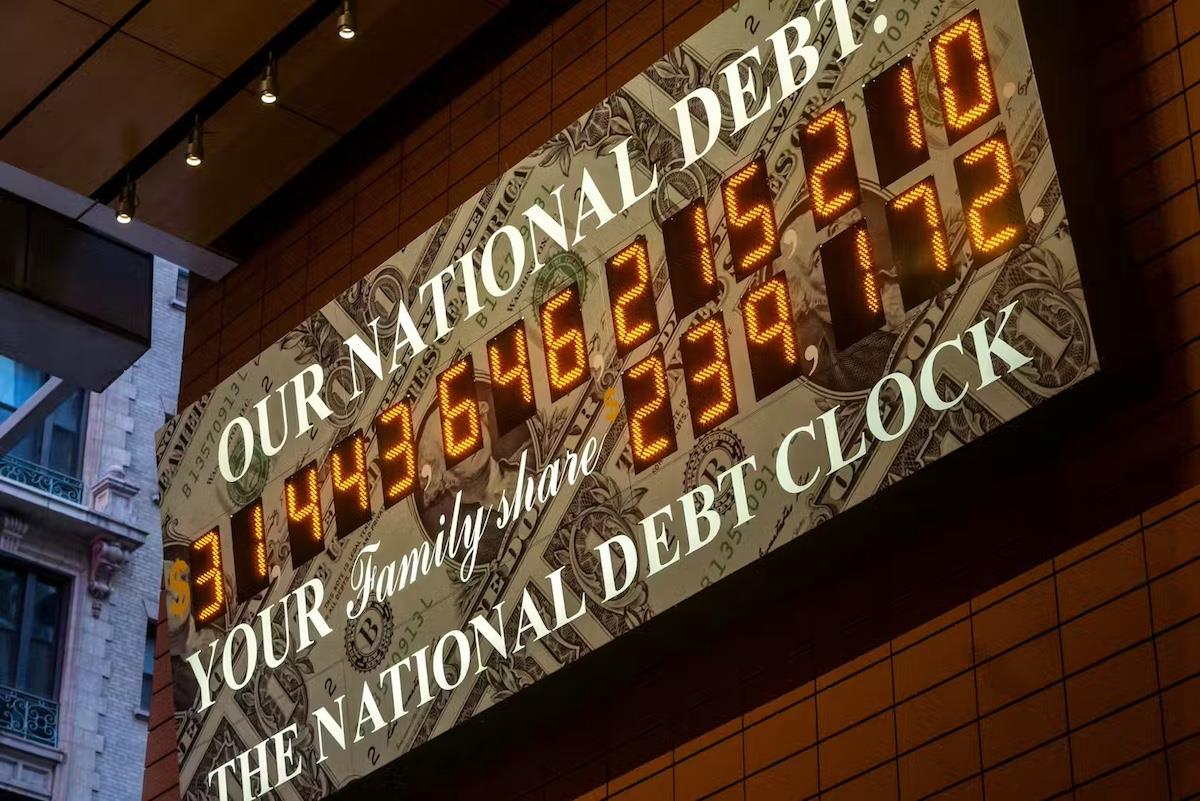

America is now heavily reliant on global capital markets to fund its large and growing budget deficits. Every year, the US government needs to persuade investors, at home and abroad, to buy vast quantities of new Treasury bonds. That normally happens quietly and routinely, on the assumption that the US remains a predictable and reliable steward of the world's financial system.

Sign up for one of our free newsletters-

The Daily Report

Start your day right with Asia Times' top stories

AT Weekly Report

A weekly roundup of Asia Times' most-read stories

But that assumption is precisely what Trump's broader political project puts at risk. Efforts to rewrite the rules of international trade, to pressure allies or to treat economic relationships as instruments of coercion all increase uncertainty about how the US will behave in the future.

Financial markets are often patient, but they are not indifferent to this kind of uncertainty.

If international investors became less willing to hold US government debt then bond prices would fall, yields would rise and the cost of financing America's government debt would increase. That would feed through into higher borrowing costs across the entire US economy, from mortgages to business loans to government spending itself.

This kind of adjustment would not happen overnight but it is exactly the sort of slow, grinding financial pressure that even the US cannot avoid. Trump may believe he holds all the cards but, in a debt-dependent world, the bond market still gets a vote.

Alex Dryden is PhD candidate in economics, SOAS, University of London

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Sign up here to comment on Asia Times stories Or Sign in to an existing accounThank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

-

Share on X (Opens in new window)

Share on LinkedIn (Opens in new window)

LinkedI

Share on Facebook (Opens in new window)

Faceboo

Share on WhatsApp (Opens in new window)

WhatsAp

Share on Reddit (Opens in new window)

Reddi

Email a link to a friend (Opens in new window)

Emai

Print (Opens in new window)

Prin

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment